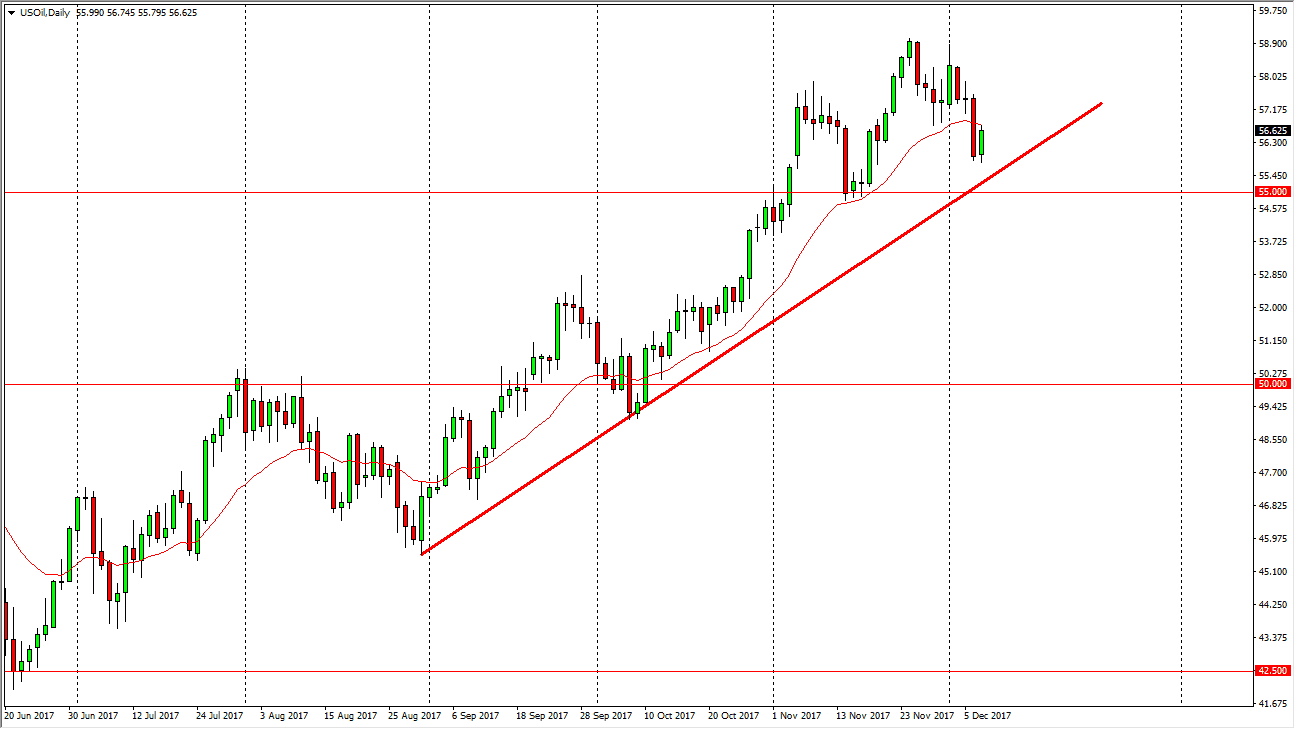

WTI Crude Oil

The WTI Crude Oil market bounced slightly during the trading session on Thursday as we continue to see volatility in the crude oil complex. There are various factors going on at the same time in this market, not the least of which will be the OPEC production cuts, and of course the high evaluation of oil attracting American drilling. In general, we have a jobs number coming out during the day could have a massive influence on what happens with the US dollar, and of course the perception of demand going forward. I believe that the $55 level underneath is massively supportive, so a pullback to that area will more than likely find buyers willing to take advantage of value at that lower level. If we break down below the $55 level though, the market could breakdown to the $53.50 level.

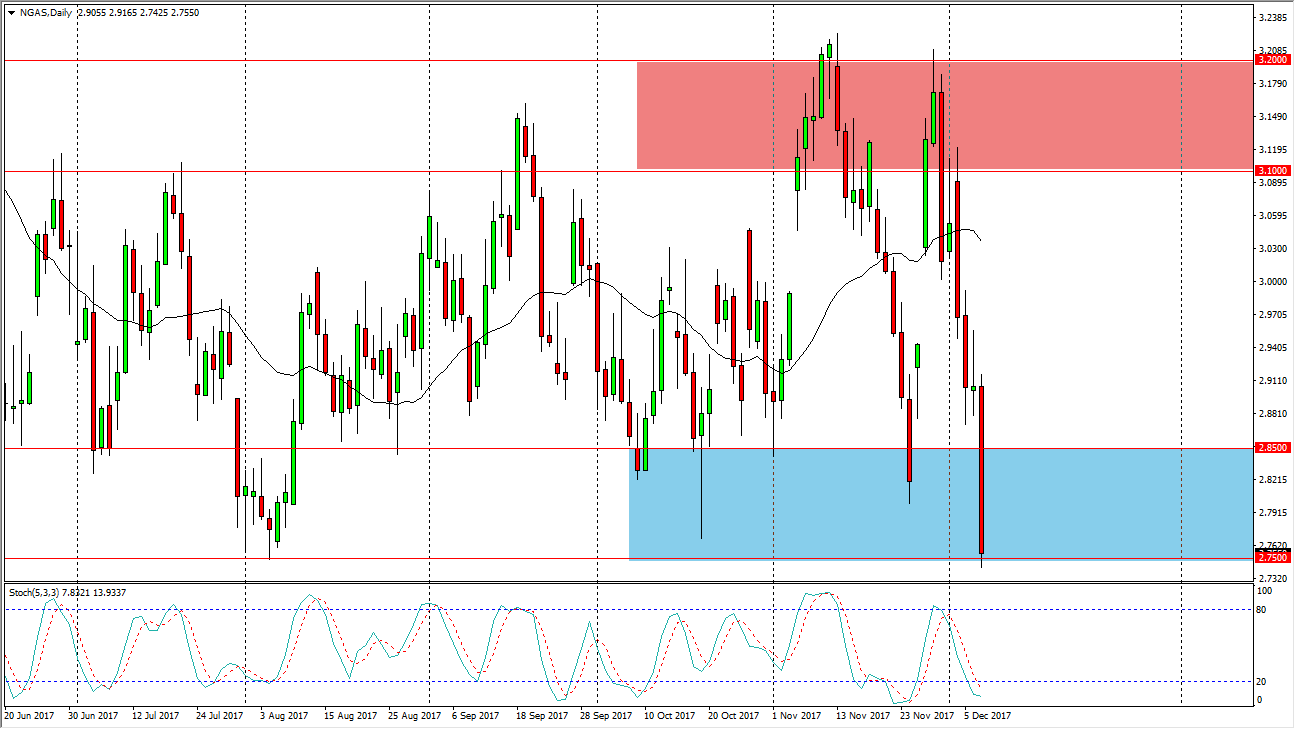

Natural Gas

Natural gas markets have reached towards the $2.75 level, but are starting to show signs of support. If we break down below the lows of the trading session, natural gas could go a bit lower, but quite frankly I think we will more than likely see a turnaround as it has been so oversold in this general vicinity. We have been here before, and have consistently seen buyers jump in near this area. In the short term, you might be noisy, but I believe a bounce from here is reasonable to expect. If we did breakdown significantly, we would then go looking towards the $2.50 level underneath for support, which of course has not only structural support, but it also has a significant psychological aspect to it as well. A break above the $2.85 level sends this market looking for the $3.10 level. Either way, it’s going to be choppy.