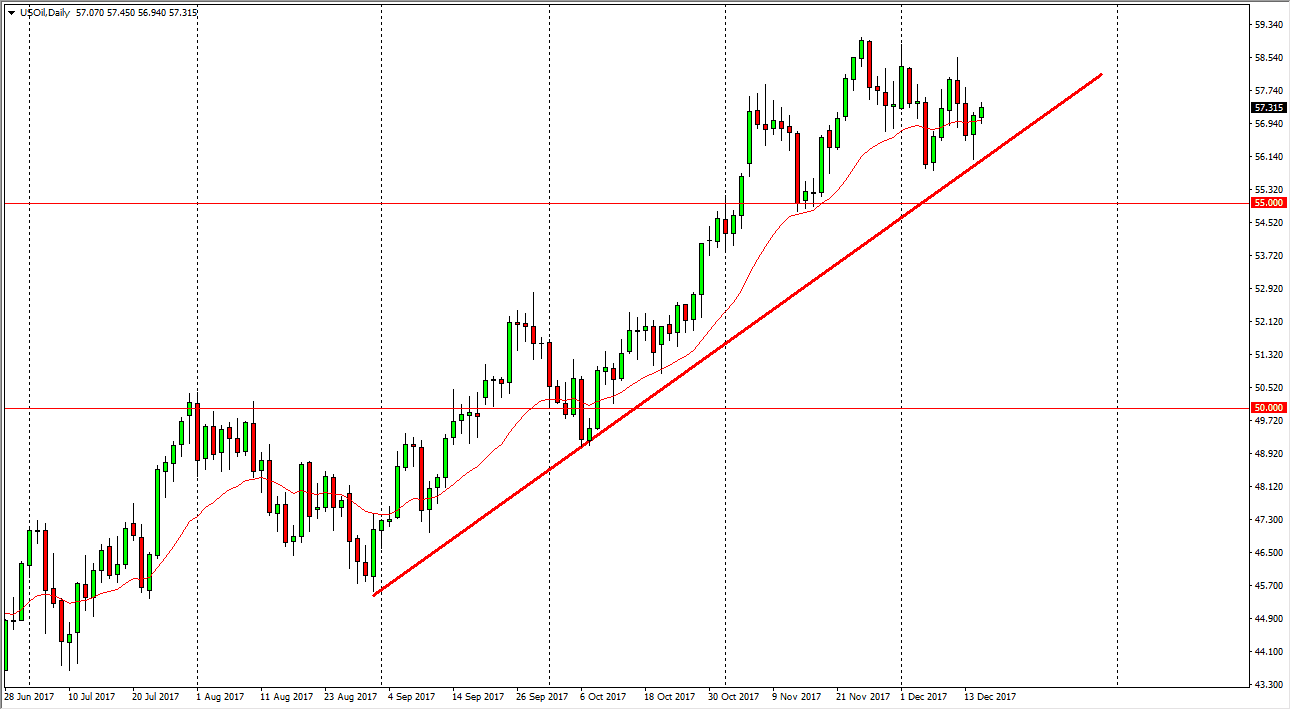

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Friday, breaking above the top of the hammer from the previous session. This of course is a bullish sign and then we also have the uptrend line underneath, which of course is supportive. Because of this, I think that the market will eventually reach towards the $59 level, and then eventually the $60 level after that. I think this is a market that will continue to be very noisy in general though, because not only do we have OPEC cutting production along with Russia, we also have the issue of high pricing attracting Americans and their supply. Because of this, expect a lot of back and forth momentum, but given enough time I think that the buyers will make a case. If we were to break down below the $55 level, the market could break down significantly.

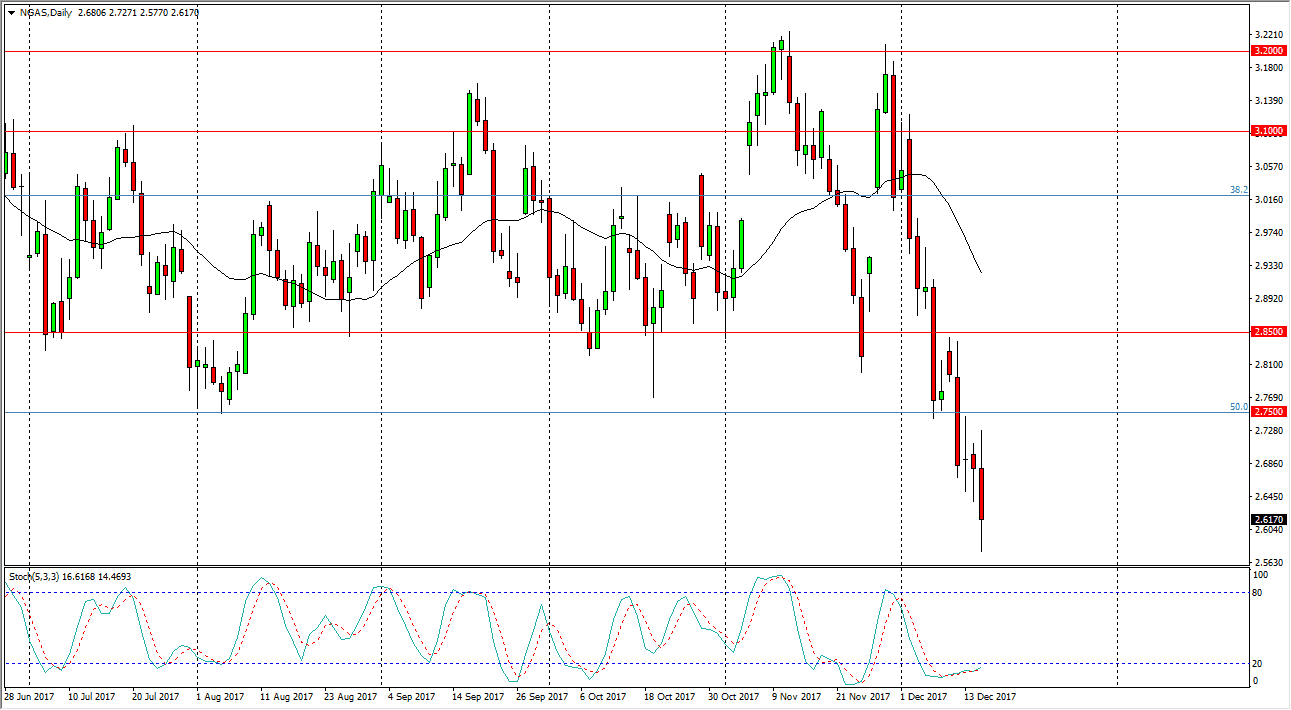

Natural Gas

Natural gas markets were negative during the trading session on Friday, initially trying to reach towards the $2.75 level, but rolled over to show signs of negativity. The market broke down below the $2.60 level, which of course is a negative sign and I think we will eventually go looking towards the massive support level underneath, at the $2.50 level. I think that eventually; the sellers will come in on any rallies but we will probably have to look at short-term charts to do so. $2.50 has been massive support over the longer term, and I think it will be going forward. After all, we do have colder temperatures in the northeastern United States that will eventually come into play. I’m surprised that we could pull back the way we have and fall, which suggests that the market is much weaker than I originally anticipated.