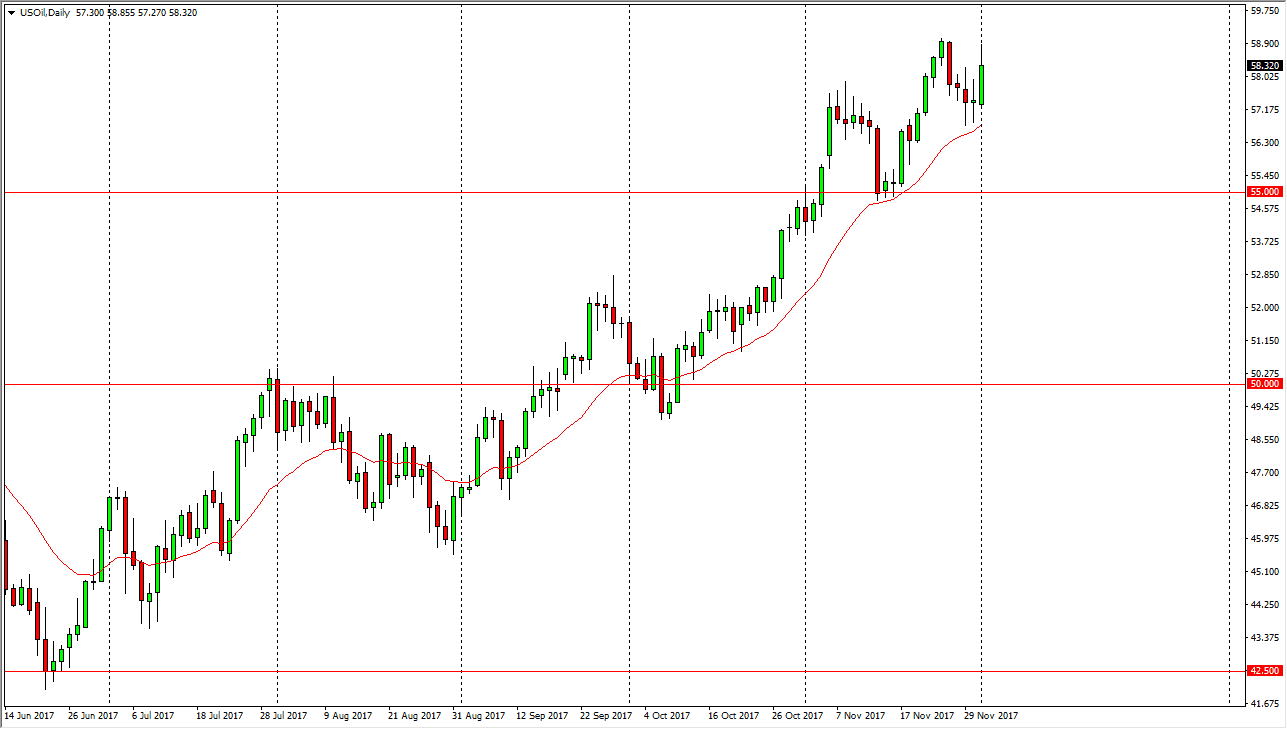

WTI Crude Oil

The WTI Crude Oil market rallied significantly during the trading session on Friday, reaching towards the $59 level. The $59 level is minor resistance, but the pullback I think is somewhat short-lived. The real fight is probably closer to the $60 level above, as it is a large, round, psychologically significant number. There are a lot of moving pieces when it comes to the WTI Crude Oil market, as the OPEC extension of production cuts is of course bullish, the US dollar getting hammered during the Friday session is also bullish, but we also have the specter of American drillers pumping the market with massive supply as these higher levels offer more profits. Ultimately, I think that we continue to see a little bit of a grind to the upside, but with serious complications and possibly breakdown.

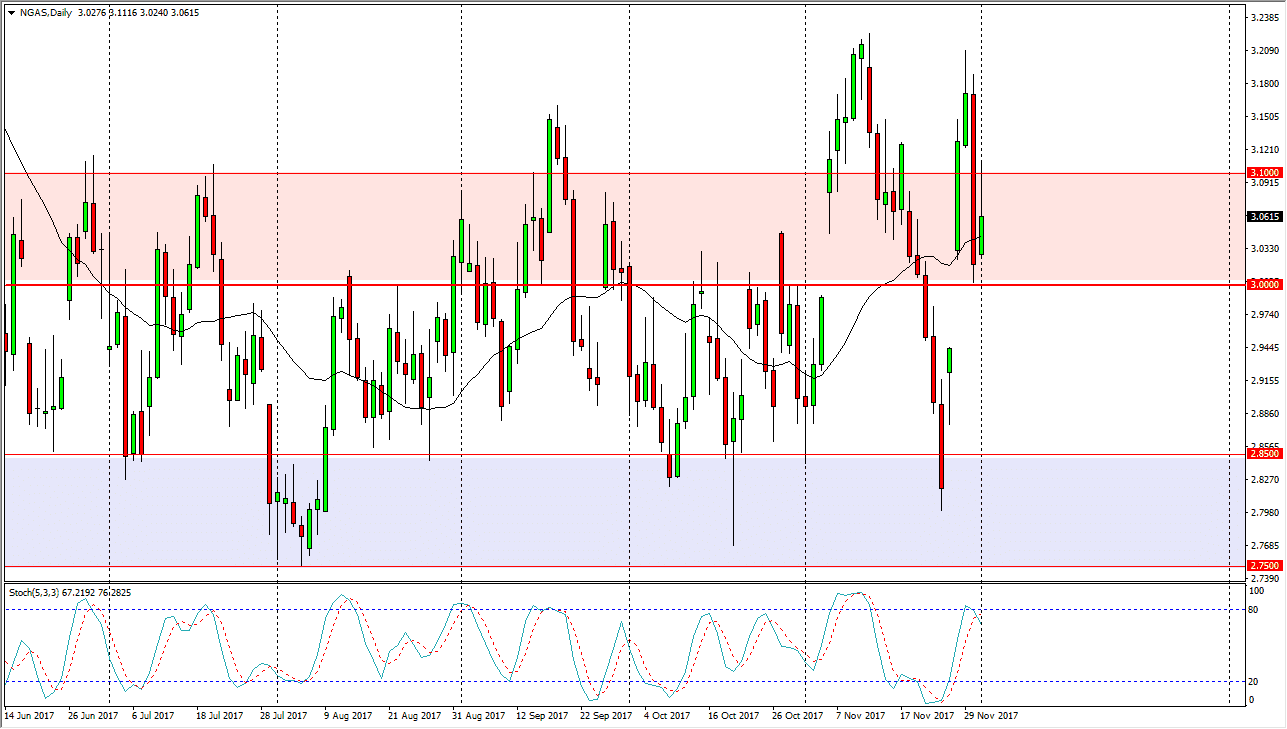

Natural Gas

The natural gas markets rallied during the trading session, turning around to form a shooting star. The shooting star breaking down below the bottom of the candle kids in this market testing the $3.00 level, and a breakdown below there should go down to the bottom of the gap which is closer to the $2.93 level. Ultimately, I think that we will probably break down to the $2.85 level, which should be massively supportive. Alternately, if we break above the top of the shooting star during the trading session on Friday, that move above the $3.10 should send this market to the $3.20 level. The market continues to be very volatile, and quite frankly trading on next week’s weather forecast for the northeastern part of the United States. Because of this, Thomas impossible to trade with any real size at this point.