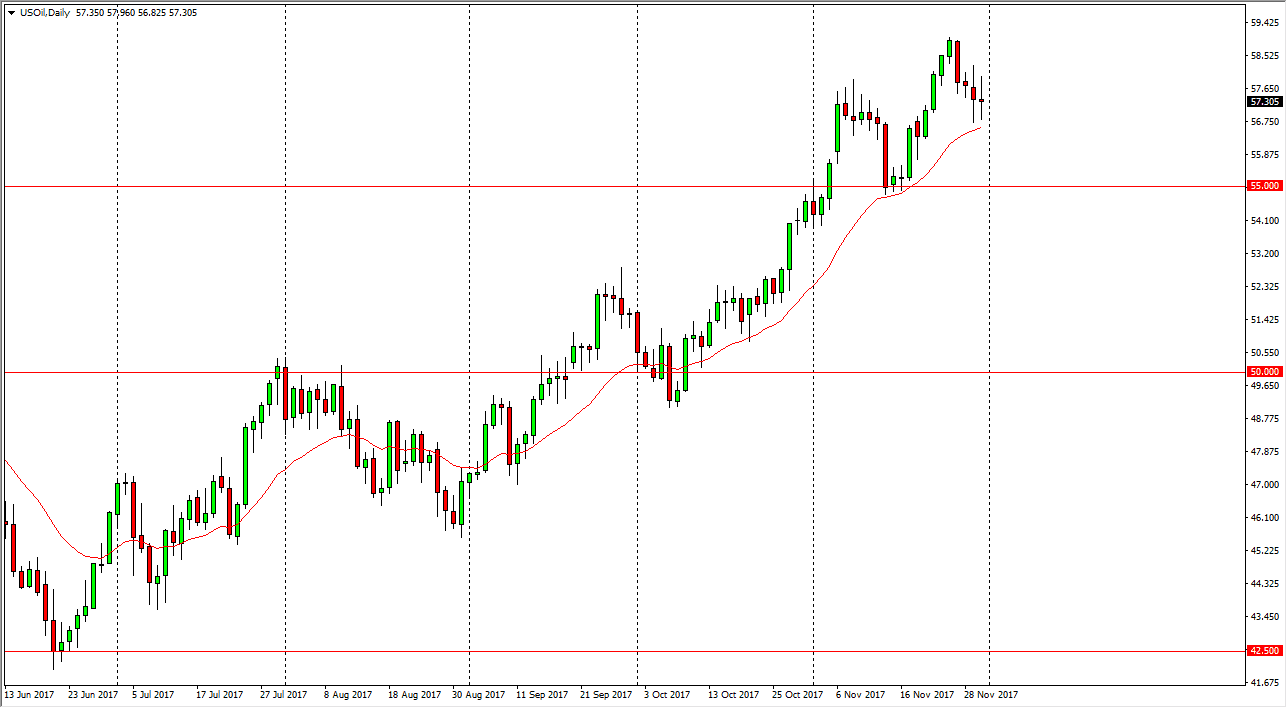

WTI Crude Oil

The WTI Crude Oil market was very noisy during the trading session on Thursday, as we bounced around the $57.50 level. This is a market that continues to be very choppy, as there are a lot of issues with this market. The OPEC production cuts are being extended, but quite frankly the same time it looks as if the markets get a little too bullish from here, there will be plenty of American drillers willing to jump into the market and supply at this high evaluation. I believe that the $55 level underneath is massively supportive, and I think that any pullback at this point will probably find buyers there. Alternately, if we break above the top of the candle for the Thursday session, we could go as high as the $60 handle above. Volatility will certainly be an issue.

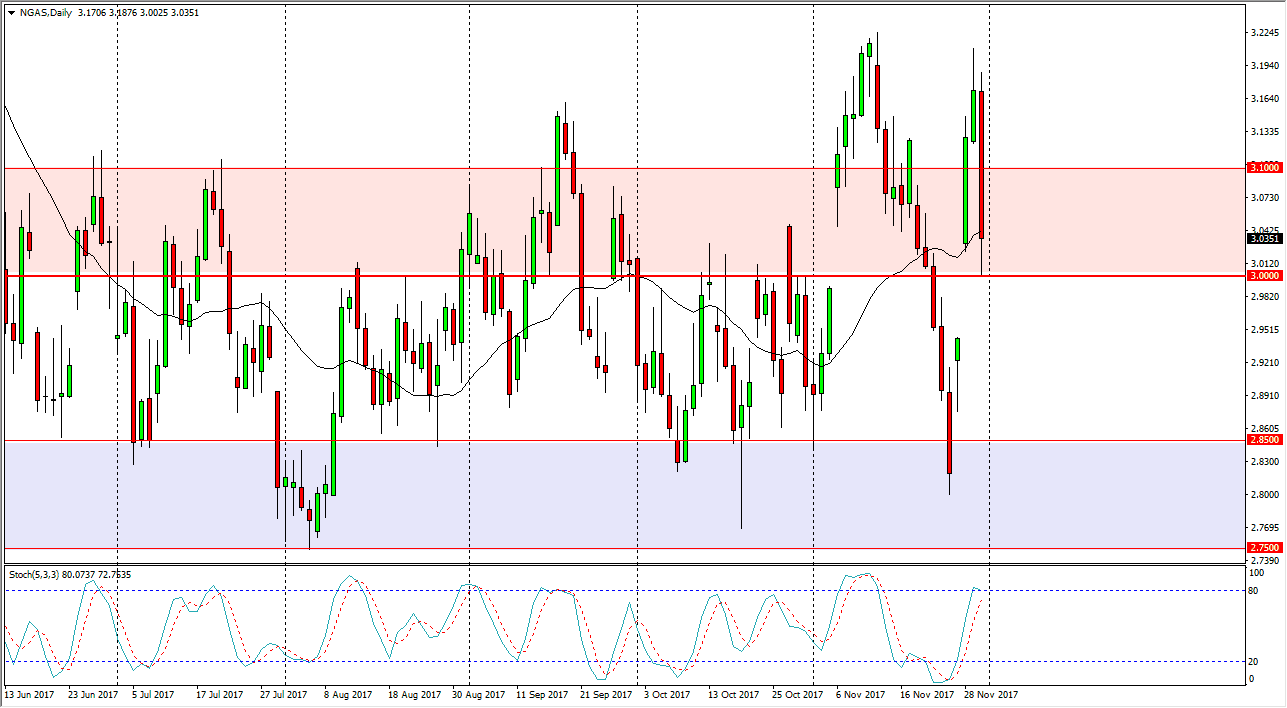

Natural Gas

Natural gas markets had an extraordinarily negative session on Thursday, as we continue to see volatility. The $3.00 level underneath offered support, and we did bounce from there, reaching towards the $3.03 level. That being said, the market has a gap underneath that is still waiting to be filled, and it looks likely that the market may try to break down from here, but quite frankly this is the market that has been gapping from every couple of days, and it looks likely that the overall attitude of the market will shift back and forth due to weather reports coming out of the northeastern part of the United States, so quite frankly it’s almost impossible to trade this market for any length of time. At this point, I believe that sitting back or trading is all you can do.