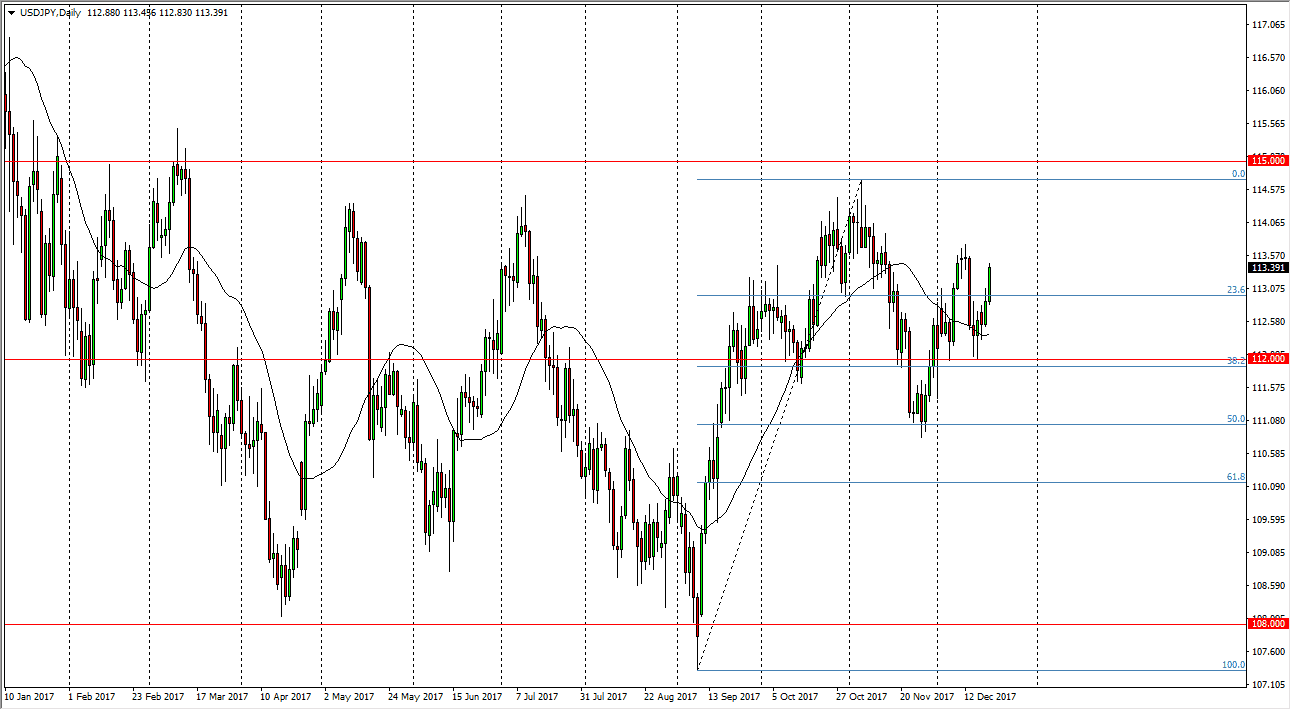

USD/JPY

The US dollar rallied significantly against the Japanese yen during the trading session on Wednesday, as tax reform is finally a reality in the United States. This should propel the US dollar higher against the Japanese yen, as it brings in a “risk on” attitude overall. I believe that pullbacks offer buying opportunities, and that the 112-level underneath will be a bit of a support level that should hold quite nicely. I believe the market eventually goes towards the 114.50 level above, extending resistance to the 115 handle. If we can clear that area, the market goes much higher and it becomes more of a buy-and-hold situation. In the meantime, buying short-term dips probably remains the best way to deal with this market, but keep in mind that as the holidays approach, we are looking at volume drying up in the market.

AUD/USD

The Australian dollar did very little during the trading session on Wednesday, as we continue to bang around the 0.7650 level. The market looks very unlikely to make a significant move in the short term, mainly because we are going to lose a lot of volume. The gold markets have rallied a bit, and that of course helps the Australian dollar, but we also have tax reform coming out of the United States which helps the US dollar. In general, this is a market that should continue to be a back and forth situation, so I believe that the easiest way to trade this market is to look for short-term back and forth type of situations, using the short-term chart. Longer-term trades are almost impossible at this point, but if we did breakdown below the uptrend line that coincides with the 0.75 handle, that would be a very negative sign.

chris.png)