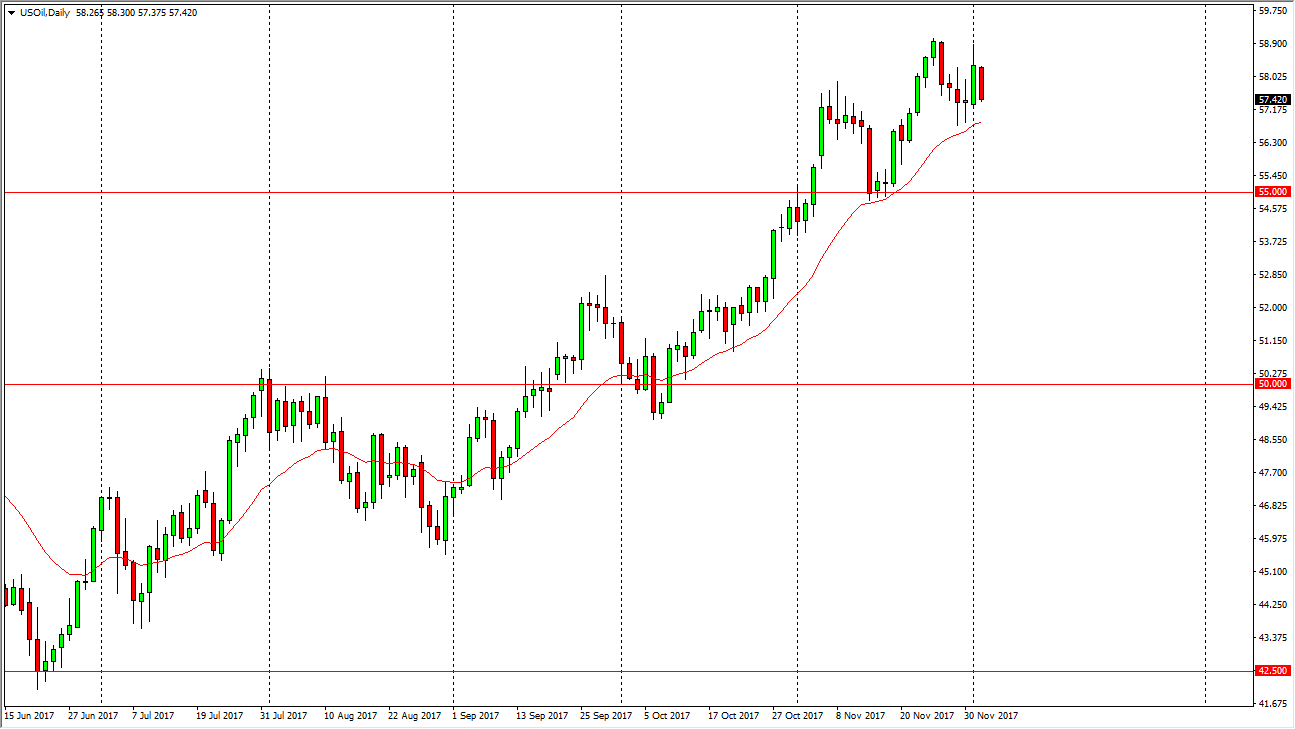

WTI Crude Oil

The WTI Crude Oil market fell during most of the trading session on Monday, as we continue to grind back and forth. I recognize that the markets are dealing with a significant amount of headwind above, as higher prices will certainly attract a lot of American drilling and supply into the market. At the same time, OPEC looks very likely to be able to hold together the production cuts through the rest of 2018, so it’s likely that we will have a perfect dichotomy of pressure in this market, keeping it very choppy and difficult to hang onto for long time frames. A breakdown below the $55 level could send this market down to the $52.50 level, where I see the previous I could offer support again selling pressure as it enters the market. At the same time, I believe that the $60 level above would be resistance.

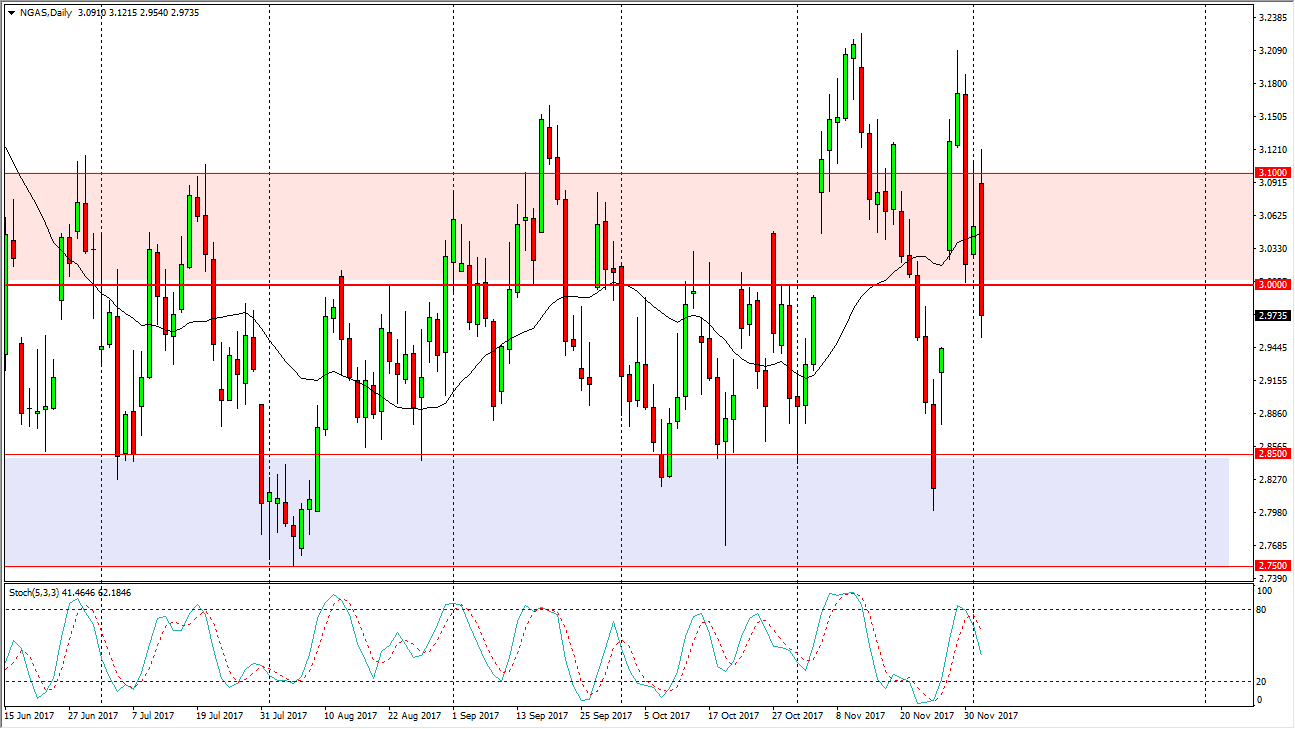

Natural Gas

The natural gas markets initially gapped higher during the trading session on Monday, but then rolled over significantly to break below the $3.00 level. It looks as if we are trying to fill the gap from about a week ago, so I think at this point we will probably find a little bit of a bounce, but if we do continue to go lower, then we are more than likely to go down to the $2.85 level underneath, which is the beginning of massive support on the longer-term charts. I believe that the market should continue to go back and forth in general, as we are in a situation that we have oversupply, but we are also in the middle of the high demand season in the United States. Because of this, I believe that we stay within the consolidation area, and therefore I think we go a little bit lower, then bounce, and then break down again.