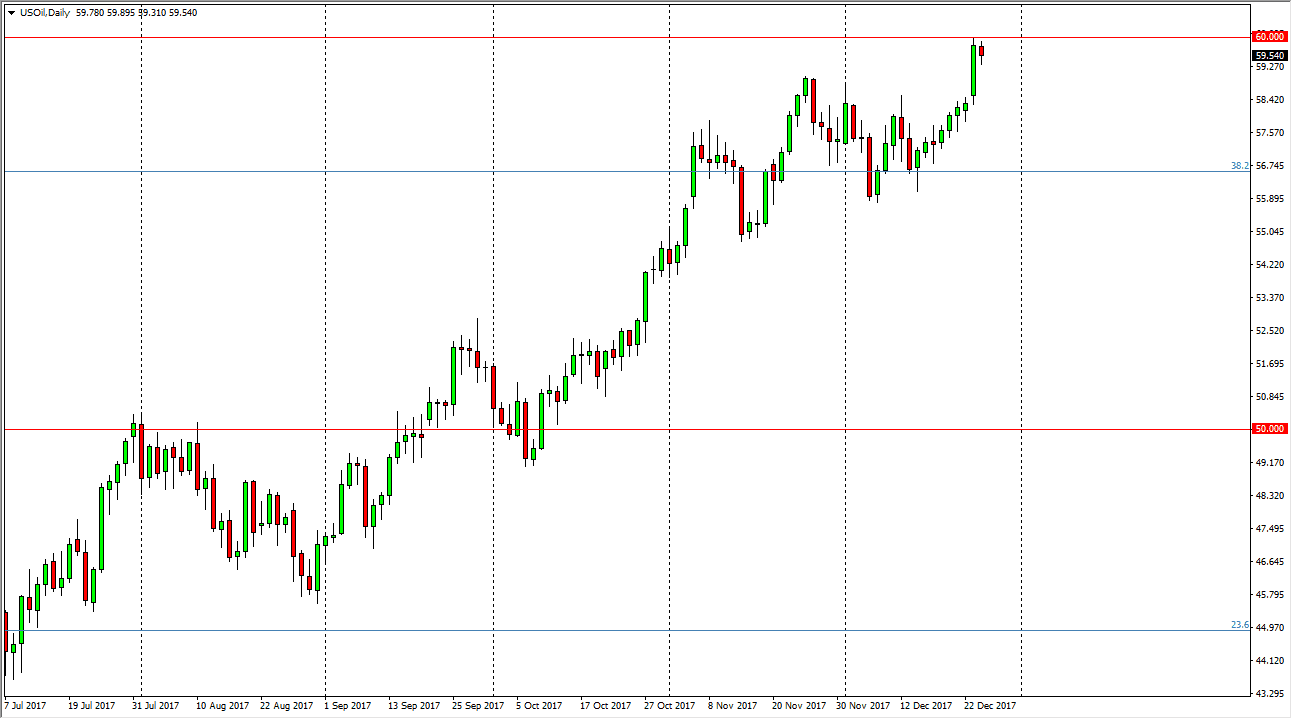

WTI Crude Oil

The WTI Crude Oil market fell a bit during the trading session on Wednesday, but obviously on very low volume. The $60 level offered a bit too much resistance, so it’s not a surprise that we would pull back from there. The large, round, psychologically figure will more than likely continue to offer resistance, but if we can break above there I think the market goes looking towards the $62.50 level. Currently, looks as if the $59 level is going to offer at least short-term support. The market has been in an uptrend for some time, but with the low volume it’s almost impossible to guess where we go next. I think that the low volume environment is probably one you should avoid, but certainly if you are going to trade this market, you need to favor the upside overall.

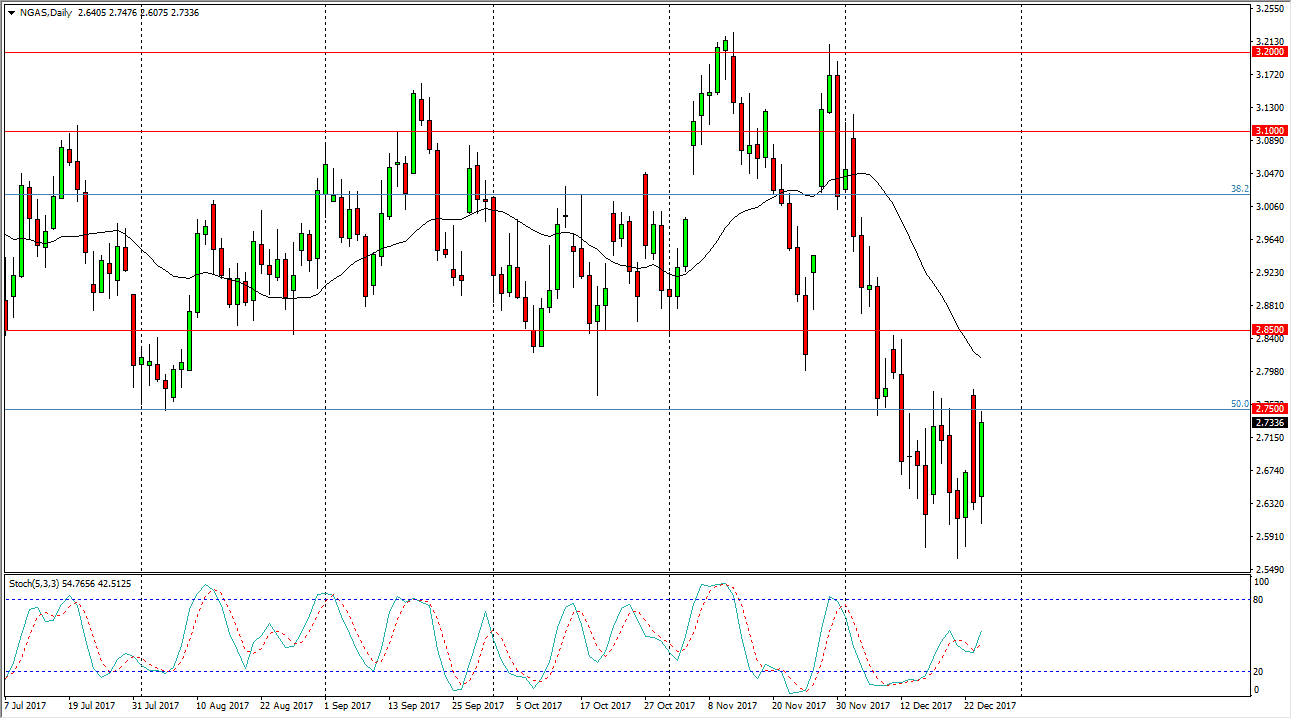

Natural Gas

Natural gas markets rallied significantly during the day on Wednesday, after initially dipping. The bullish move slammed into the $2.75 level, but as you can see pull back slightly. It looks as if we’re going to continue to consolidate in general, so I think short-term trading back and forth is probably the best way to look at this market. If we can break above the $2.75 level, it’s likely that we will find even more resistance at the $2.85 level. That’s an area that of course is going to be an area that I would look to sell on signs of exhaustion, but I would do so on short-term charts. I believe that the negativity in the market over the last couple of months has been quite brutal and telling, considering that we are in the coldest part of the year in the northeastern part of the United States, and cannot keep rallies going for any length of time.