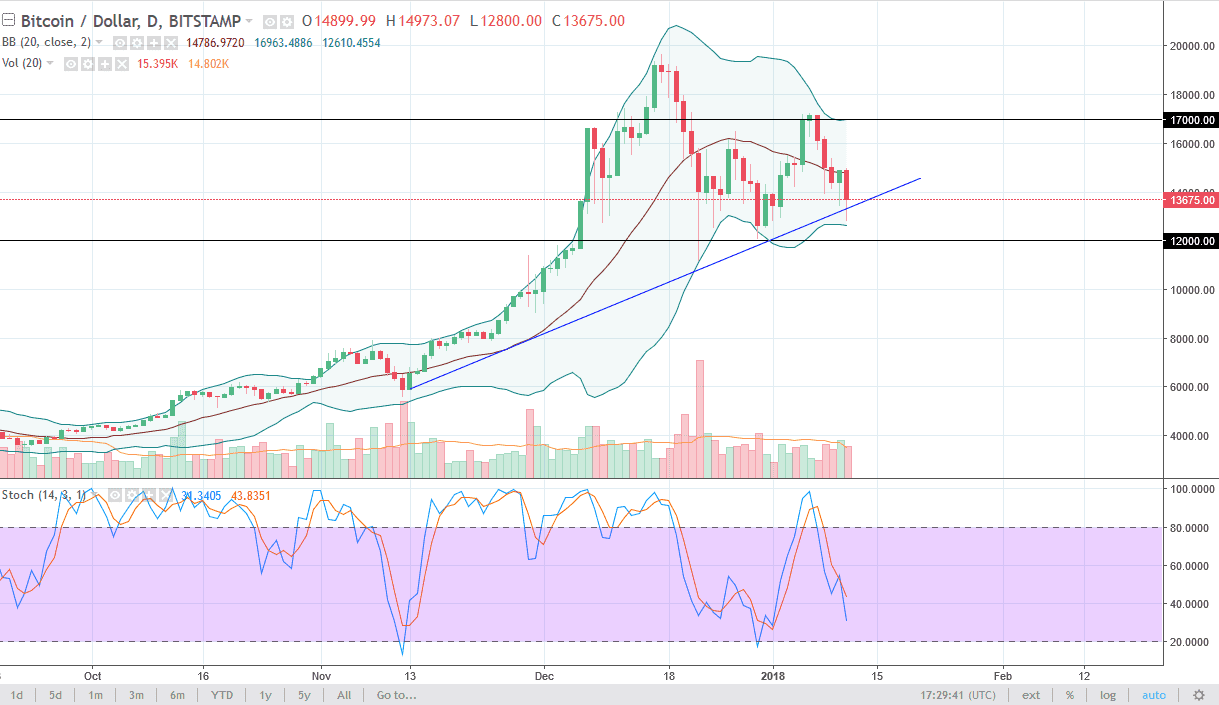

BTC/USD

Bitcoin markets drifted a bit lower during the trading session again on Thursday, as the volume continues to drift a listless sleep. Bitcoin has been struggling since the opening of futures markets in Chicago, and now look to be settling into a range. The $12,000 level on the bottom and the $17,000 level on the top currently dictate where price goes, and quite frankly I don’t see anything on this chart that tells me we’re going to change this dynamic anytime soon. Look for range bound trading opportunities, buying at the bottom, and selling at the top until something changes, something that doesn’t look likely to happen in the short term. There were a lot of questions as to what the futures exchanges would do to Bitcoin, I think we have our answer: stability.

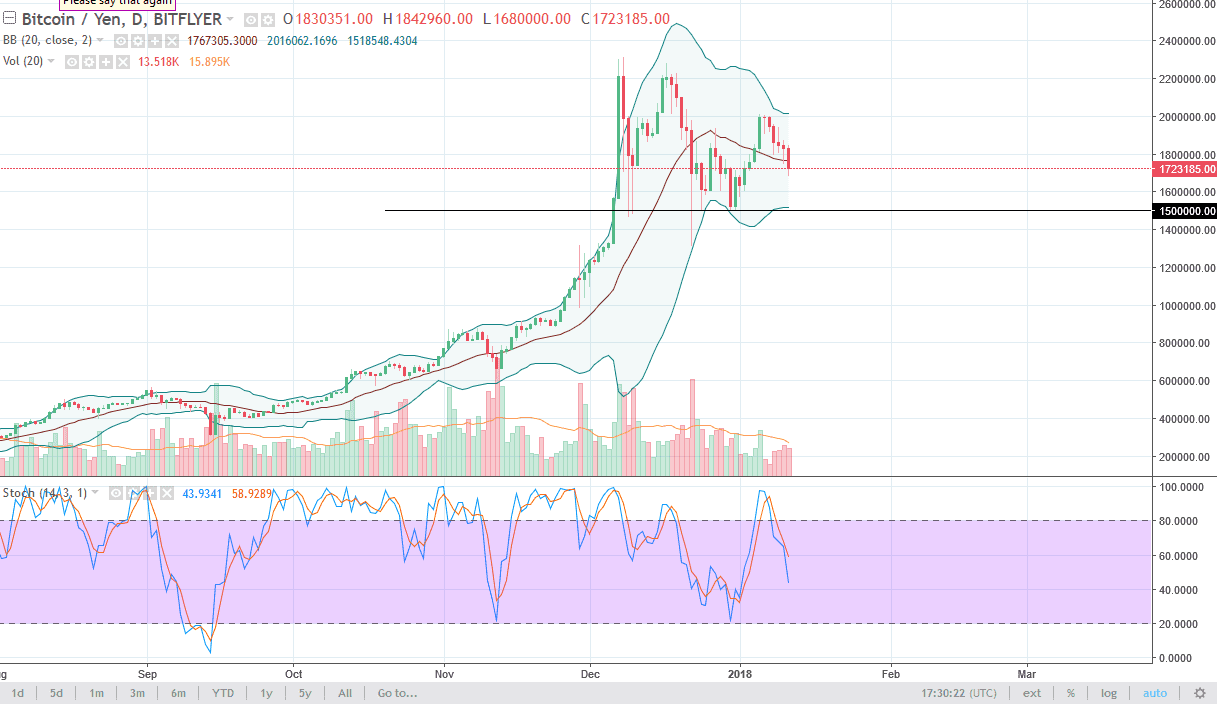

BTC/JPY

Bitcoin fell against the Japanese yen, keeping some of the losses later in the day. This makes sense, because the Japanese yen itself has been strong in the Forex markets, which of course are much more influential when it comes to global finance and of course volume. The ¥1.5 million level underneath looks to be a target, and I think that is where we are going to end up. When you look at the previous 2 candles, we had a shooting star and a hammer. Both have been broken down, and now it looks like the sellers are in control. I would expect a significant amount of support at the ¥1.5 million level though. Because of this, I think this is a short-term selling opportunity, but is not until we break down below the ¥1.4 million level that I would become aggressively short. I would anticipate that there should be some type of bounce near the ¥1.5 million level, as history has shown more than once.