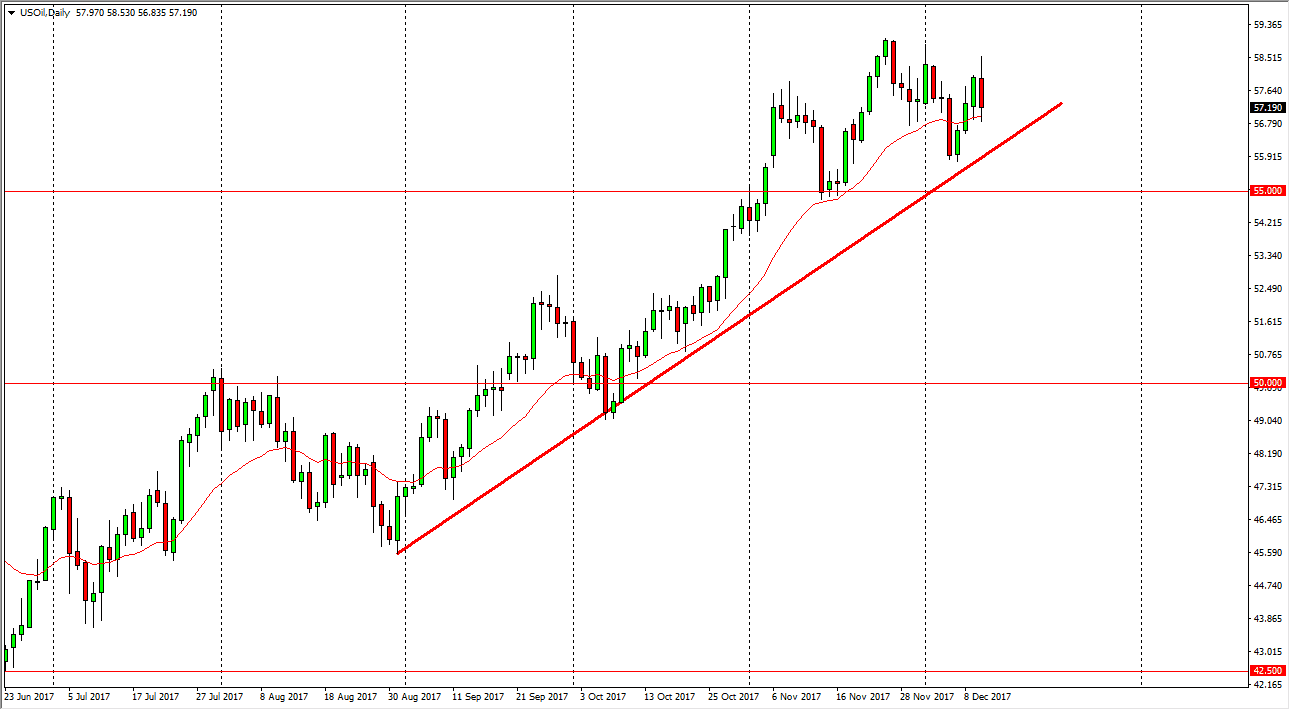

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the trading session on Tuesday, but rolled over as the market plunged towards the $57 handle underneath. If we can break down below here, I think that the market is probably going to test the uptrend line just below, so I think that more softness may enter the marketplace, but ultimately, it’s not until we break down below the $55 level that I would be concerned about the uptrend. In the meantime, I think you are going to need to see some type of bounce below to take advantage of a continuation of the uptrend. Because of this, patience will be necessary going forward, especially considering that the Federal Reserve will have a massive effect on the US dollar today.

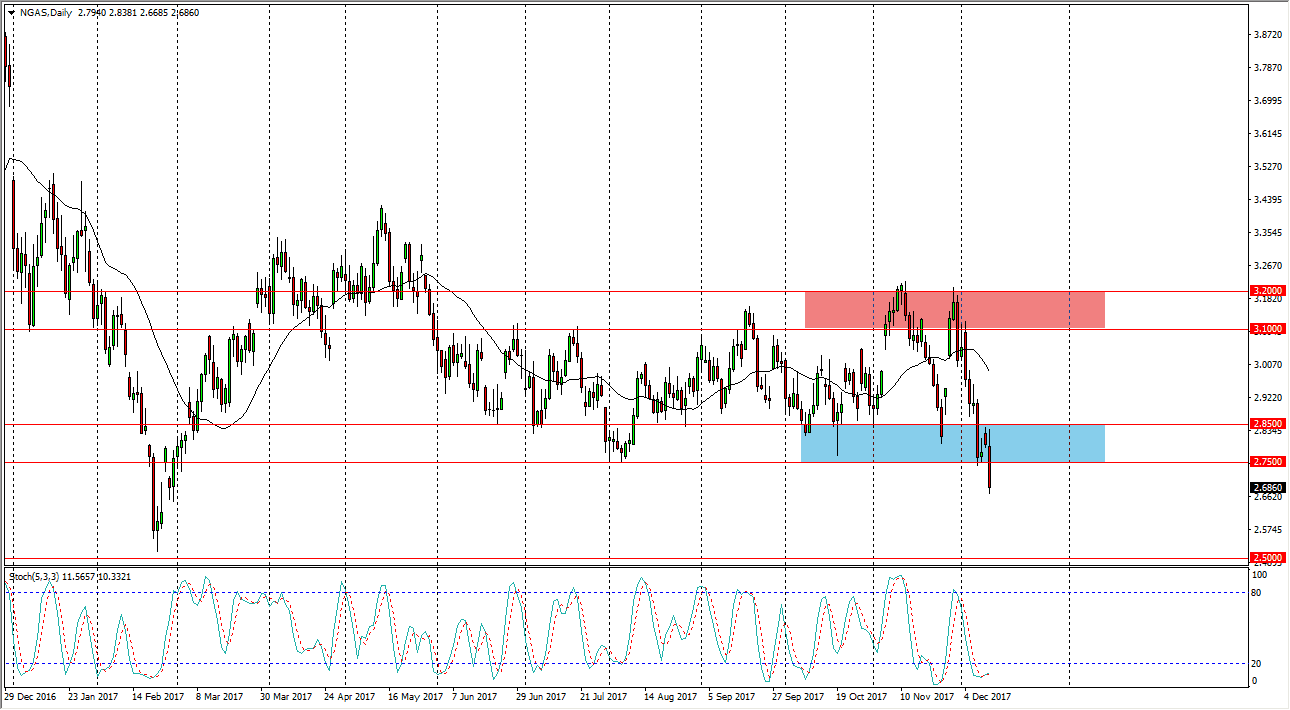

Natural Gas

In a huge surprise to me at least, the natural gas markets tried to rally towards the $2.85 level but did something that I didn’t think what happens during the month of December: they broke down yet again. By slicing through the $2.75 level, it looks likely that we are going to go towards the $2.50 level in the longer term, but I think short-term rallies will be needed to short this market, as sudden bounces could occur in a very thin energy market. Overall, I believe that the market will find plenty of support near the $2.50 level, but needless to say the extreme amount of volatility has caught the market off guard this winter, as we typically have buying pressure this time year, but clearly that has not panned out very well for the buyers. Keep your position size very small.