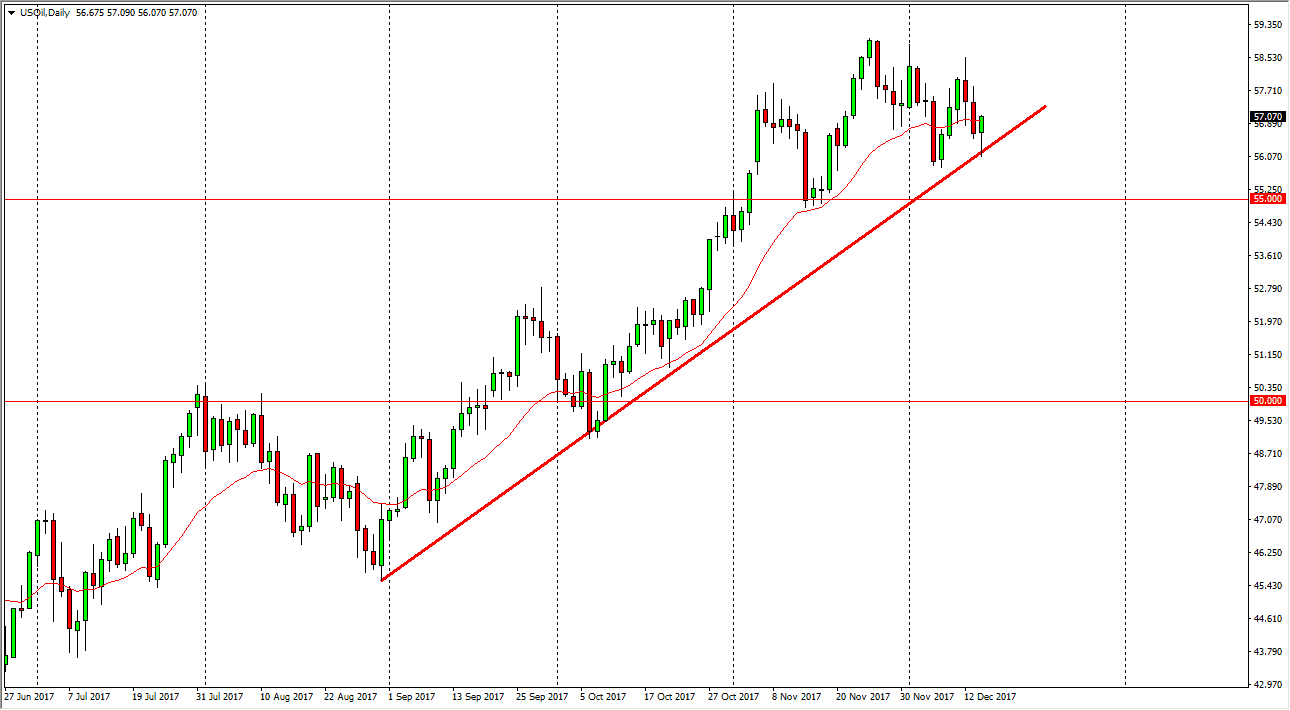

WTI Crude Oil

The WTI Crude Oil market initially fell during the session on Thursday, but found enough support at the uptrend line to turn around and form a nice-looking hammer. Because of this, and the fact that we get the Baker Hughes Oil Rig Count coming out during the day, that could provide bullish pressure. I believe that a massive uptrend line should continue to attract a lot of traders, and I believe that the $59 level above will cause a significant amount of resistance, extending to the $60 level. I think the $60 level above is a massive ceiling in the market, and I also believe that it is the highs of the market going forward. If we were to break above there, that would be explosively bullish, but at this point I think that once we break above the $60 handle, and attracts a lot of attention from the Americans, and that of course will cause a flooding of the market.

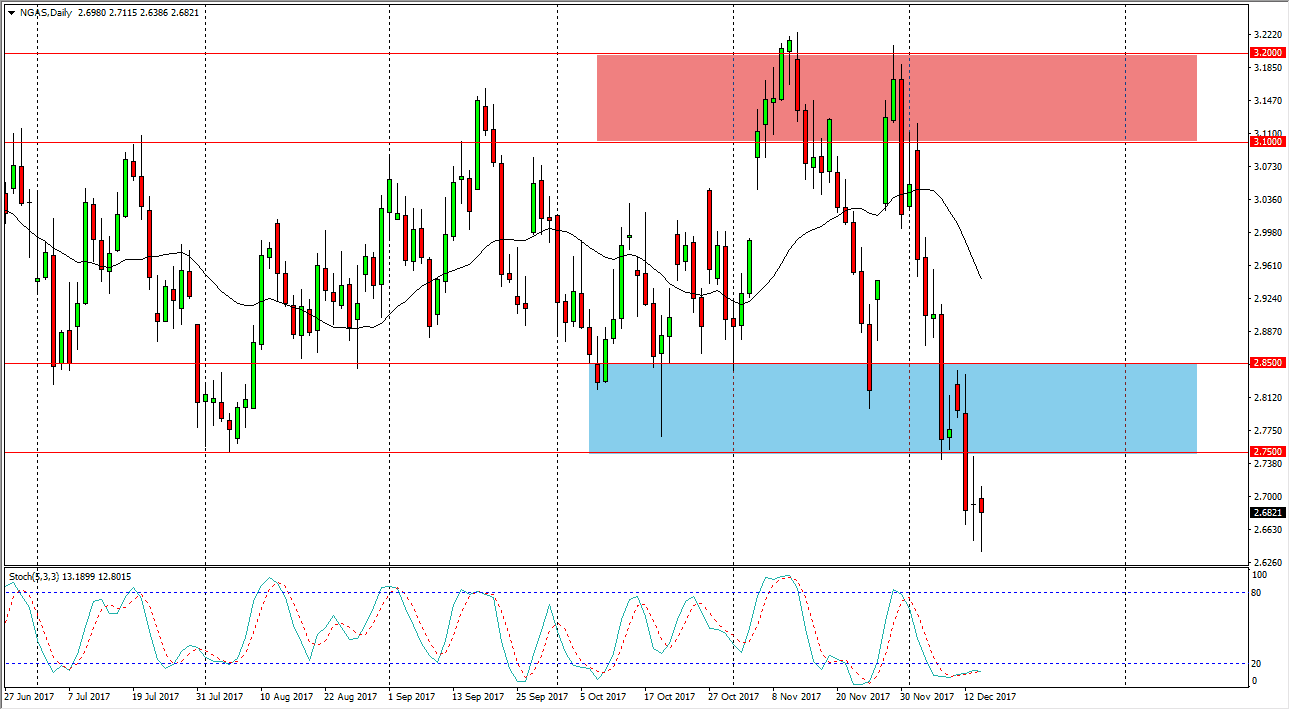

Natural Gas

The natural gas markets fell significantly during the day, reaching below the $2.65 level, and then bounced enough to form a hammer. The hammer of course is a bullish sign, so we should get a nice bounce from here and quite frankly I welcome that, as an opportunity to start shorting this market at higher levels. I think that the $2.85 level should continue to be very resistive, and as a result I think if we break above there, we could go all the way to the $3.10 level and a rather quick move. However, the fact that we have been so negative during the coldest part of the year in the northeastern part of the United States suggests to me that this market is in serious trouble. I think the $2.50 level is the target.