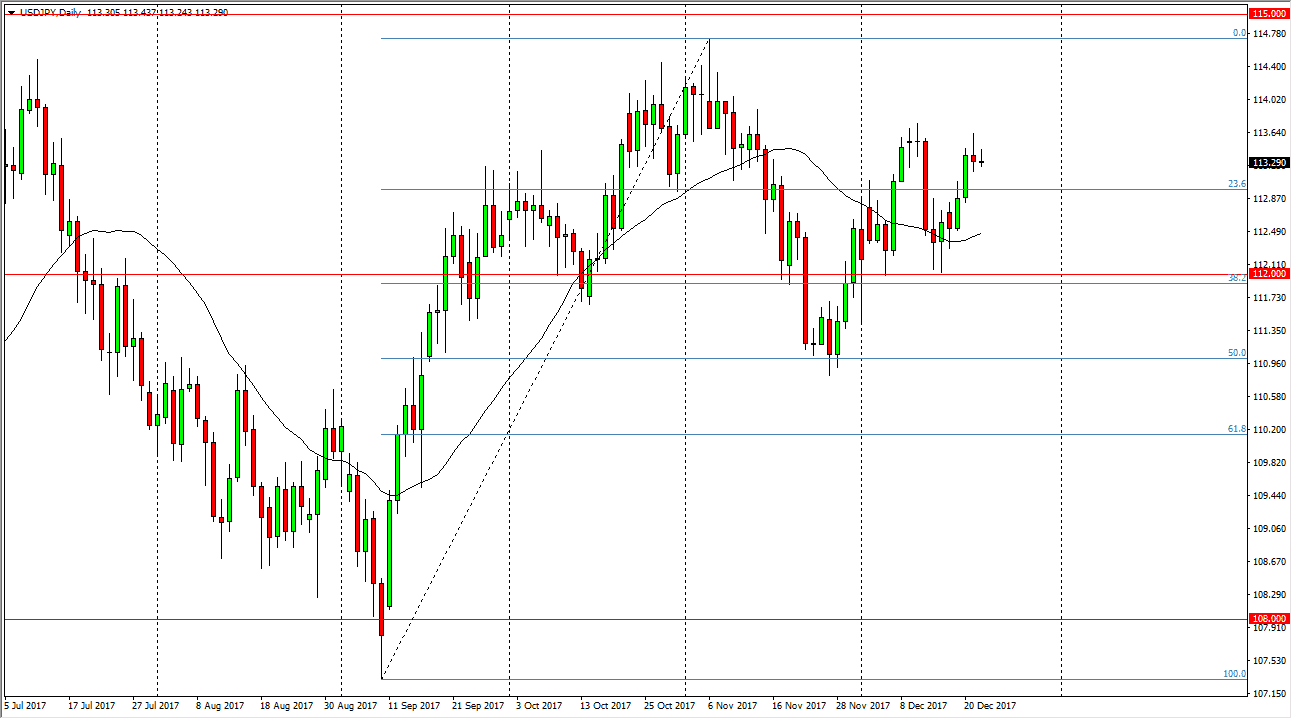

USD/JPY

The US dollar initially tried to rally during the Friday session, but turned back around to form and exhaustive candle. The market looks likely to roll over at this point, but I think that the 112-level underneath is massively supportive, and I think the 111 level after that as supportive. Given enough time, it’s likely that the buyers will return, and I think that eventually we break out to the upside as the interest rate situation in the United States and looks likely to favor the US dollar in general. I believe that the market breaking above the 115 handle would be a “buy-and-hold” situation. I have no interest in shorting this market, I believe that we have been building a base to break out to the upside for some time, and that we will see much higher levels later next year.

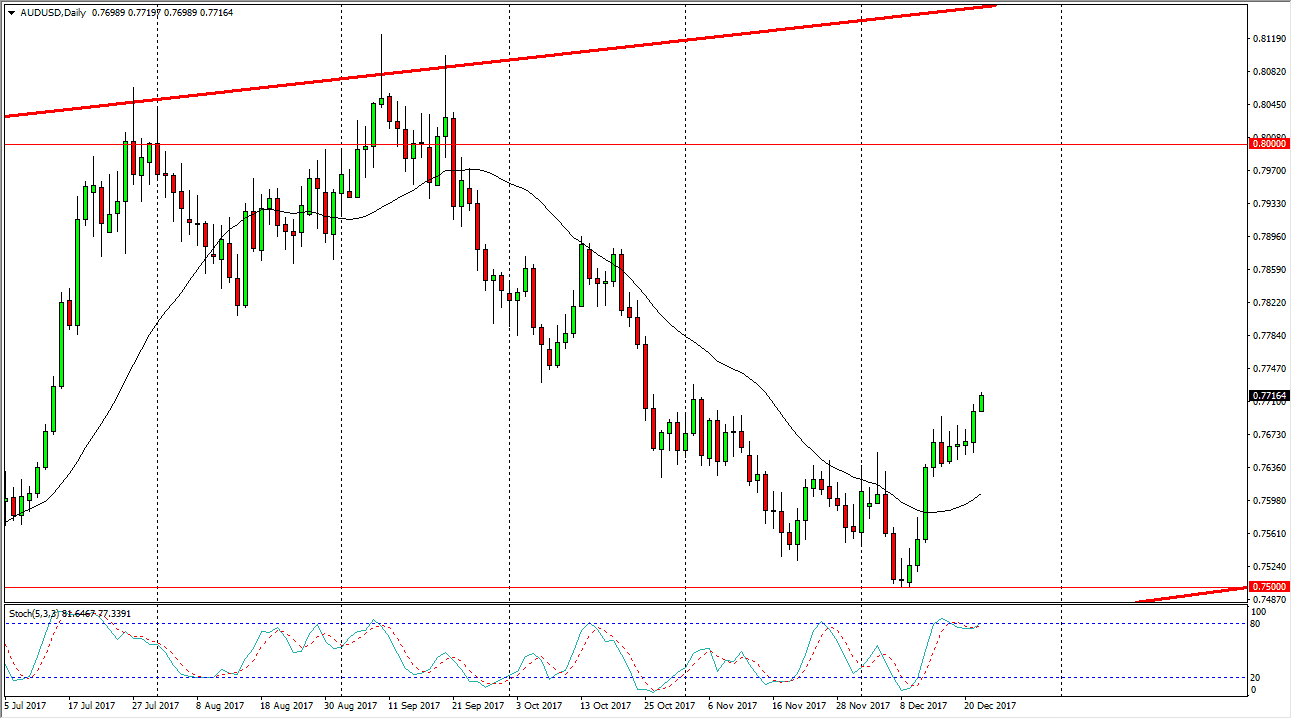

AUD/USD

The Australian dollar rallied slightly during the trading session on Friday, but we don’t have much in the way of volume. I believe that now that we have broken above the 0.77 handle, it’s likely that the market may go looking towards the 0.79 level after that. There is a lot of noise in this market, but with gold rally in the way it has, I think that the Australian dollar will continue to be influenced by that market as well. If we can break towards the 0.80 level above, I think at that point there will be a lot of bullish pressure in the market after the breakout, but I think any signs of exhaustion will also bring in a lot of sellers. Expect a lot of noise, but in general I think that the markets will continue to be very difficult.