By: DailyForex

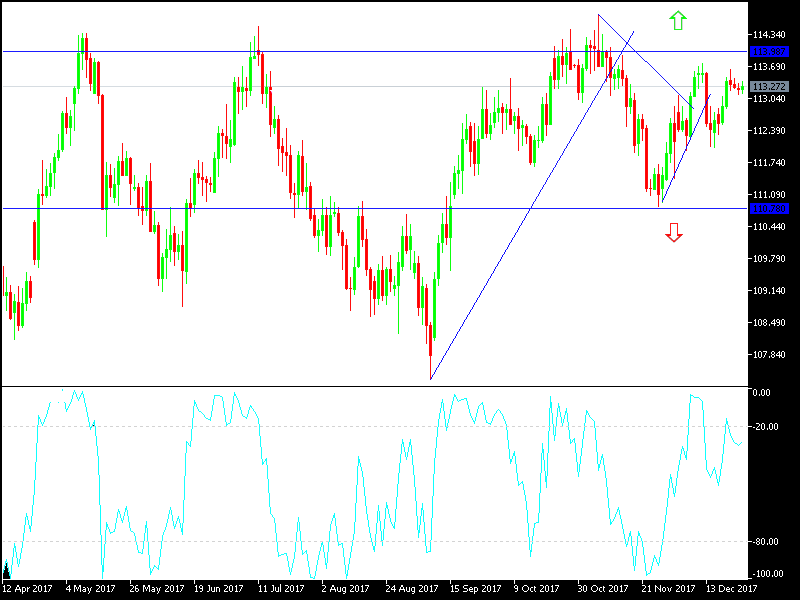

For the 4th day in a row, the USD/JPY is moving in tight ranges trying to avoid dropping below support at 113.00 to avoid more bearish pressure. The US Index DXY faced bearish pressures pushed it toward 92.96 DXY, and the US stock market dropped before closing at a slight rise yesterday, contributing to the drop of the USD/JPY pair to the 113.11 support level. If it wasn’t for the passage of the US tax cut bill last week, the USD/JPY pair would have had a chance to more gains, as the US data were supporting the greenback, but with the markets digesting the passage of the US tax cut law, the dollar gain’s halted.

The USD didn’t find enough support from interest rate rise by the Fed for the third time this year, and expectations of 3 raises next year, as the markets where expecting 4 interest rate rises in 2018. The US Central Bank’s fears of continued lower inflation levels below the bank’s target of 2%, gave the markets an indication that the bank might face hurdles of continued lower inflation pace next year.

Technically:

The USD/JPY will have strong bearish move in case it moved towards support at 112.90, 112.00 and 111.60, and we still prefer buying at each bearish bounce. On the bullish side, the nearest resistance levels are currently at 113.75, 114.30 and 115.00. The daily chart shows clearly a break of the bullish trend lately. In light of market closer due to holidays this week and early next week for Christmas and New Year, traders need to be alert of price gaps due to markets coming back in interrupted form sometimes, and it is better to avoid trading until the markets are fully back to normal.

On the economic data front today:

The economic agenda today will focus on the Japanese manufacturing production and retail sales data. And from the US, there will be a release of the unemployment claims, good’s trade balance and the Chicago PMI. And will also closely watch for renewed international geopolitical fears, with the reemergence of the North Korean crises, along with anything related to Trump’s internal and external policies.