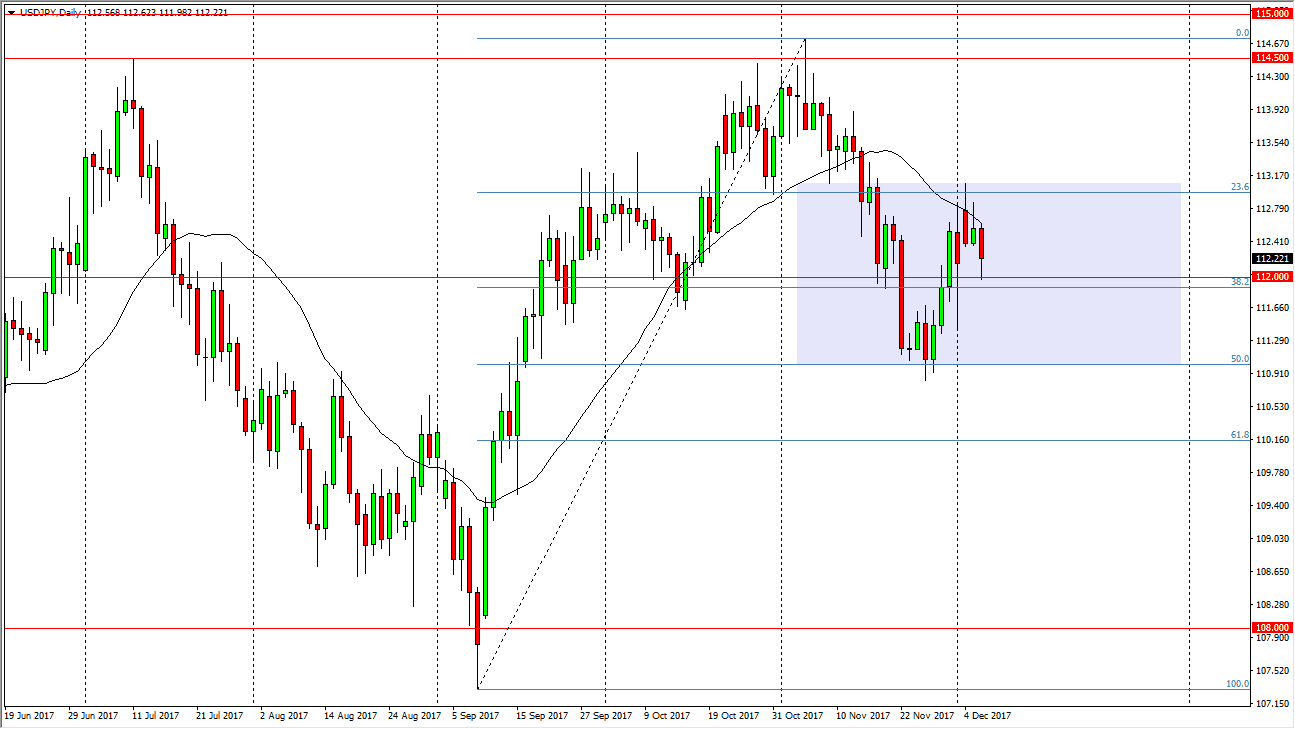

USD/JPY

The US dollar initially tried to rally during the trading session on Wednesday, but then fell towards the 112 level. That being said, the 112 level did create a significant bounce, and I think it’s only a matter of time before the buyers get involved, as the US dollar continues to rally due to higher interest rates in comparison to Japan. I think that will continue to be the case, and eventually we should go looking towards the 113 handle. However, if we break down below the 111.80 level, I think the market should then go down to the 111 level where I see even more support. Either way, I think it’s a matter of buying the dips, and eventually we should go looking towards the 114.50 level above, which is massive resistance. A break above the 115 handle should send this market into more of a buy-and-hold market.

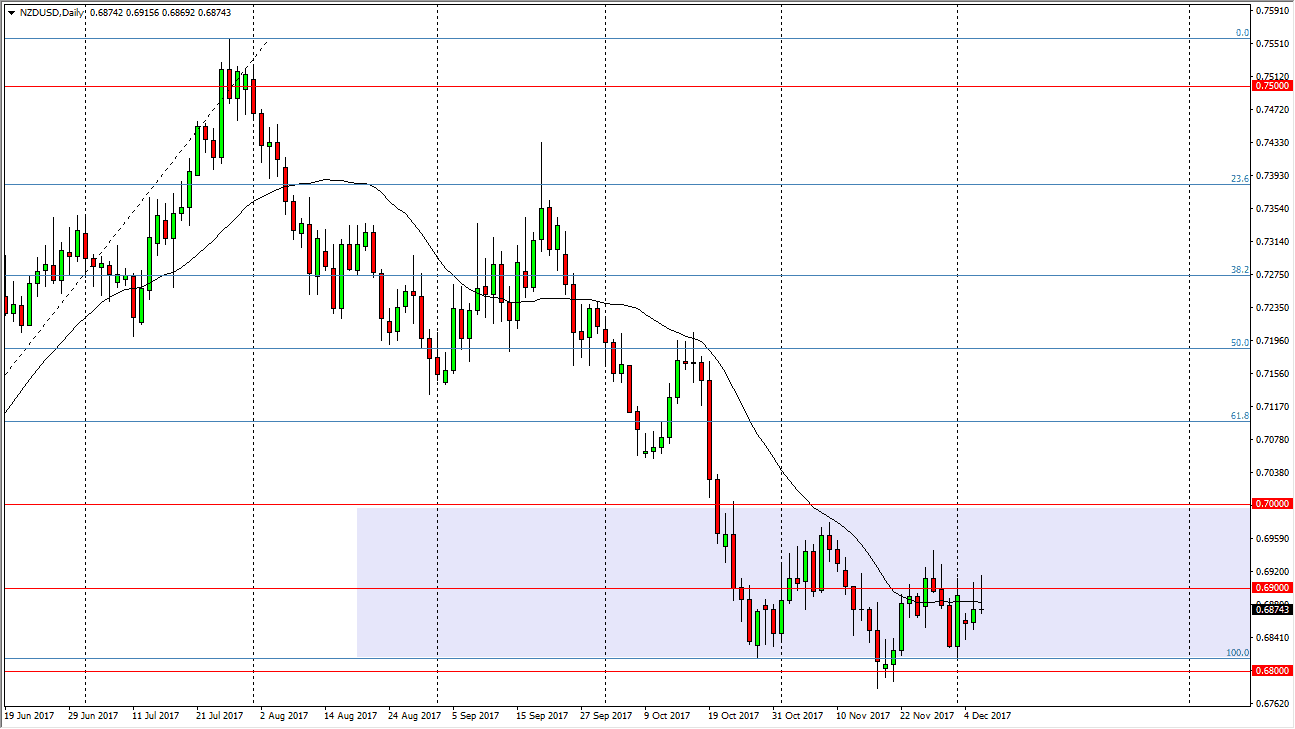

NZD/USD

The New Zealand dollar initially tried to rally during the trading session on Wednesday, but found the 0.6925 level to be a bit too resistive. We ended up forming a shooting star yet again, which is something that continues to be the case in this pair. In general, the market looks like it is ready to push lower, testing the 0.68 level underneath. Once that level breaks down, I believe we will see an acceleration of the downtrend, sending this market to the 0.65 level over the longer term, with the 0.67 level being the first target. If we were to break above current levels, I think that there is a massive amount of resistance at the 0.70 level, so it’s not until we break above that level that I’m willing to buy the kiwi dollar. Expect volatility, but more importantly - sustained downward pressure.