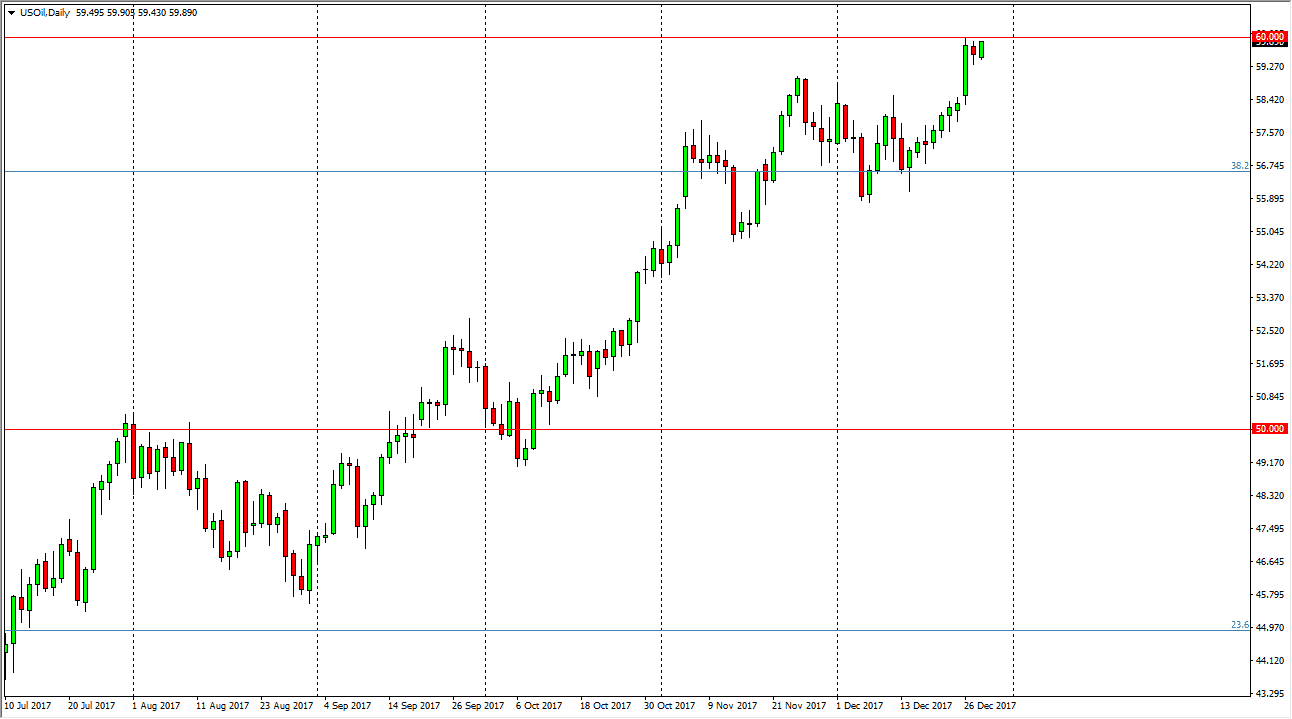

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Thursday, testing the $60 level. If we can break above the $60 level, the market should continue to go towards the $62.50 level, which is a bit of a target. I think if we break down from here, there’s probably plenty of support underneath to continue to push to the upside. However, I think that if we break down below the $58 level, the market is likely to be very difficult to deal with and the short-term, but longer-term I think we will see that the market is getting a bit overextended. Because of this, it’s likely that it will be very noisy, so I do not like the idea of putting large position done for huge moves. I think it’s probably best to favor the upside right now, but just in short bursts.

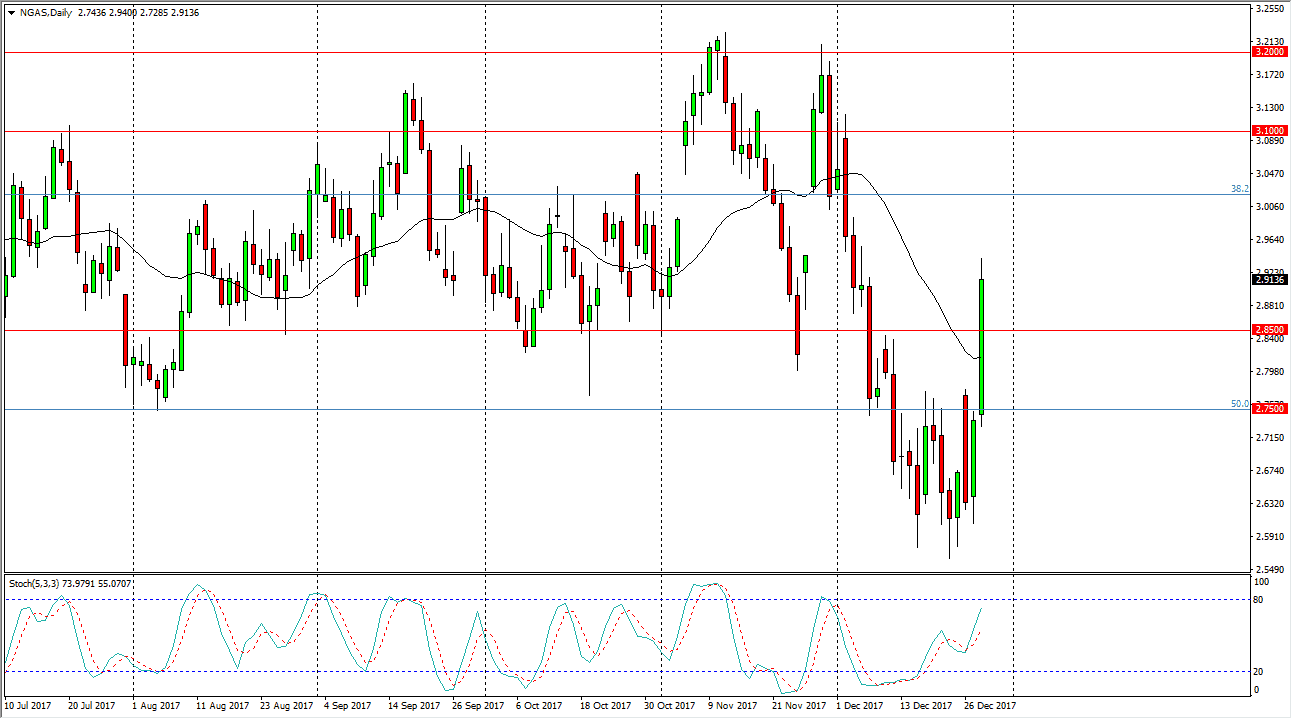

Natural Gas

Natural gas markets exploded to the upside, ironically because the natural gas inventories numbers were just as expected during the trading session. I think this is probably a bit of relief as people were worried about whether natural gas demand would pick up, but at the end of the day, you should keep in mind that there is a serious lack of volume currently, so I look at this is a nice selling opportunity. I wouldn’t do it today, but I think it’s only a matter of time before we get an exhaustive candle that we can search shorting. The $3.10 level above is more than likely going to be “a bridge too far”, so I will keep you advised as to what I’m doing, but for now I’m willing to step to the sidelines and wait for an exhaustive candle, or perhaps start selling below the $2.85 level.