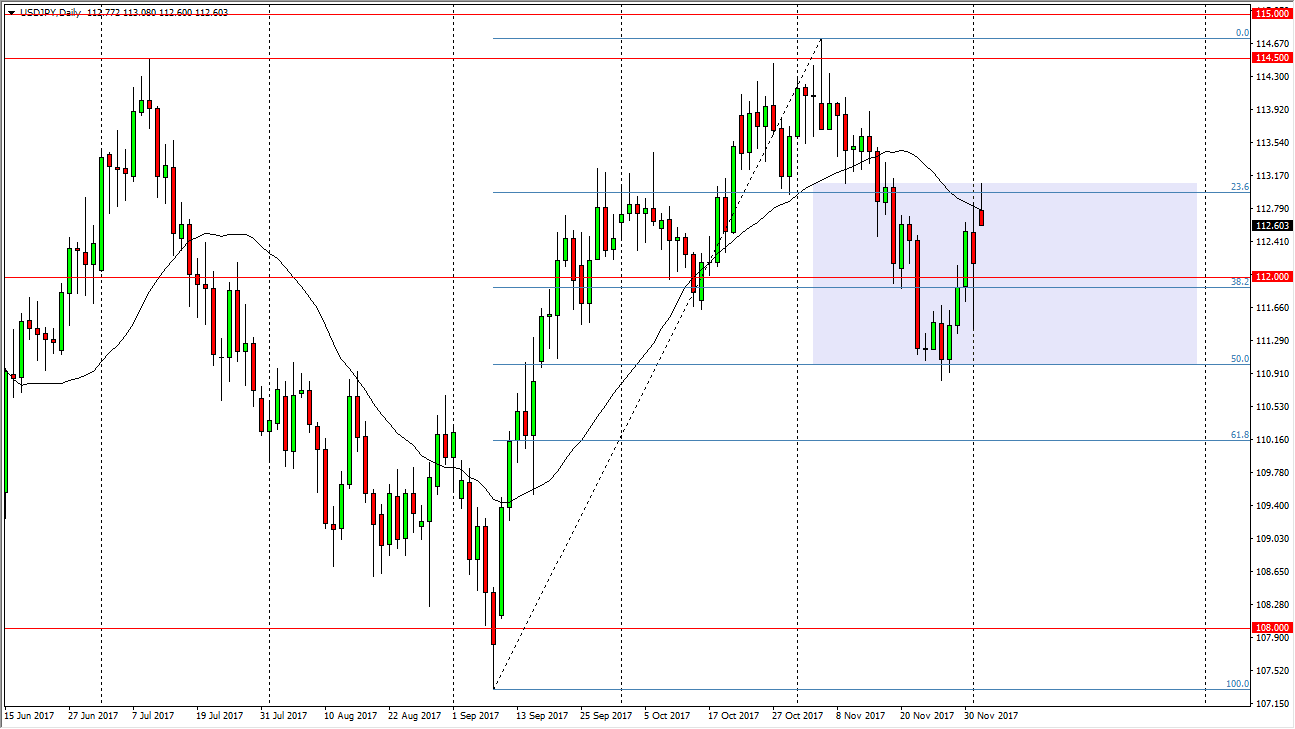

USD/JPY

The US dollar rallied against the Japanese yen, gapping higher initially. We reached towards the 113 level, but found enough resistance to fall and form a shooting star. Because of this, I think we are going to see a bit of a pullback, with the 112 level being very likely to offer support. However, if we break above the top of the shooting star for the Monday session, that is a very bullish sign and should send this market looking towards the 114.50 level above. That level is the beginning of resistance that extends to the 115 handle. Alternately, if we were to break down below the 112 level, the market should find plenty of support near the 111 level. Ultimately, this is a market that I think will eventually find buyers, and that is especially true if the tax reform in the United States gets passed.

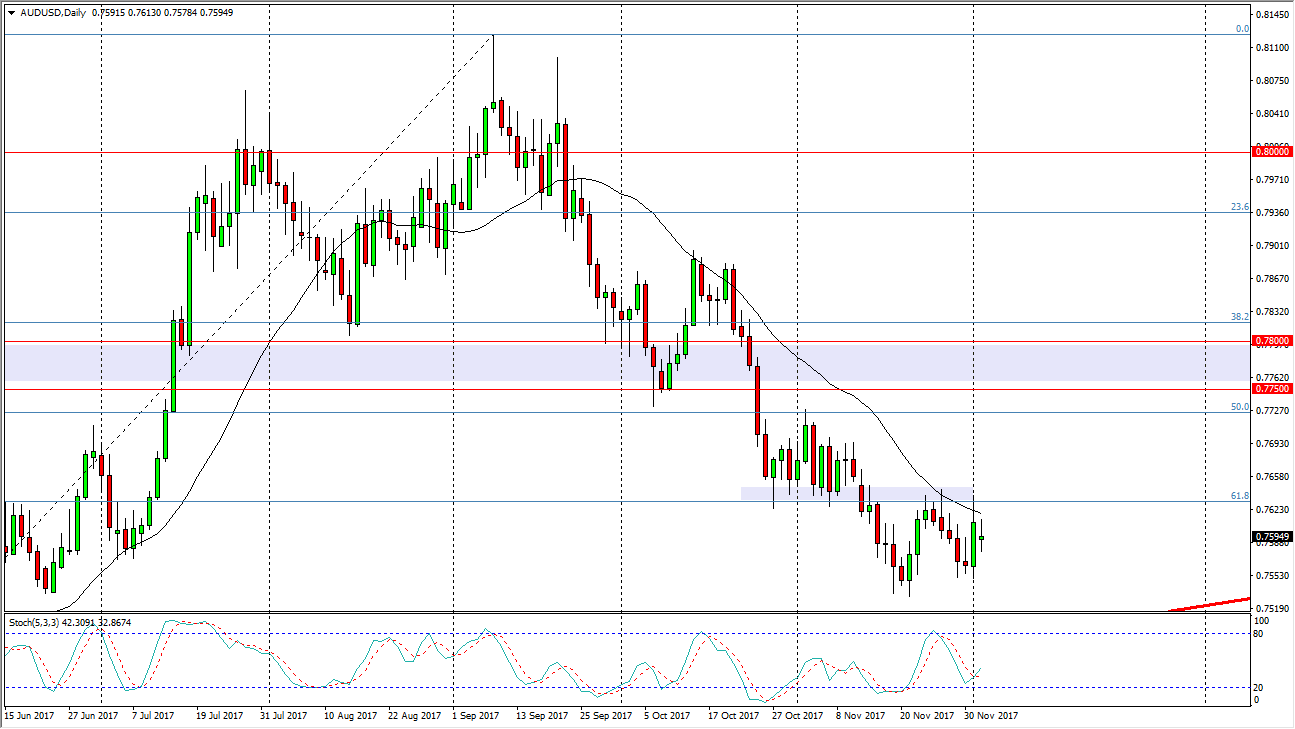

AUD/USD

The Australian dollar gap lower during the trading session on Monday, dancing around the 0.76 level. The 0.75 level underneath should be massively supportive, which is a large, round, psychologically significant number, and of course there is an uptrend line that dissects that area. In general, I think this market is waiting for today is RBA interest rate statement, and that of course could give us an idea as to where the Australian dollar will go as either dovish or hawkish attitude will be read into. I believe that the 0.7650 level above should be resistive, so if we can break above there, it’s likely that we will then go to the 0.7750 level above is resistance. In general, I think that we will get a lot of noise over the next couple of days, so a small position would probably be the best way to play this market in either direction.