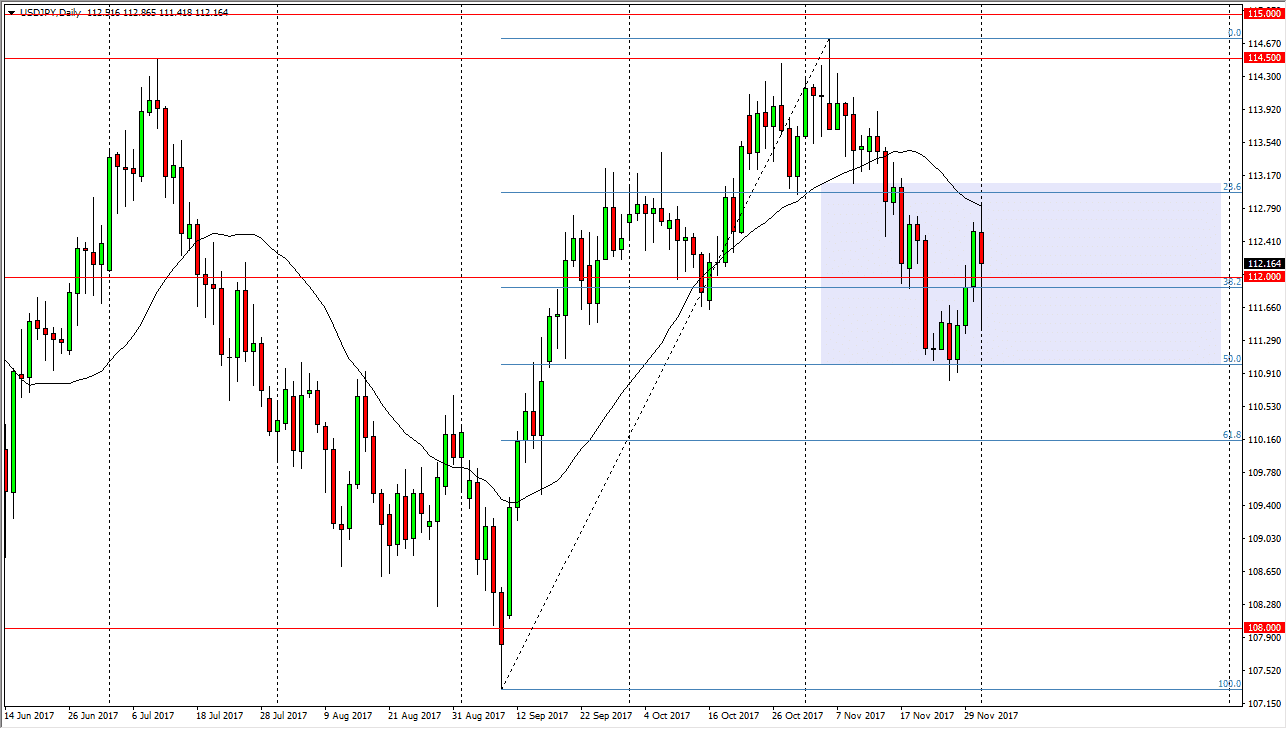

USD/JPY

The US dollar was very volatile against the Japanese yen, as we broke down below the 112 level at one point during the day after it was announced that General Flynn is going to testify against the White House in the Russia probe. We bounced to turn around and reach towards the 112.50 level, before settling back down. Ultimately, this market looks likely that we are going to continue to go to the upside. Longer-term, we could go to the 114.50 level, which is the beginning of significant resistance. Expect choppiness, and over the weekend we are going to get a lot of headlines coming out about this that could have an influence on what the markets do next. If we could be looking at a significant gap in one direction or the other.

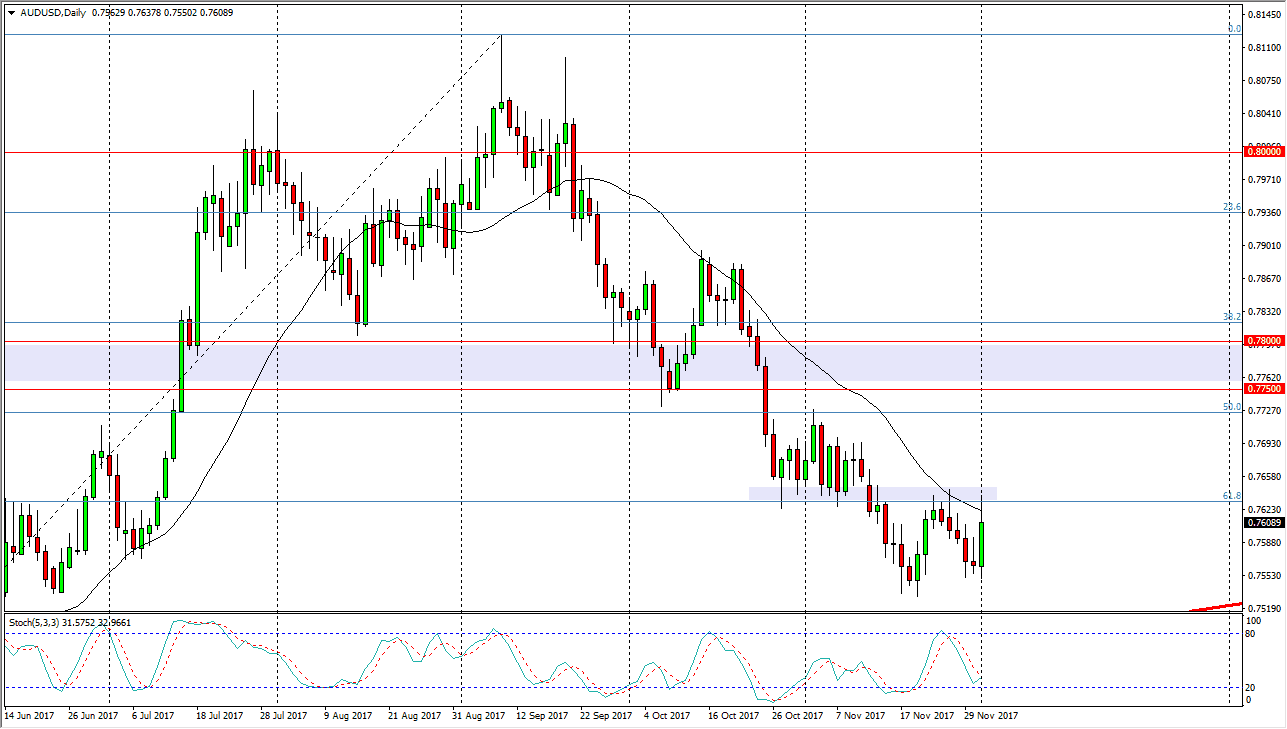

AUD/USD

The Australian dollar rallied significantly during the course of the session on Friday, reaching towards the 0.7650 level, an area that has been resistive and supportive in the past. We gave back some of the gains from the session, so I think we are getting ready to roll over, and perhaps reach down to the 0.75 level. That is a level that is massively supportive, and a breakdown below that level would be the market letting go and reaching towards the 0.7350 level. Alternately, if we break above the 0.7650 level, the market probably goes looking towards the 0.7750 level. Gold has not broken out, and therefore I think we are going to continue to struggle to hold on the gains, and that being the case it’s likely that it is going to be easier to short rallies than anything else.