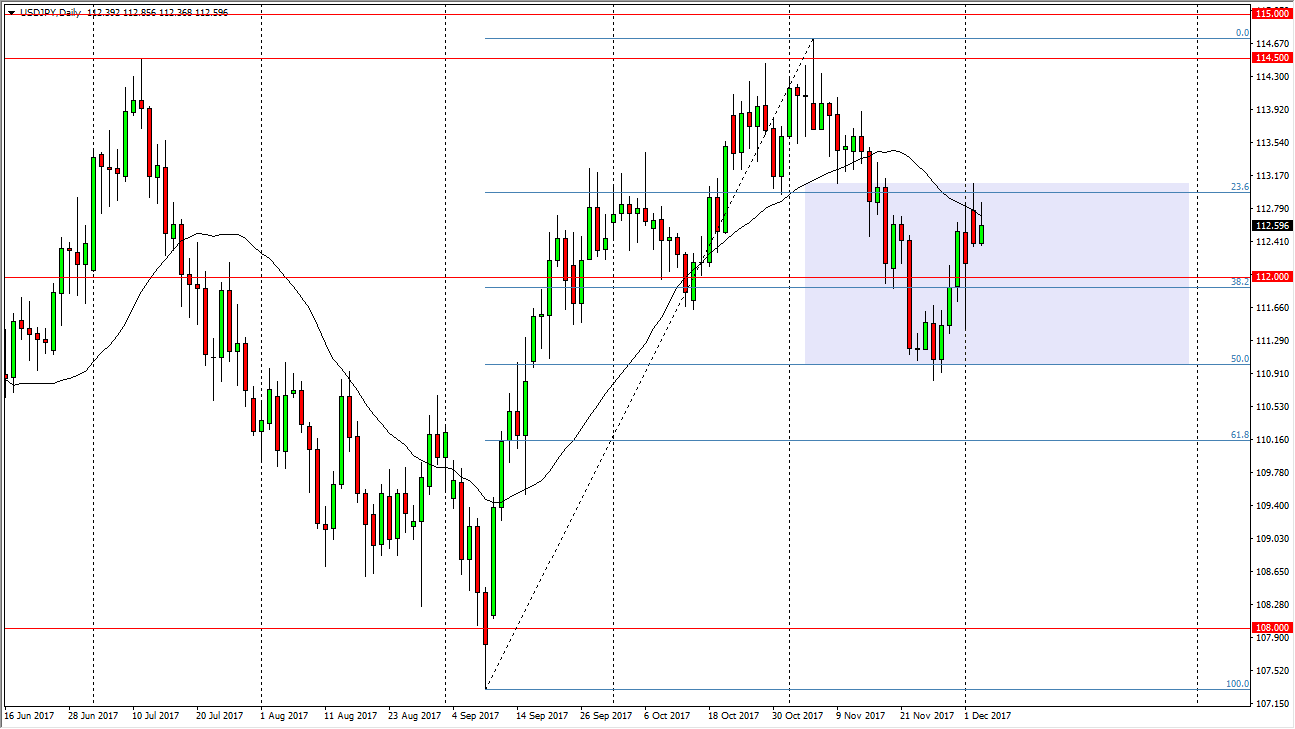

USD/JPY

The US dollar tried to rally during most of the session, but found enough resistance above to turn things around and form a shooting star. The shooting star of course is a negative sign, so we may pull back a bit, but I think that the 112 level should offer support. If we can break above the 113 handle, then I feel the market is free to go much higher, perhaps reaching towards the 114.50 level above. That 114.50 level has been important previously, and I think it extends resistance to the 115 handle, and a move above there would allow the market to become more of a buy-and-hold scenario. In the meantime, I think dips offer buying opportunities and that they should be thought of as such. If we can get tax reform, that could continue to push the dollar higher as well.

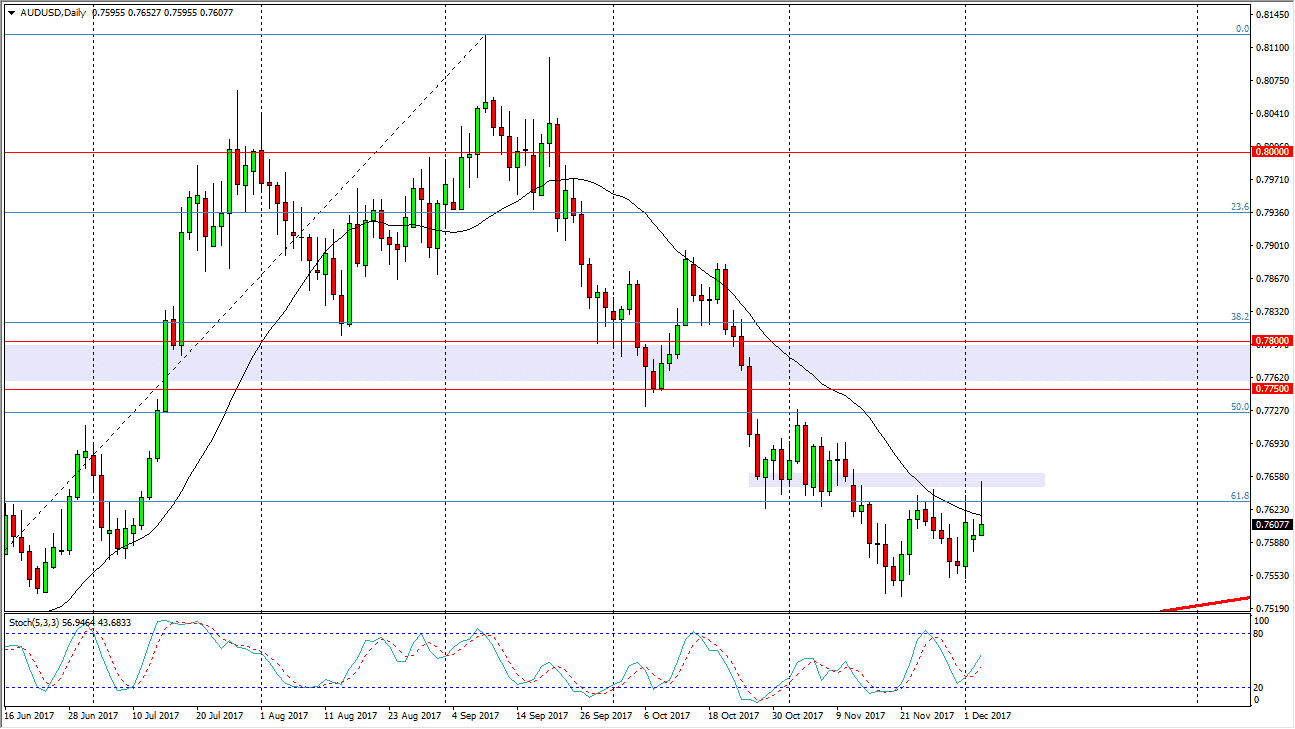

AUD/USD

The Australian dollar initially tried to rally during the trading session on Tuesday, but struggled at the 0.7650 level, turning around to form a shooting star. The shooting star of course is a negative sign, and I think that the 0.75 level will offer significant support. A breakdown below there sends the market down to the 0.7350 level after that. Alternately, if we break above the top of the shooting star for the day, the market will probably go looking towards the 0.7750 level after that. As an area that has been rather resistive in the past, so I think that a breakout to the upside is a short-term buying opportunity at best. We need the gold markets rally right along with the Aussie for to show signs of strength, and that doesn’t look very likely to happen in the short term, and I believe that the market will continue to show signs of exhaustion and weakness.