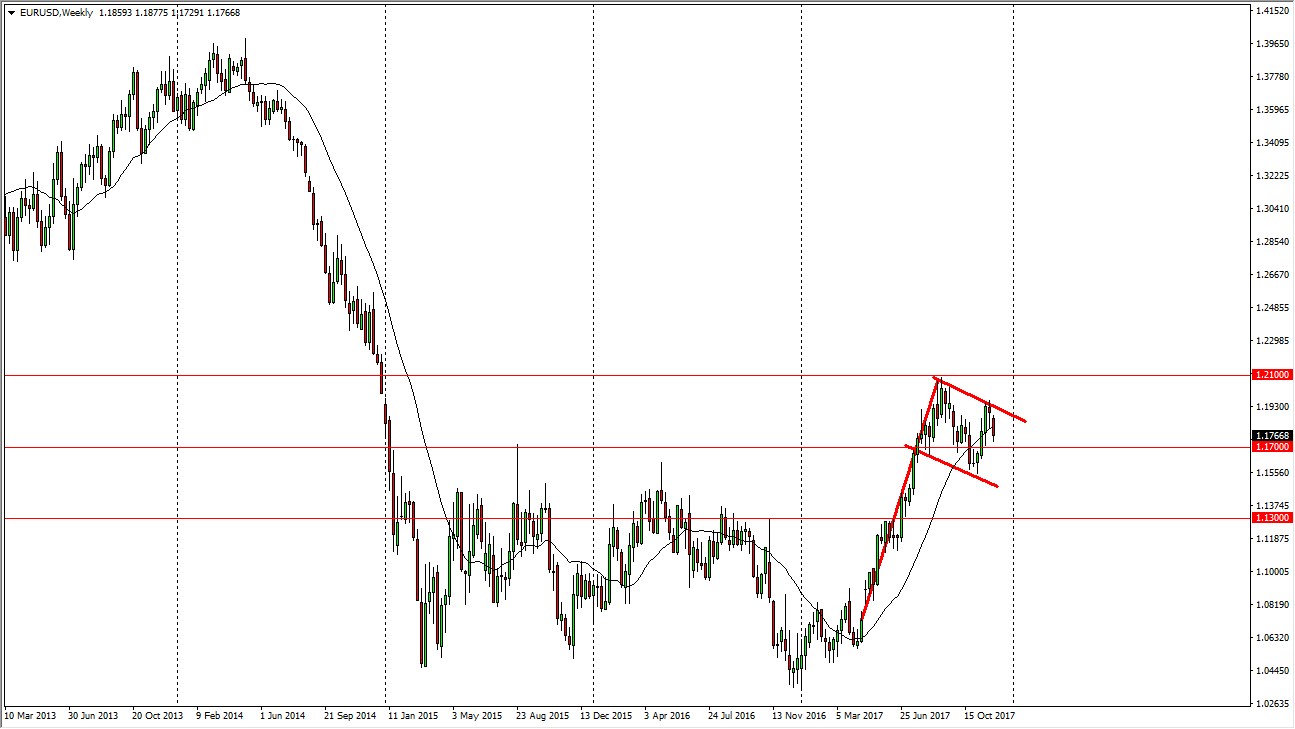

EUR/USD

The EUR/USD pair had a slightly negative week, but quite frankly when I look at the longer-term charts, I see plenty of support underneath. I think that we may continue to drift a little bit lower, but I expect to see a significant amount of support between the 1.16 and 1.17 levels, so given enough time I think that a breakout above the downtrend line on the weekly chart should send this market much, much higher as the bullish flag signifies that we may see a very strong move to the upside next year.

