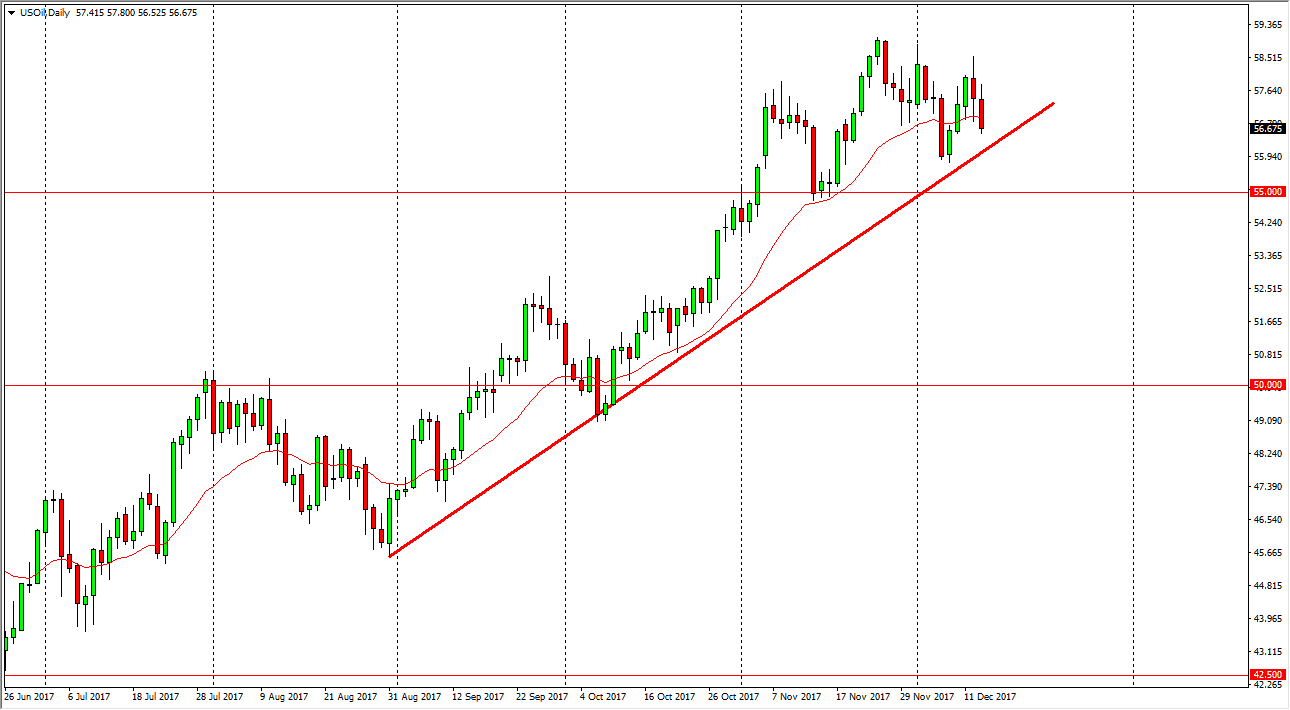

WTI Crude Oil

The WTI Crude Oil market initially tried to rally, but then rolled over the show signs of exhaustion during the day on Wednesday. There is a nice uptrend line just underneath, so that should be a nice buying opportunity, so waiting for a supportive candle is reason enough to go long. However, if we were to break down below the $55 level, I think that the market should send this market down to the $52.50 level below, which should be the next support level. I think volatility continues to be a major issue in this market, so we will have to see whether we can continue the uptrend, but I believe that the $60 level is essentially the ceiling in the market as the oversupply of petrol will continue to be an issue. Keep your position size small.

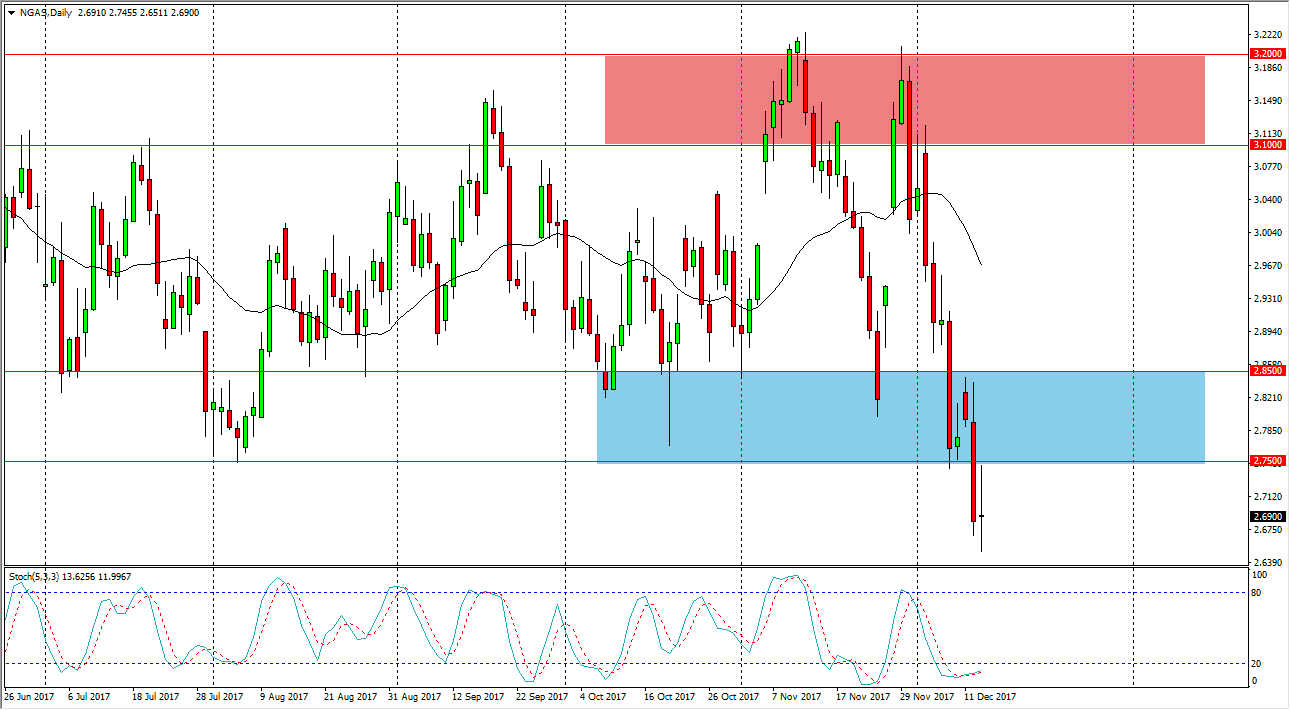

Natural Gas

Natural gas markets have been very noisy during the trading session on Wednesday as well, reaching towards the $2.75 level, and then pulling back significantly. I believe that the market should continue to be negative, and short-term rallies will send this market lower. I think it will be difficult to hang onto a trade, but we could go as low as the $2.50 level underneath. If we can break above the $2.85 level, that would change everything and perhaps in the market towards the $3.10 level. However, if natural gas can’t rally during a cold snap in the northeastern part of the United States during the month of December, when can it accomplish a rally? I think selling continues to be the best way to play this market, but I do recognize that the snapback rally could happen.