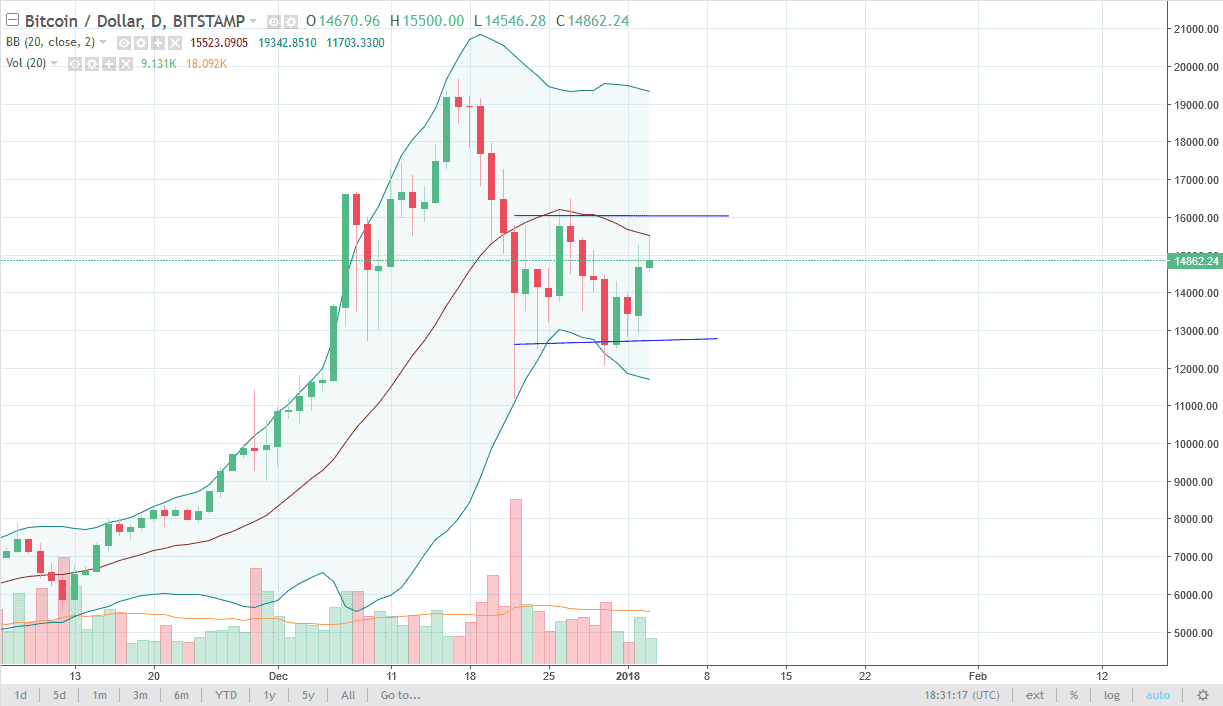

Bitcoin initially rallied during the trading session on Wednesday, but ran into a significant amount of resistance at the $15,000 region. As you can see, we are testing the middle of the Bollinger Bands indicator, the 20 SMA. I think that we pull back from there, showing a sign of extreme weakness in forming the shooting star. The shooting star suggesting that we are probably going to go down below the bottom of the consolidation area, perhaps reaching towards the $13,000 level underneath. I believe that a breakdown below the bottom of the shooting star is the signal, as it is a negative sign in a market that has been rolling over. However, if we can break above the $16,000 level, then I think the market could continue to go higher, perhaps reaching towards the $20,000 region over the longer term. Short-term though, the initial target would be the $18,000 level.

Ultimately, I believe that the market breaking below the $13,000 level is a very negative sign, perhaps sending the market down to 12,000 after that, and then eventually the $10,000 level. Longer-term, when we pull back, we could go to the 50% Fibonacci retracement level, which is all the way down near the $80,000 handle. As the market has been rolling over, I find it very interesting that we have not been able to keep gains, and that the other crypto currencies have been outperforming Bitcoin for some time. In fact, it seems as soon as the futures markets opened in Chicago that might have been the top, at least for the meantime. I believe that eventually we will find buyers though, and at that point it should be a nice value, but Bitcoin had gotten so far ahead of itself that it’s not a surprise we are struggling.