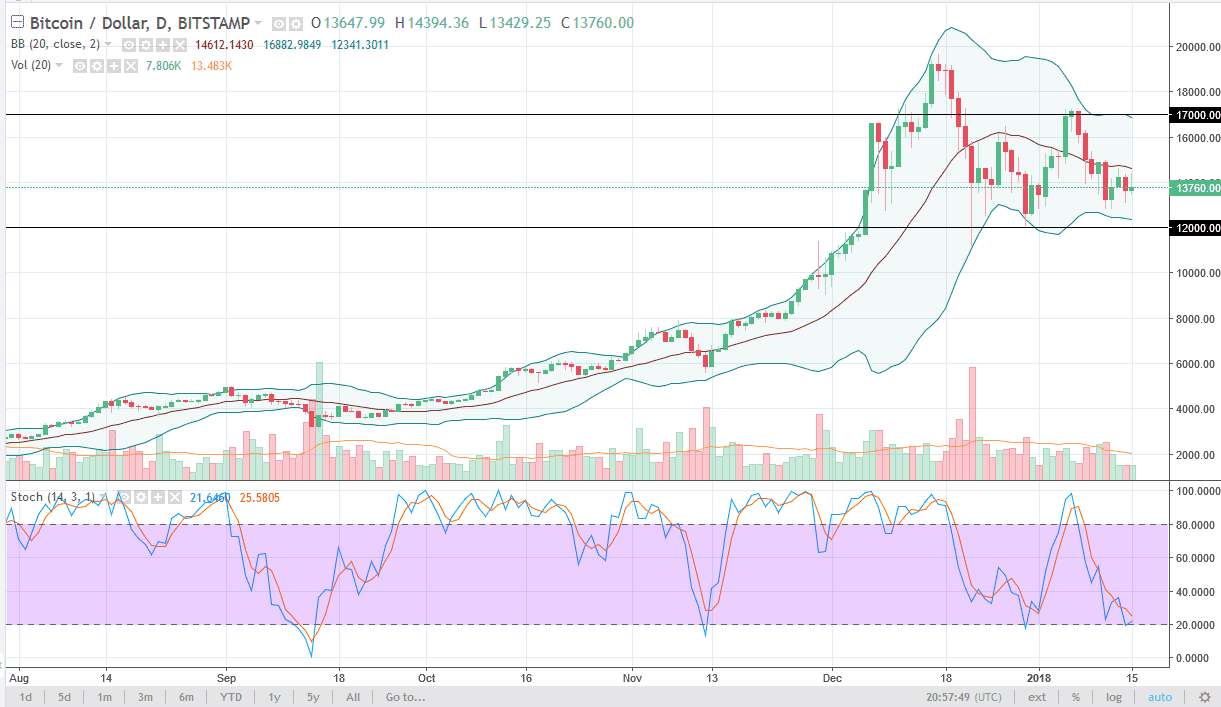

Bitcoin traders did almost nothing during the session on Monday yet again, as volume is starting to become an issue. It was also Martin Luther King Jr. Day in America, a major holiday which would influence volume. Because of this, I think that we may continue to drift slightly lower, perhaps aiming towards the $12,000 level. If we can break down below there, the market then goes looking for the $10,000 level, followed by the $8000 level.

I cannot help but notice the crypto currency markets in general have absolutely flattened after the futures markets were opened in Chicago. I believe that the “easy money” in crypto currency trading has been made, and at this point the best thing you can help for is a gentle grind higher. It would also not be a surprise to me if we broke down below the $12,000 level and sold off rather rapidly. Quite frankly, I think a lot of the hype around crypto currencies now has a lot of the longer-term traders and larger institutions shunning Bitcoin, even though many of them believe it will go much higher over the longer term. That’s the key though, “the longer term.”

When the futures markets opened in Chicago we were at roughly $17,000, and then spite another couple of thousands of dollars higher, and that was the peak in the market. I think at this point, there isn’t anyone left to buy this market. For the retail trader, this is a dangerous game, because most of them will be over levered. In fact, we could get a bounce for the $12,000 level, but I suspect that the market will probably reach towards $14,000 and run into a significant amount of trouble. Think of it this way: we would need to gain another $6000 to break free of significant resistance, and roughly $7000 to continue the upward momentum. Right now, I think that there is much more of a compelling argument to short this market on small rallies.