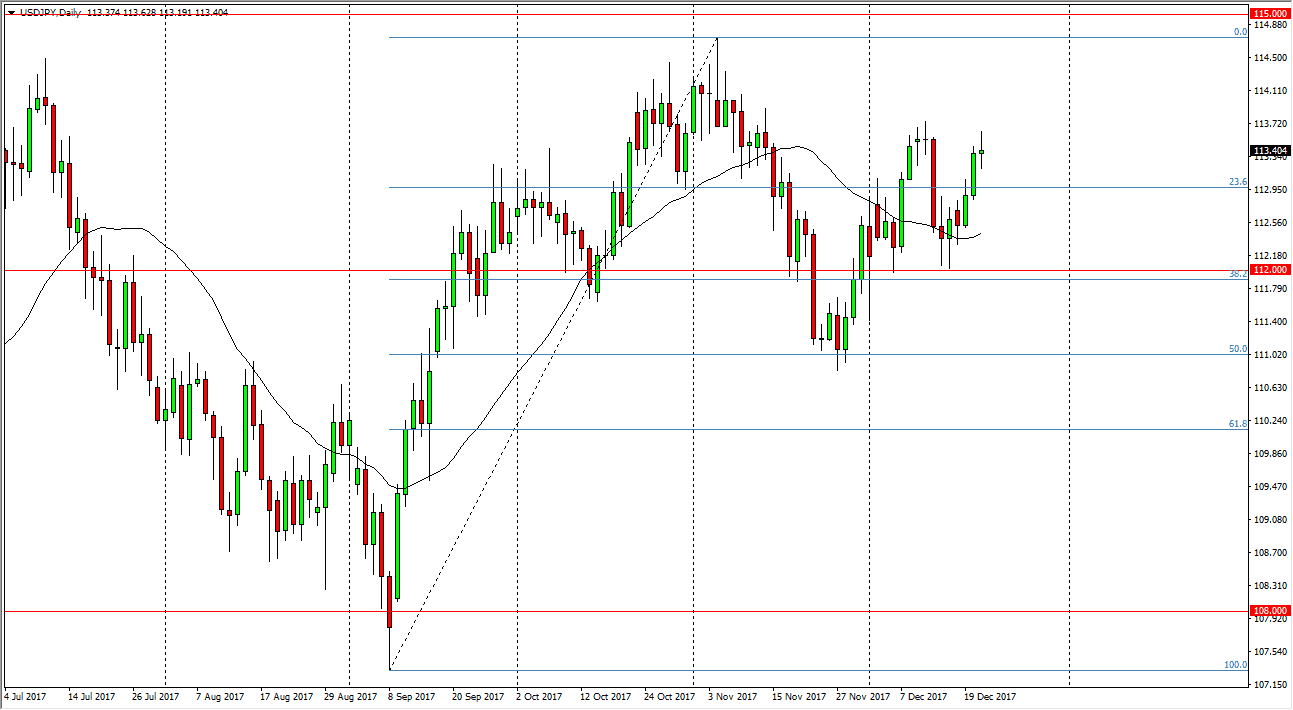

USD/JPY

The US dollar went back and forth during the trading session on Thursday, as traders reacted to a less than stellar GDP number coming out of the United States. However, I think the biggest problem was a lack of volume, and the fact that we were approaching significant resistance. By forming the shooting star, I suspect we are going to pull back, but longer-term I think we are looking at building bullish pressure, it’s just that as we head into the holidays, it’s difficult to convince traders to put on large positions. In the meantime, it’s likely that we consolidate between here and the 112 level, but I think at best this is a market that scalpers will be attracted to. I suspect that it will be very choppy in general on short-term charts, but that’s about all we're going to get.

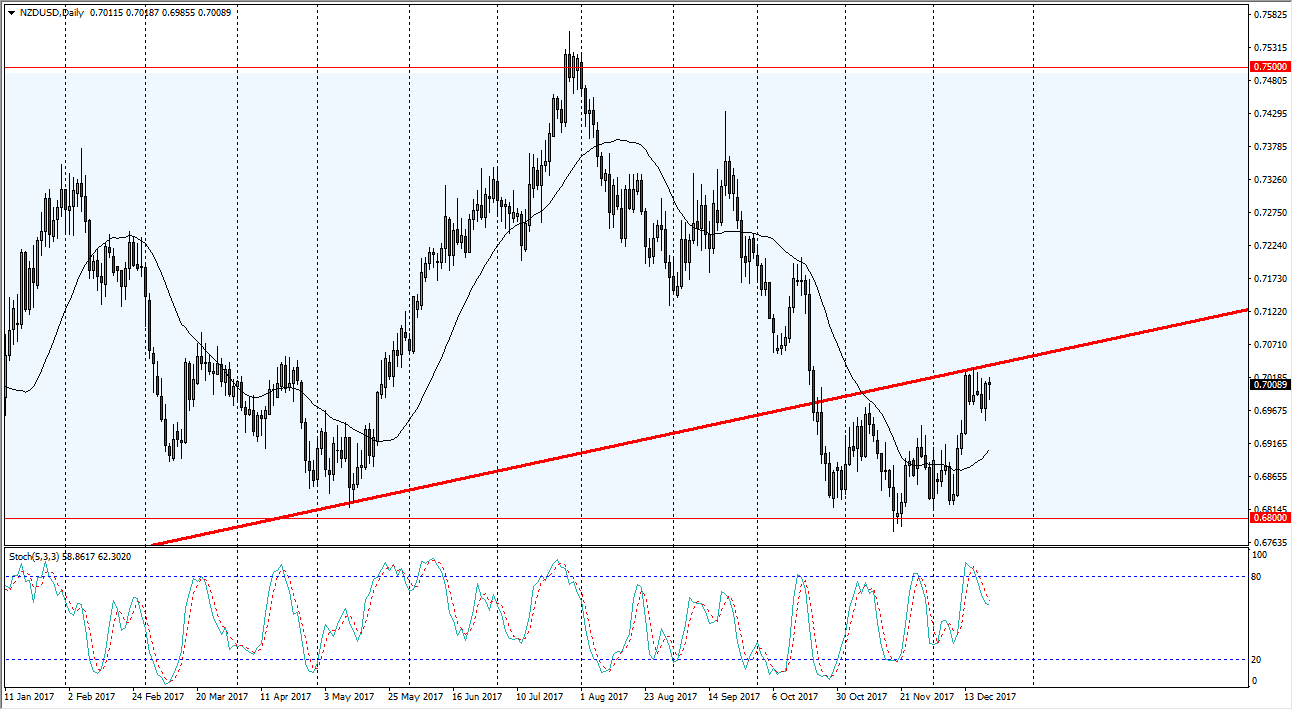

NZD/USD

The New Zealand dollar went back and forth during the day as well, testing the bottom of an uptrend line that we have broken through on the weekly chart. I think at this point, the New Zealand dollar will continue to go sideways overall, so I think that not much can be read out of the charts right now, as traders are leaving for the holidays. Longer-term, I suspect that we will make a larger decision, but it’s not until we break above the 0.7050 level that I’m willing to start putting money to work to the upside, just as I be a seller below the 0.6975 handle. Between those 2 levels, I think it’s essentially “no man’s land”, and it could cause you to lose a bit of money if you will get involved. With the lack of volume, that could become a major issue in this pair of the next several sessions.