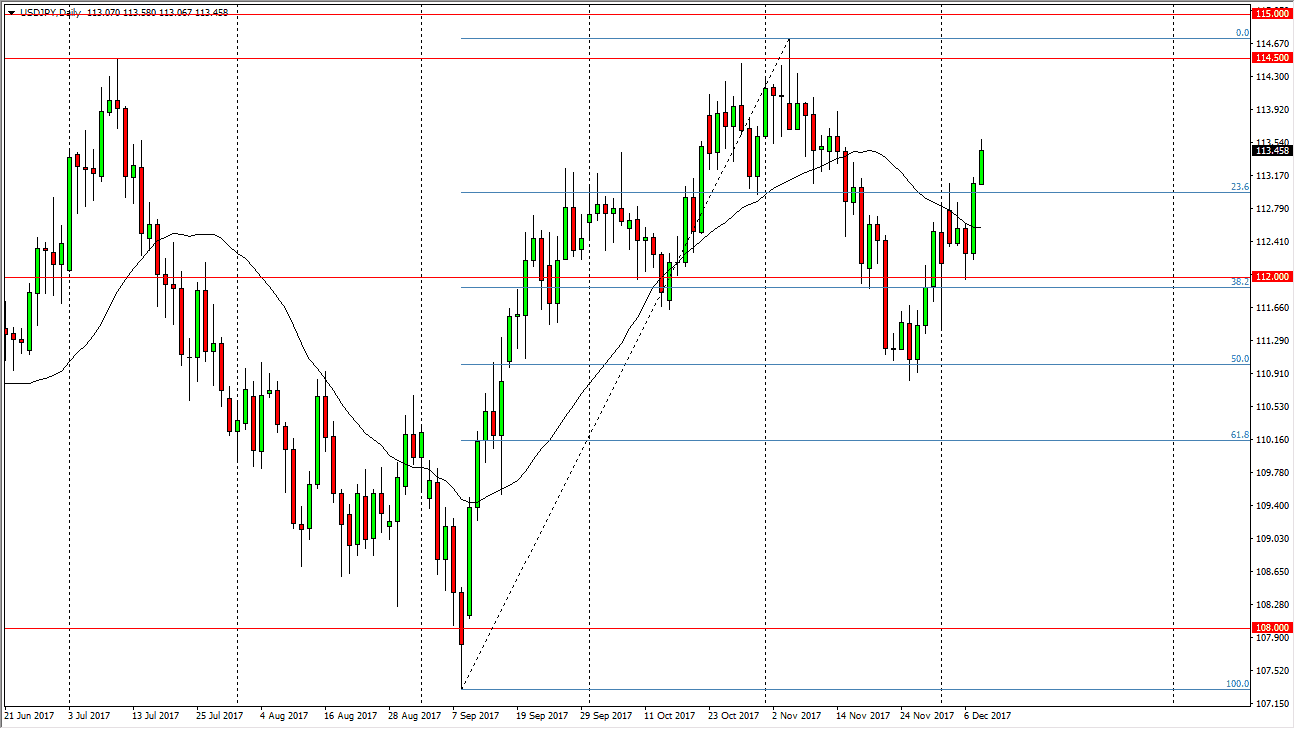

USD/JPY

The US dollar has rally during the Friday session, breaking above the vital 113 handle. Because of this, I believe that pullbacks continue to offer value the traders will take advantage of, perhaps trying to send the market to the 114.50 level above. I like pullbacks for value, and I believe that the 112 level should continue to offer a bit of a short-term “floor.” With interest rates going higher in the United States, and perhaps a hawkish overtone to the Federal Reserve statement this month, we could see the market finally break above the vital 115 handle above. In general, I like this market, but I also recognize that it will be very choppy in general. If we can break above the 115 handle, then the market becomes more “buy-and-hold.”

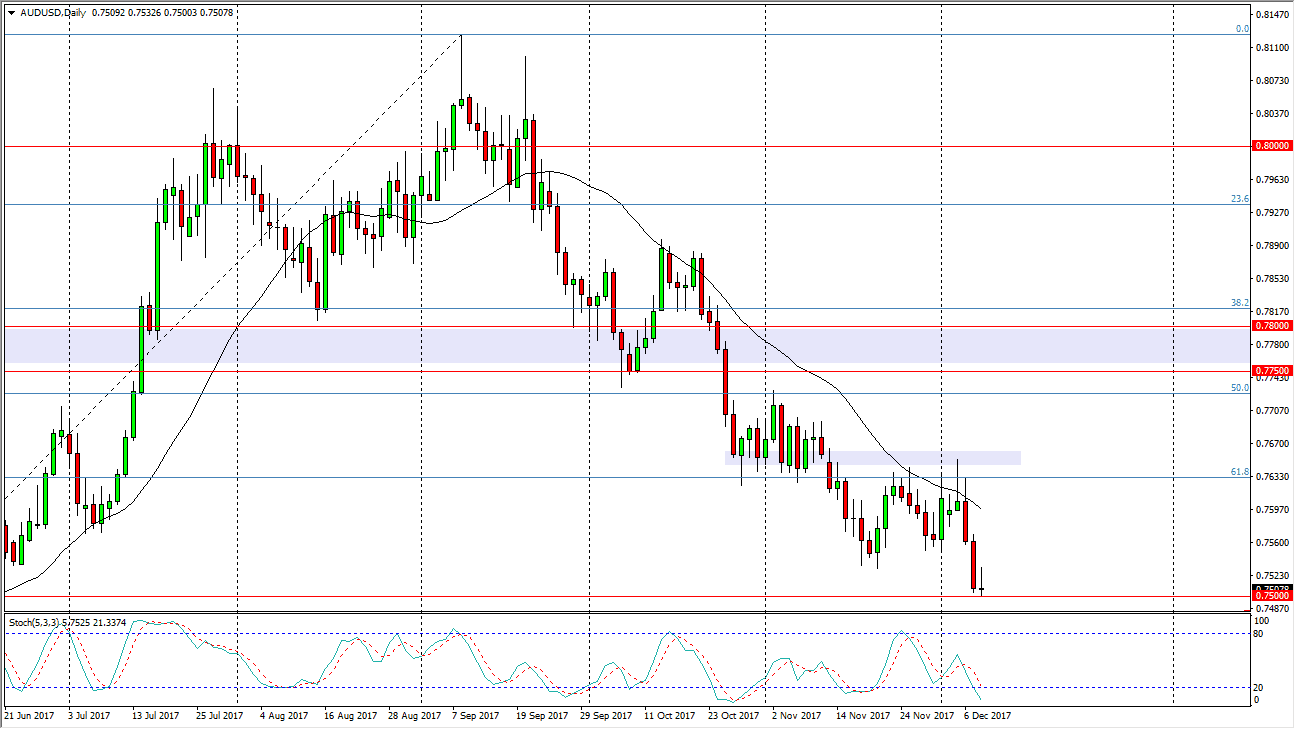

AUD/USD

The Australian dollar initially tried to rally during the trading session on Friday, but turned around to form a shooting star. The shooting starts at the bottom of a downtrend, and now sits above the 0.75 handle, an area that is massively supportive and is also at the same area we see an uptrend line from the longer-term weekly chart. If we break down below the 0.75 handle and close below there on a daily chart, I think the Australian dollar gets pummeled. Alternately, if we break above the top of the shooting star for the day, we probably go to the 0.7633 handle again. I believe that we will get a significant move soon, and should follow the gold market for a bit of a hint as to where we are going. Currently, gold looks a bit soft, and that of course translates to a lower Australian dollar in general.