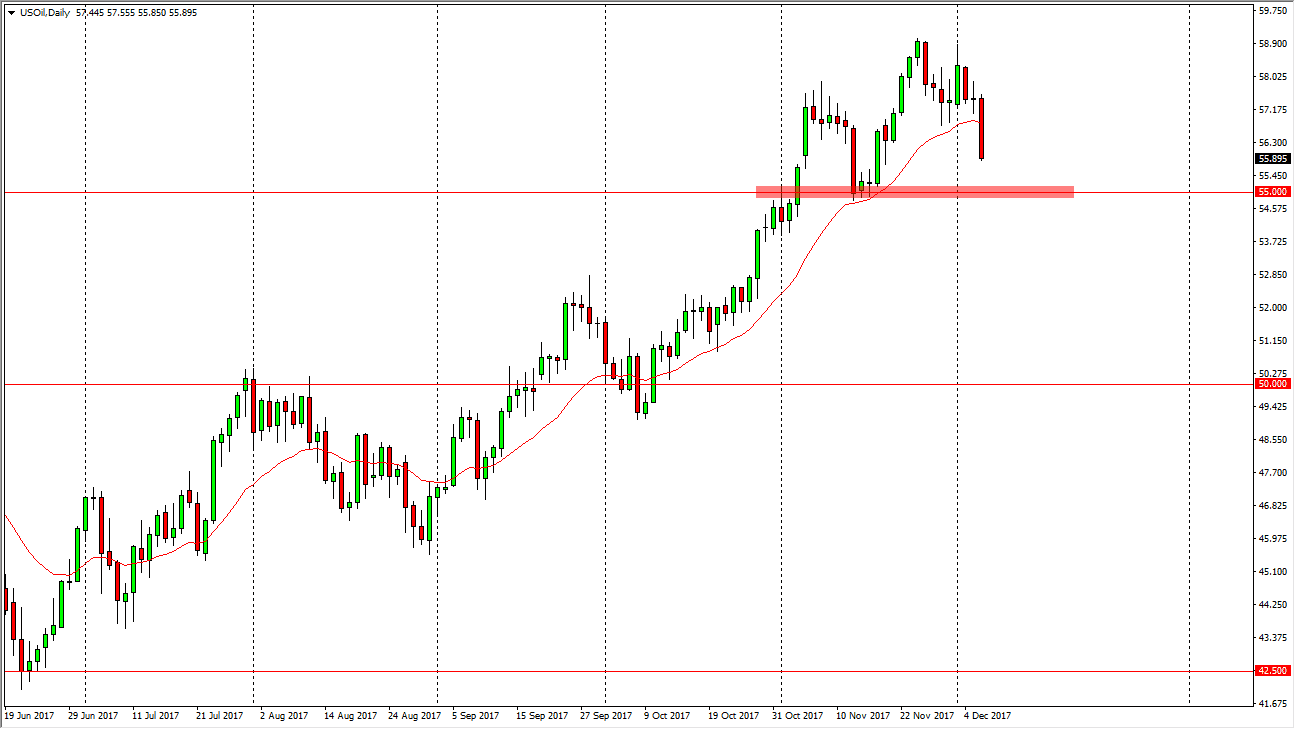

WTI Crude Oil

With a weaker than anticipated inventory number, the WTI Crude Oil market rolled over, and of course the lack of demand is very negative. The US dollar strengthening of course has a negative effect on this market as well, and I believe at this point we are going to go looking towards the $55 level. That’s an area that is massively supportive, but if we break down below there, we could reach down towards the $52.50 level underneath that has been resistance in the past. I believe that we continue to struggle, mainly because of high pricing in the crude oil market attracts plenty of American drillers as well, so I believe that no matter what happens, eventually we reach a top to this market. I don’t necessarily think that we are going to break down significantly, and perhaps melt down, but I do think that rallies are to be sold.

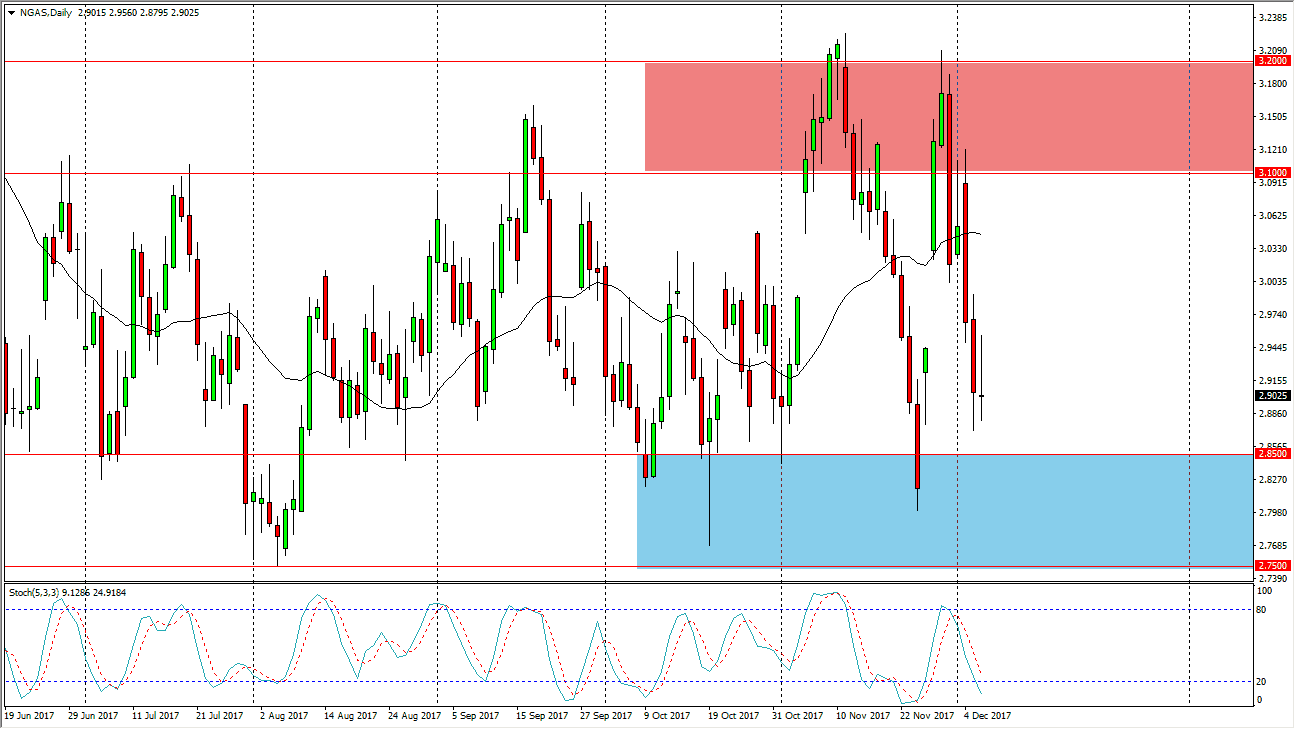

Natural Gas

The natural gas markets had a volatile session during the day on Wednesday, but rolled over to form a bit of a shooting star for the day. While this is a very negative candle, the reality is that there is a significant amount of support just below, especially starting near the $2.85 level, so I think it is only a matter of time before we get a supportive candle or a bounce that we can take advantage of. On short-term charts, it looks as if we are trying to form some type of double bottom on the hourly chart, but I think we will probably have another attempt to the downside today. Once that fails, and I think it will, it’s time to start buying as the overall consolidation continues. Natural gas continues to be volatile, but range bound.