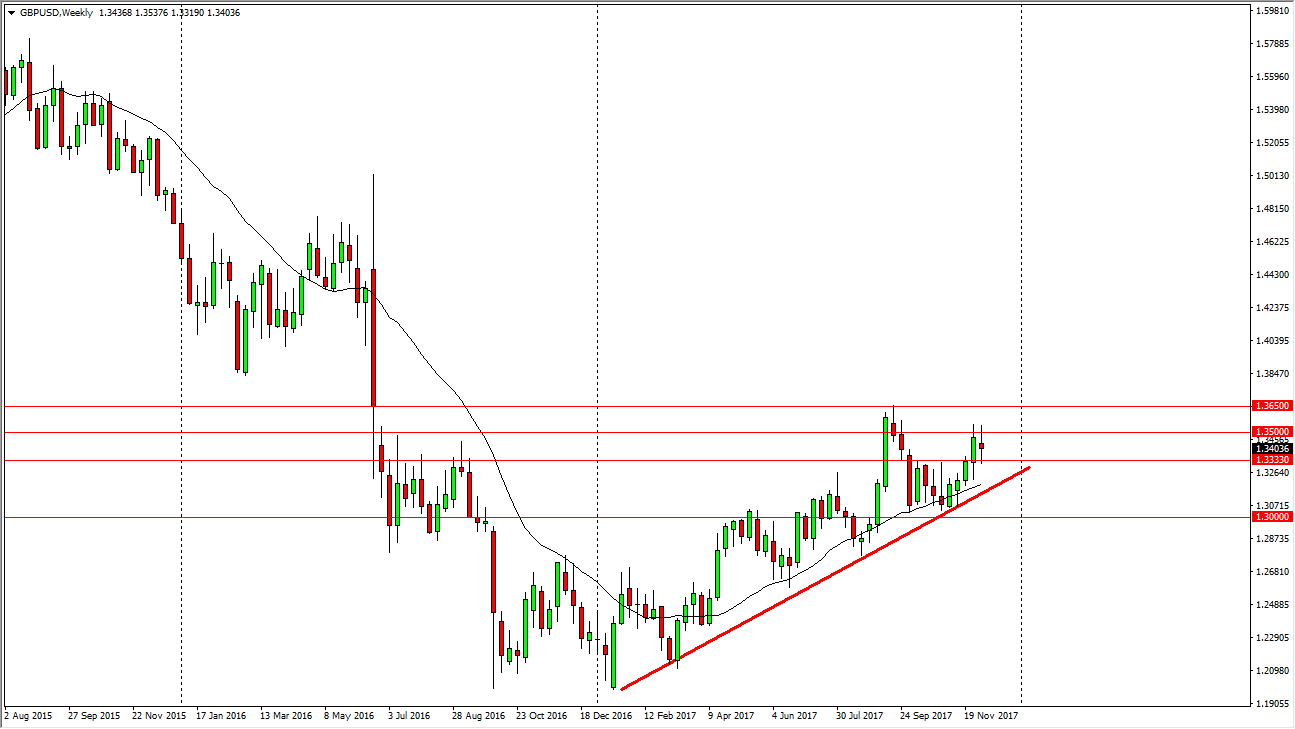

GBP/USD

The GBP/USD pair was very noisy during the week, and that makes quite a bit of sense as we have been discussing the break away of the UK from the EU. Because of this, a lot of headlines will come in and test this market, but I think a pullback should find plenty of support underneath that we can take advantage of. Look at pullbacks as value in this pair, as the death of the British pound was prematurely announced.

