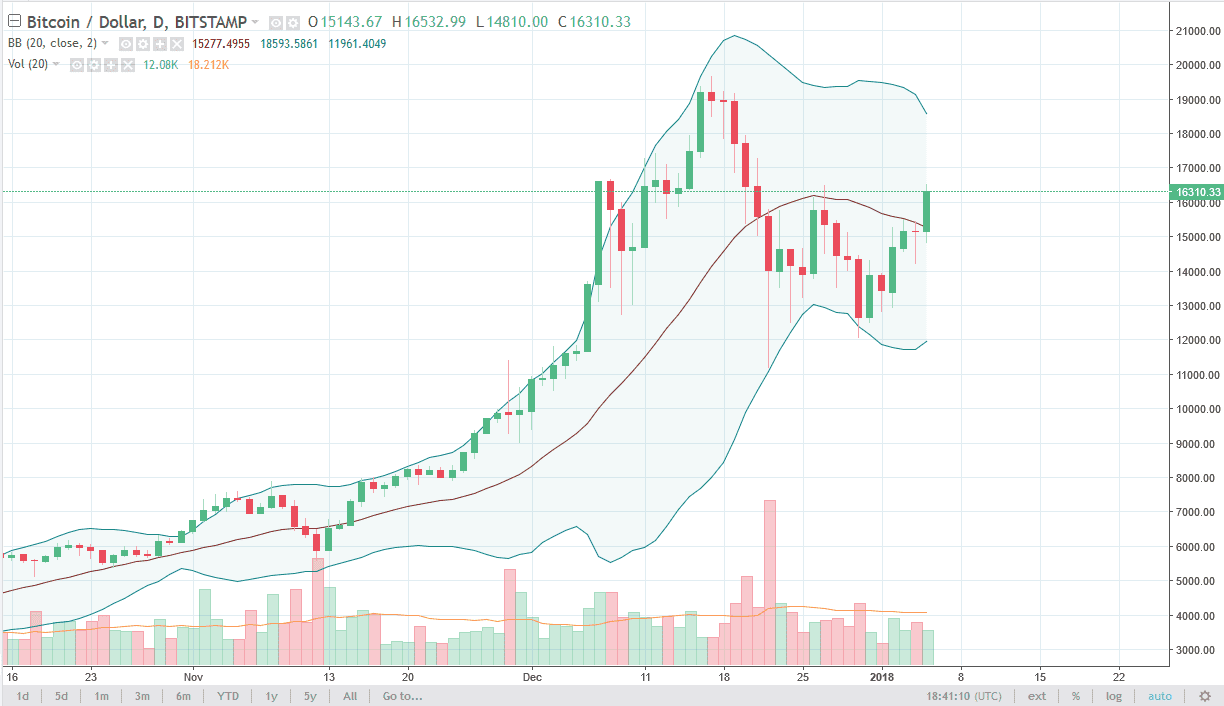

BTC/USD

Bitcoin markets rallied significantly during the Friday session, breaking above the top of the hammer from the previous session. This is a very bullish sign, as we are reaching towards the $17,000 level. A clearance of that level should send this market towards the $19,000 level, an area that has of course been important in the past as it was resistance. I think the market may make another attempt at $20,000, but volumes aren’t exactly something to write home about. The strongest volume candles are all red, so that something that you need to be concerned about. Pullbacks offer buying opportunities, but I would get involved in this market very slowly and incrementally. A break above the $20,000 level becomes more of a “buy-and-hold” scenario.

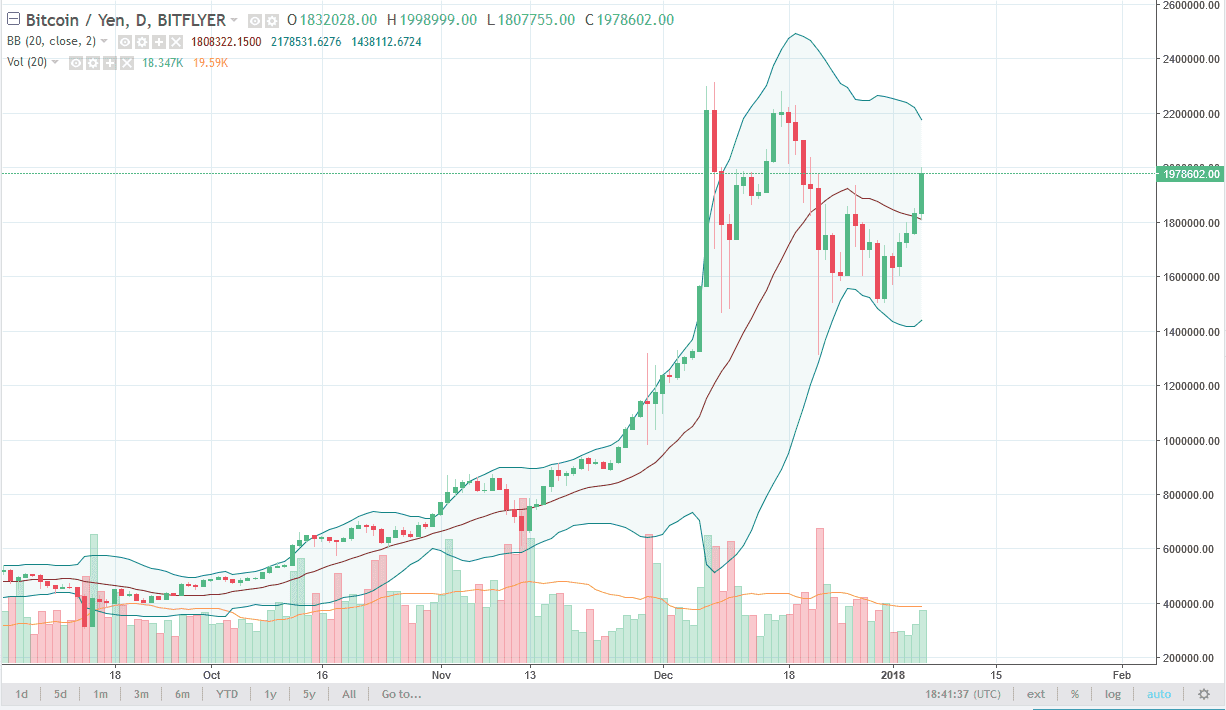

BTC/JPY

Bitcoin was even more bullish against the Japanese yen, which is not a surprise considering the Japan is 40% of Bitcoin trading. Now that we are reaching towards the ¥2 million level, if we can break above that level I think we then go to the ¥2.25 million level next. I expect pullbacks to be looked at as value propositions the people will take advantage of, as Japan has a massive amount of interest in Bitcoin overall. Longer-term, I think that we will continue to go to fresh, new highs, as the BTC/JPY pair has been one of the more reliable currency pairs over the last couple of months. In a sense, when I look at this chart the first thing I see as a bullish flag, but I also recognize that there is a lot of noise. If we were to break down below the ¥1.5 million level, that could change everything but right now it does look very likely to happen.