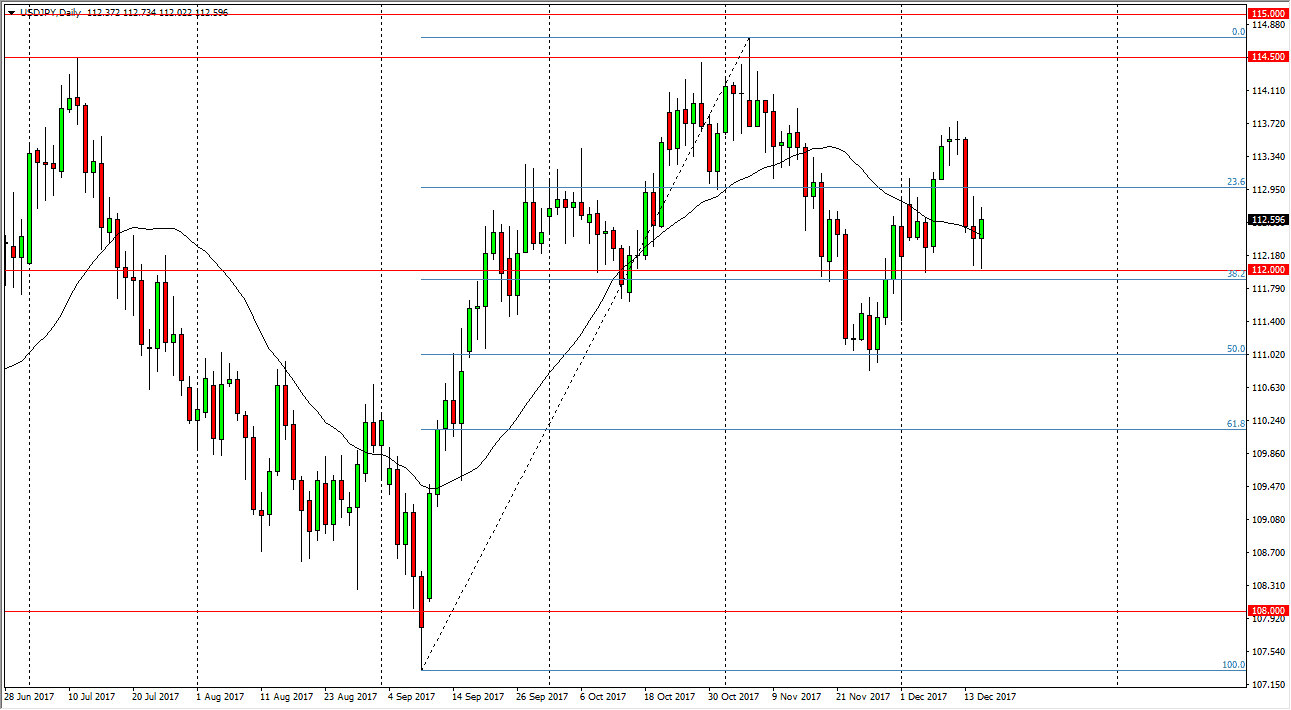

USD/JPY

The US dollar initially fell against the Japanese yen during the trading session on Friday, but found the 112-level supportive enough to turn the market around and form a hammer again. Because of this, it’s likely that we are going to bounce from here and go looking towards the 113.50 level above. If we break above there, the market then goes looking towards the 114.50 level above, which is the beginning of significant resistance. Ultimately, if we can break above there it’s likely that the market will continue to go much higher, as it becomes a “buy-and-hold” situation. In general, I believe that the market should be a bullish market, but there is going to be a lot of volatility. I believe that the Americans looking likely to sign the tax bill is a very good sign for this pair, so I have no interest in shorting.

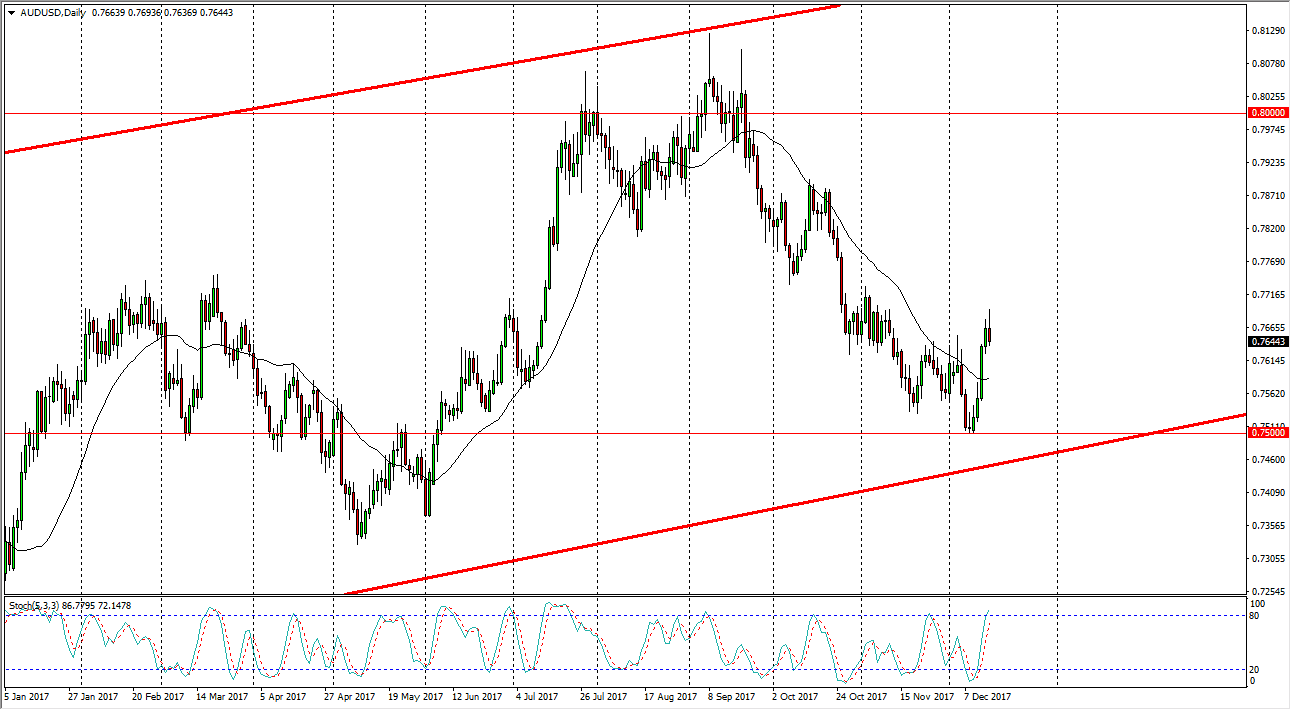

AUD/USD

The Australian dollar initially rally during the trading session on Friday, but turned around to form a shooting star. The shooting star of course is a negative sign, and I think we may go lower, perhaps looking for support near the 0.75 handle. The should be plenty support in that area though, as we not only have a large, round, psychologically significant number, but we also have an uptrend line that sits there and looks likely to bring in bullish pressure. The weekly candle looks very bullish, and of course gold looks strong as well.

If we were to break down below the uptrend line, that would be a very negative sign and I would begin shorting very drastically. However, I believe that we will more than likely find plenty of support and go higher. I think that the market is hell-bent on going to the 0.80 level above longer term. With this, I am a buyer.