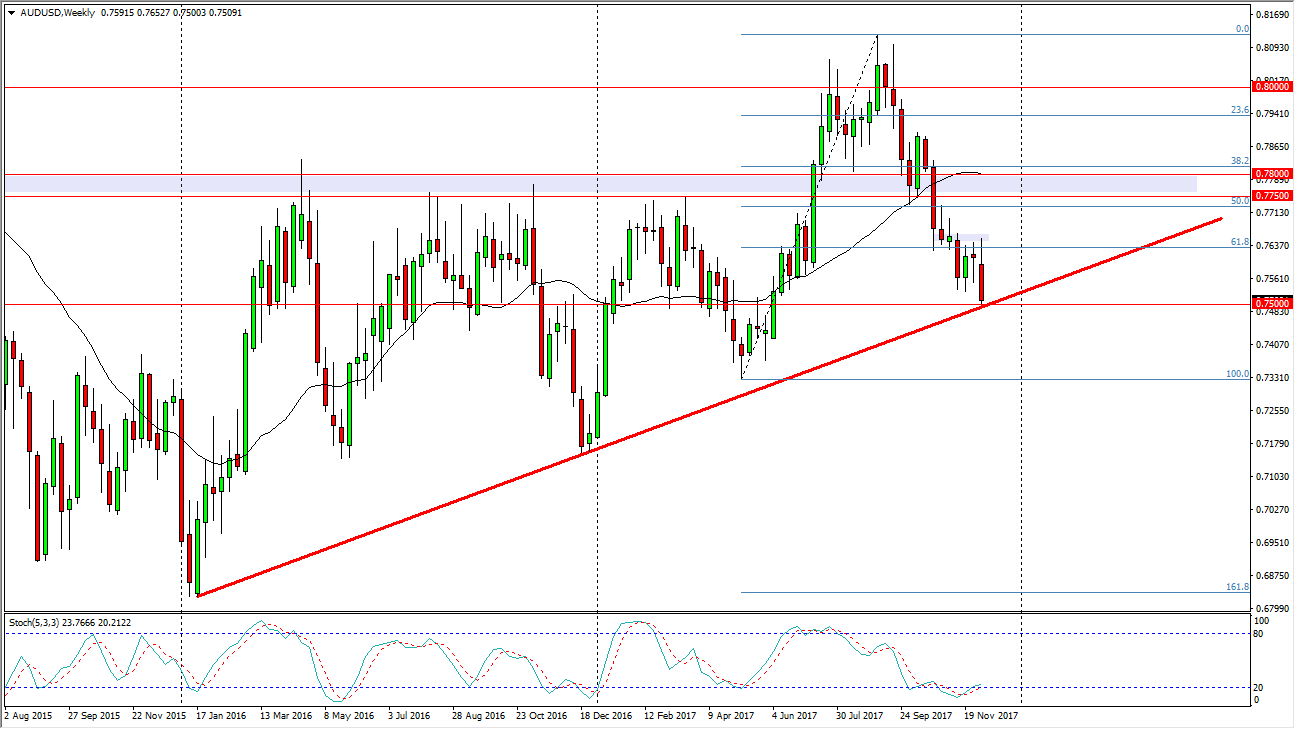

AUD/USD

The Australian dollar initially tried to rally during the week, but now is testing the 0.75 level underneath. A breakdown below the 0.75 level should send this market down to the 100% Fibonacci retracement level, testing the 0.7333 level if that happens. I think that gold breaking down could be the catalyst to send this market much lower. Once we are 4 hours into a move below the 0.75 handle, I am willing to start selling.

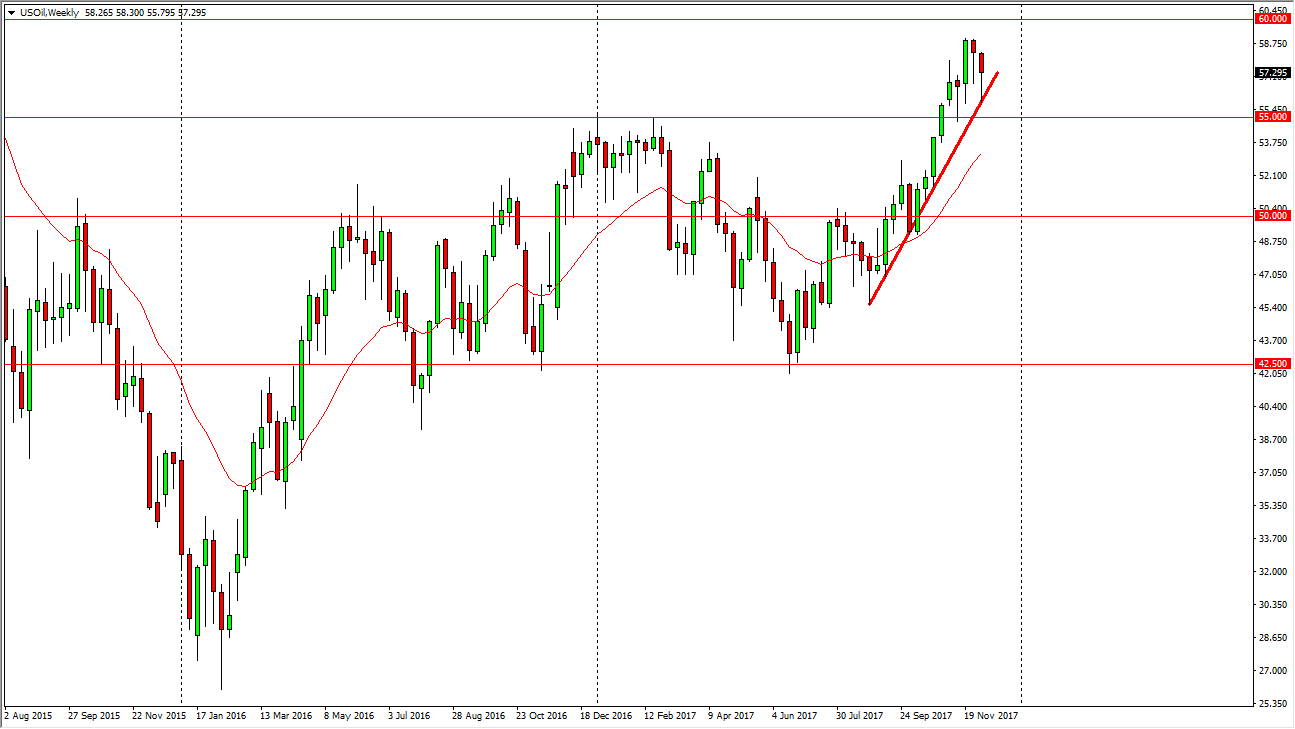

WTI Crude Oil

The WTI Crude Oil market initially fell during the week, but has turned around to form a hammer. The hammer of course is a bullish sign, and I think that we will see buyers jump into this market, perhaps trying to test the $60 level again. I think this is a short-term opportunity to go higher, but really at this point I think we will continue to see a lot of choppiness and essentially the market should go sideways over the course of the week. Look at short-term range bound strategies.