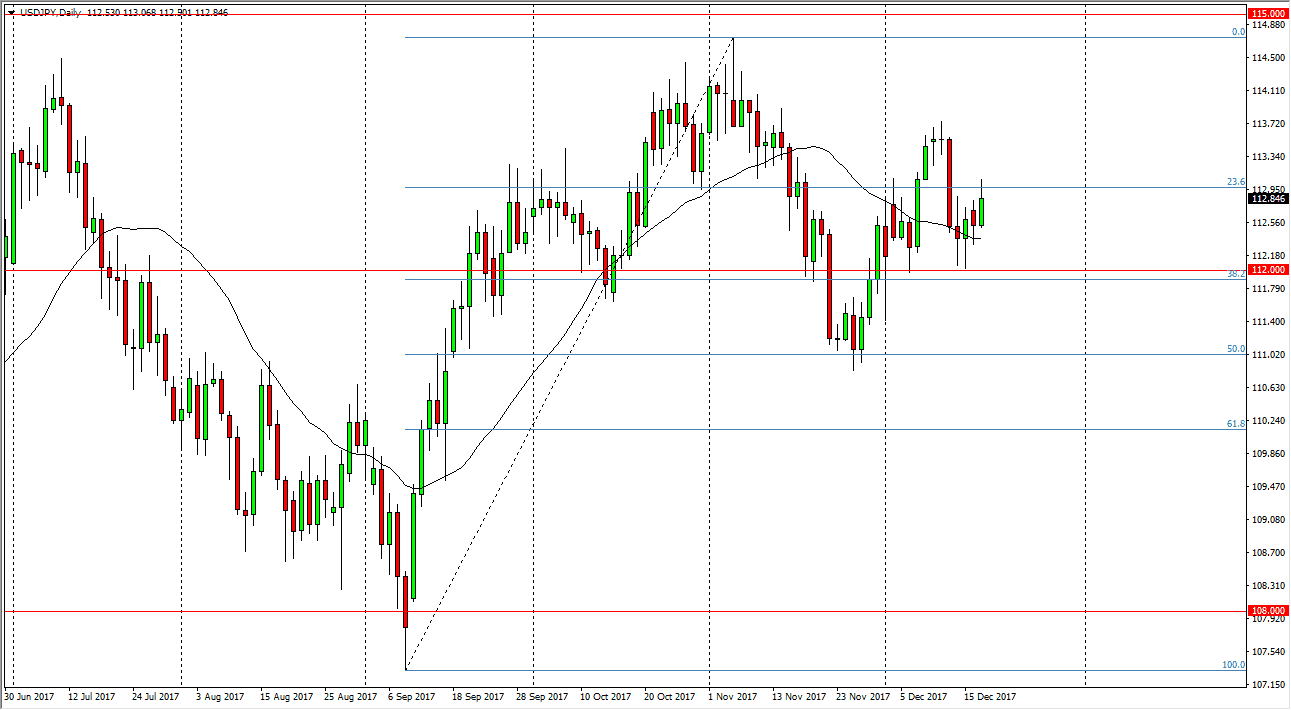

USD/JPY

The US dollar rallied a bit during the trading session on Wednesday, breaking above the top of the hammer from the Tuesday session. That being the case, it looks as if the market is trying to break above the 113 handle, and that would be a very bullish sign, perhaps sending the marketplace to the 114-handle next. I think that the volatility will pick up a bit, as we have plenty of noise in the marketplace ahead of us, as liquidity is then. In general, the market will react according to risk appetite, going higher when stock markets rally, and then obviously the opposite is true. I believe that longer-term, the US dollars going to continue to rally against the Japanese yen, as interest rates in the United States look likely to rally. If we were to break down below the 112 level, the market should then go down to the 111 level.

AUD/USD

The Australian dollar rallied initially during the day, but then turned around to form a neutral candle. This neutral candle suggesting to me that we are going to roll over at this point. A breakdown below the 0.76 level should send this market down to the 0.75 handle, which is massive support. Alternately, if we break to the upside we could go as high as 0.78, but I think there are a lot of noisy areas just above the could cause problems for the Aussie dollar, so I suspect that this will be a market that we can start selling on short-term rallies that show signs of exhaustion. In general, I suspect that this market is going to be negative, but noisy more than anything else.

chris.png)