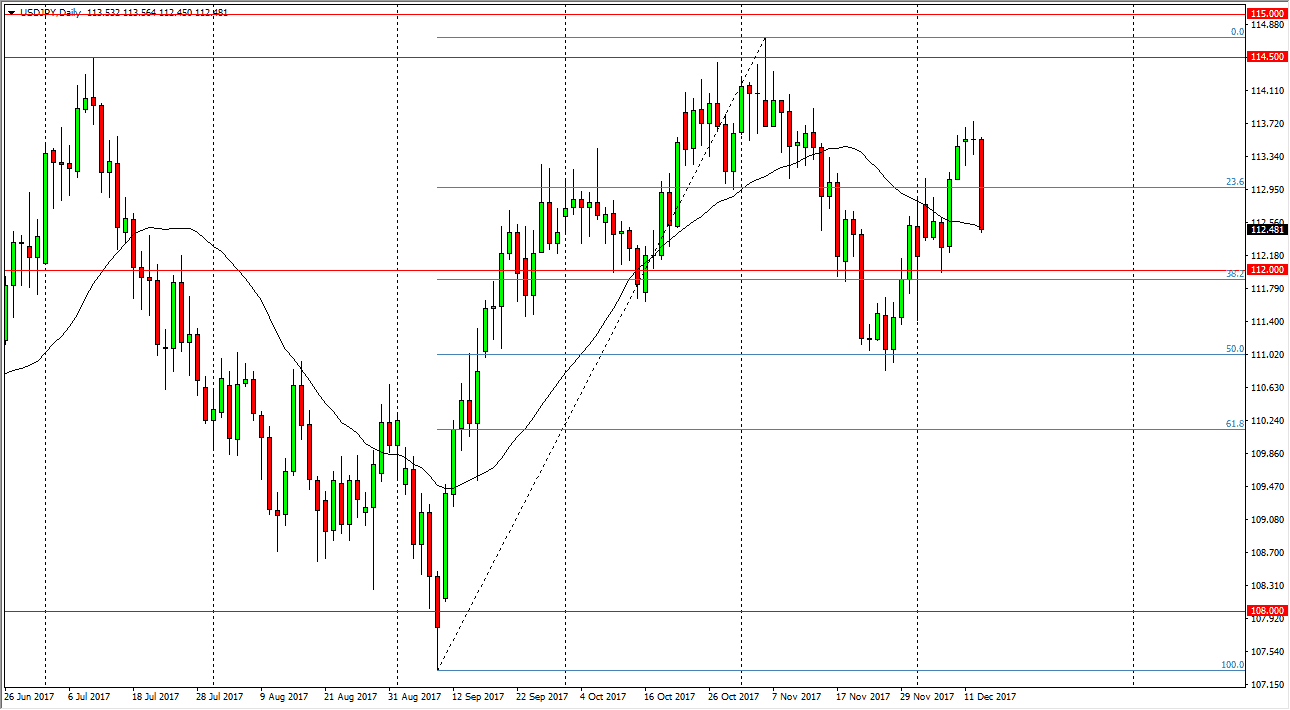

USD/JPY

The US dollar fell apart against the Japanese yen during the trading session on Wednesday, after the interest rate statement was a little less than hawkish. Because of this, I think that the market is going to go looking for lower levels for support, with the first one being the 112 level. A breakdown below there could send this market down to the 111 level after that. I don’t think this market is going to collapse, but certainly it looks as if we are going to look for some type of value underneath. I believe that the market is going to be a bit softer the next couple of days, so short-term rallies could be sold, but I’m not looking for an explosive move in the short term.

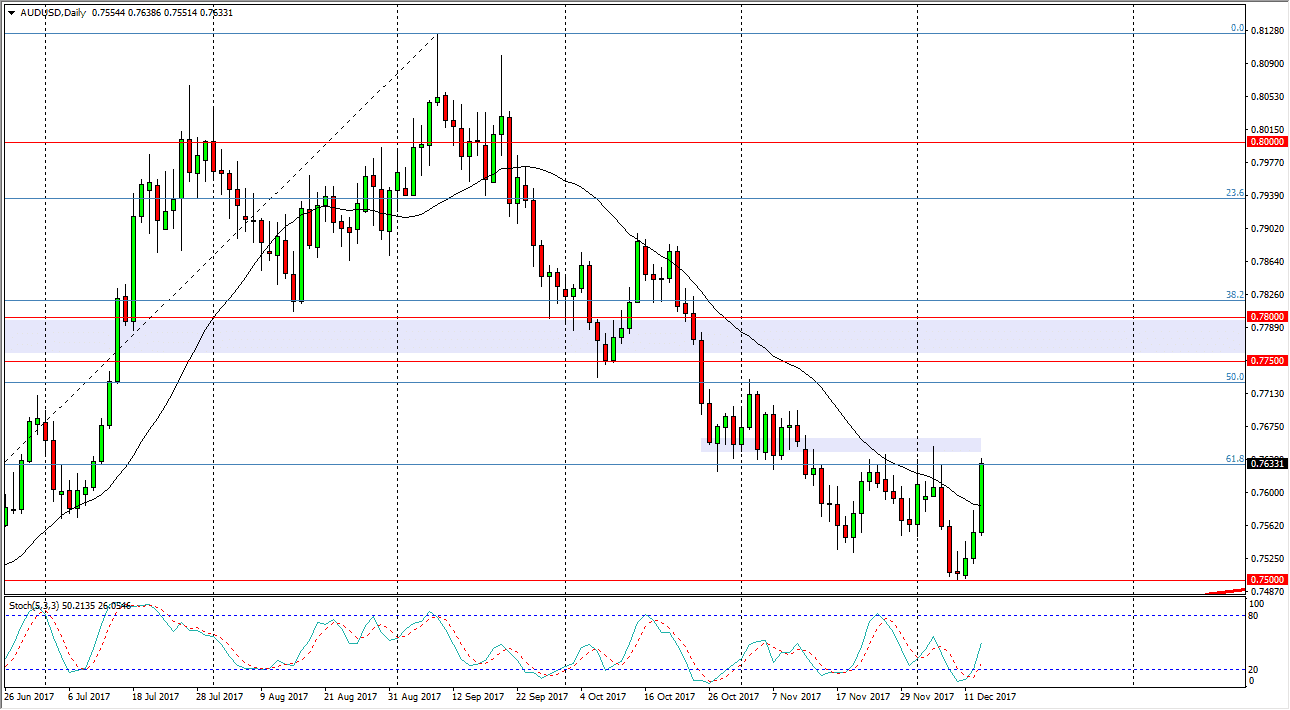

AUD/USD

The Australian dollar has rallied significantly during the trading session on Wednesday, reaching towards the 0.7650 level. That’s an area that was previous support, so if we can break above there, I think we then go to the next purple area on my chart, the 0.7750 level. Pay attention to gold, if it continues to rally, that will help this pair as well. The 0.75 level looks very likely to be a hard floor in the market, so it’s going to be difficult to break down below there anytime soon. I think that this market continues to be very noisy, but with commodity currencies in general doing reasonably well against the US dollar, it makes sense that the Australian dollar will continue to find buyers. We may have to pull back initially to build up the necessary momentum, but it looks as if the buyers are going to make a statement. Otherwise, we are simply going back and forth in the previous trading range.