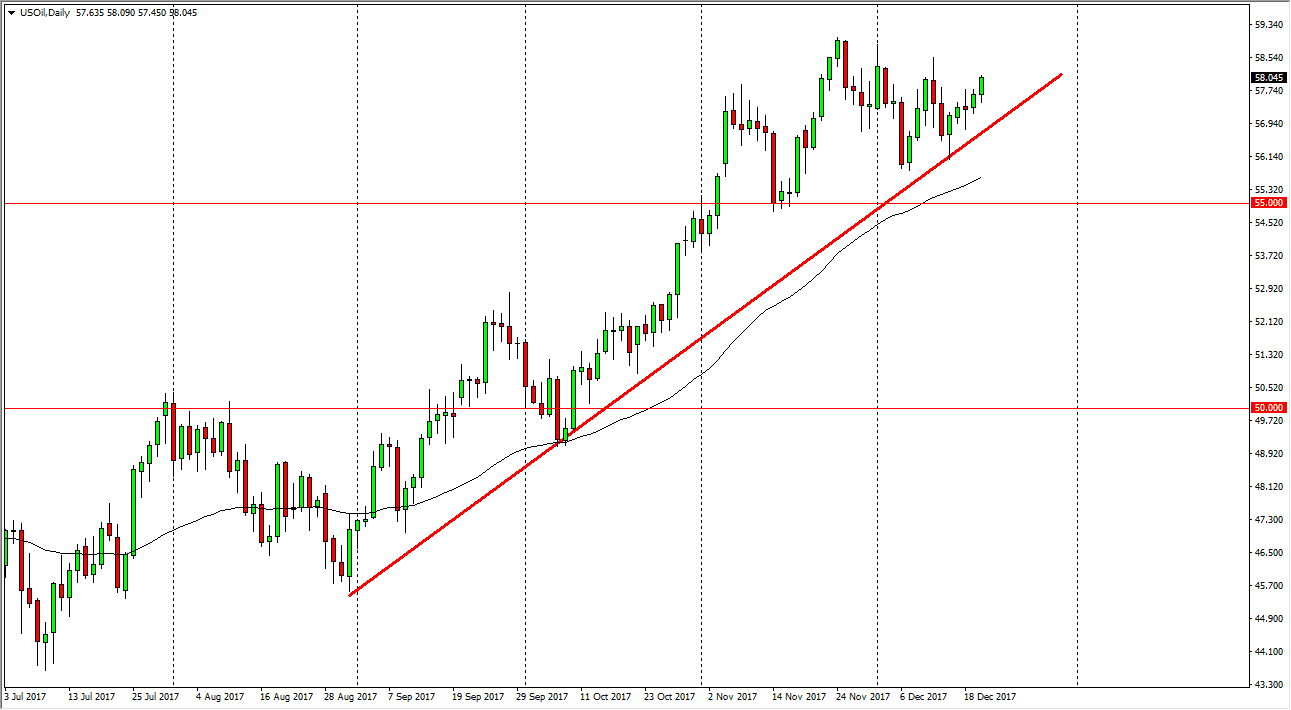

WTI Crude Oil

The WTI Crude Oil market initially fell during the trading session on Wednesday, but rallied by the time it is almost done. We are closing just above the $58 level, and I think this shows that we will continue to try to grind to the upside, perhaps reaching $59. Volume is going to be a major problem over the next several sessions, and unless there is some type of headline announcement or perhaps some geopolitical risk, I don’t think that this market is going to make major moves. I believe that the floor in the market is closer to the $55 level underneath, just as the ceiling is closer to the $59 level. Expect a lot of back and forth action over the next several sessions.

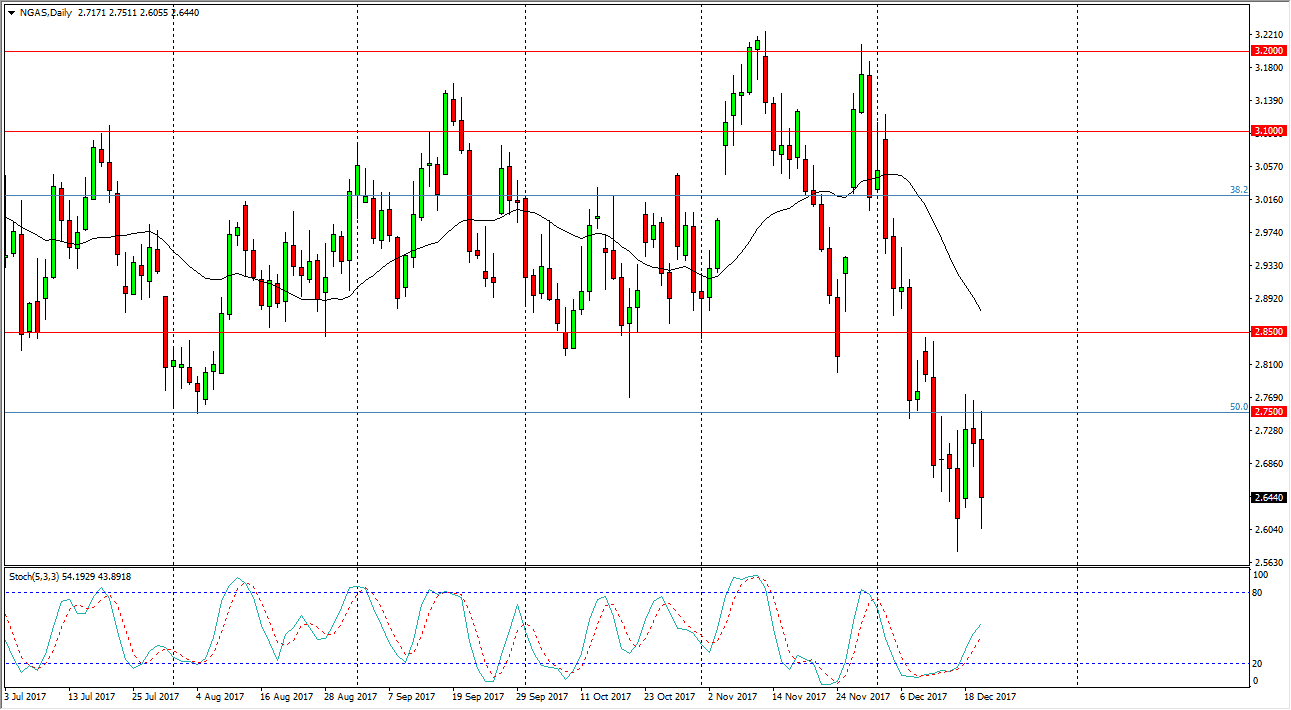

Natural Gas

Natural gas markets initially tried to rally on Wednesday but found the $2.75 level to be far too resistive to continue going higher. As we fell significantly, we reached towards the $2.60 level, only to bounced slightly by the end of the day. I think the biggest issue that we have here is massive oversupply of natural gas in the market, but also, we have a serious lack of liquidity over the next couple of sessions, as people were beginning to worry more about holidays than fundamentals in the markets. A breakdown below the $2.50 level doesn’t look very likely, as it has been a “hard floor” in the market several times, and I think that the level will hold longer term. If we were to break down below there, it would be catastrophic for natural gas. Otherwise, I think that rallies offer selling opportunities, but with a lack of volume, you’re probably better off leaving this market alone.