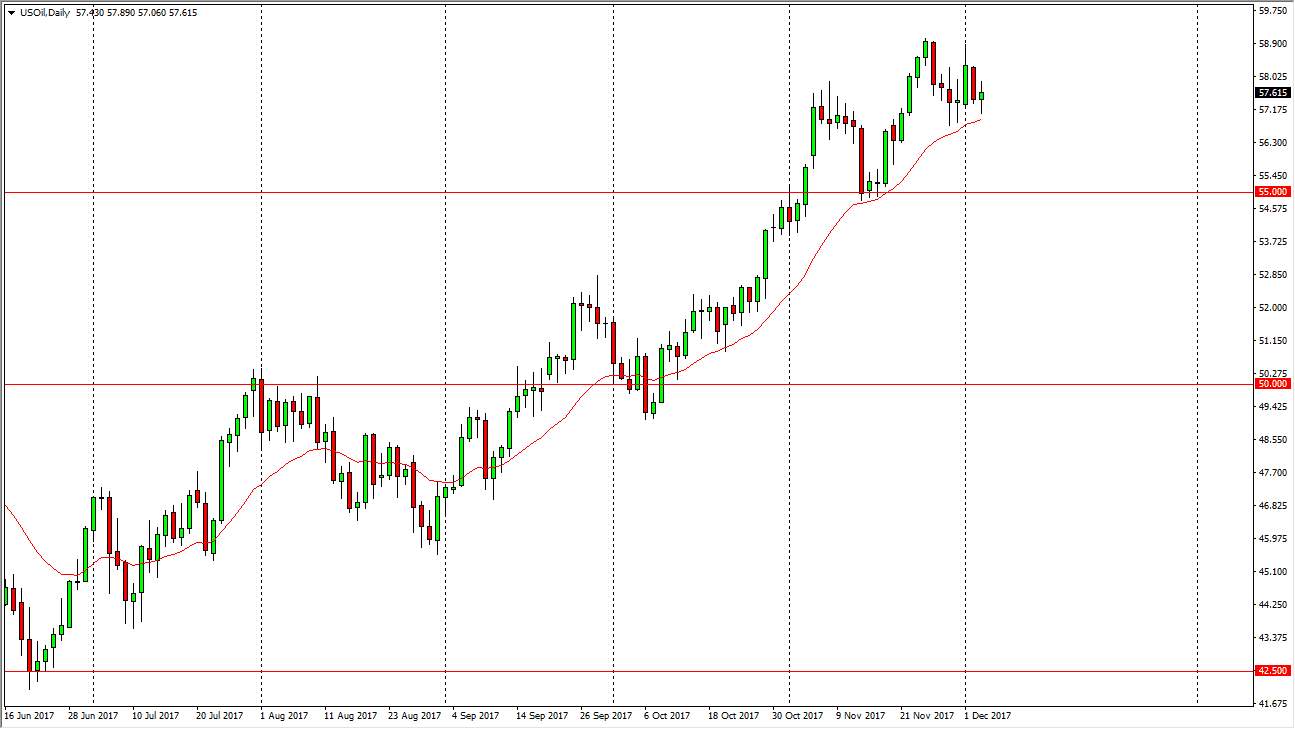

WTI Crude Oil

The WTI Crude Oil market went back and forth during the trading session on Tuesday, as we are struggling to keep momentum. The Crude Oil Inventories announcement coming out today of course will have a lot of influence on what happens next, so keep that in mind. I believe that the $55 level underneath is going to offer support, just as the $59 level above is resistance extending to the $60 level. In general, this is a “buy on the dips” scenario, but for short-term trading only as we have conflicting pressures in OPEC extending cuts through the rest of 2018, but Americans willing to throw more supply into the marketplace as pricing is relatively high. Because this, it’s likely that we will continue to see volatility no matter what happens next.

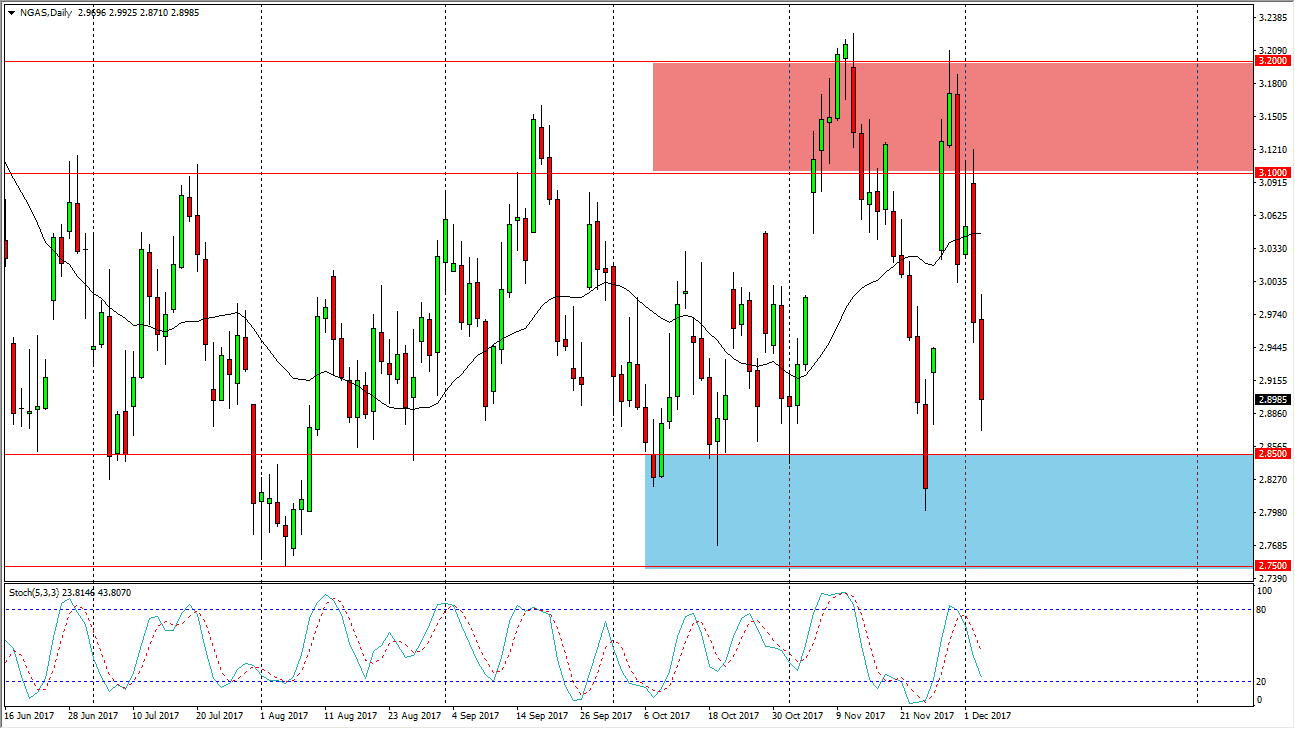

Natural Gas

The natural gas markets have been very choppy over the last several months, and the consolidation continues to be very prominent in this market. However, the consolidation area continues to expand, so it appears that we will see a significant volatility as we head into the cold months in America. Typically, we do see some type of demand increase for natural gas during this time a year, and I think that is part of what has been widening the range. As we are close to the bottom of the range, I think we are more than likely going to find a negative day followed by support. Once we get that support, I think short-term traders will push the market back towards the $3.10 level, where then we will find sellers again. This is a simple back and forth range bound type of trading situation, so ultimately, I believe you need to approach it as a market that is a simple back and forth set up.