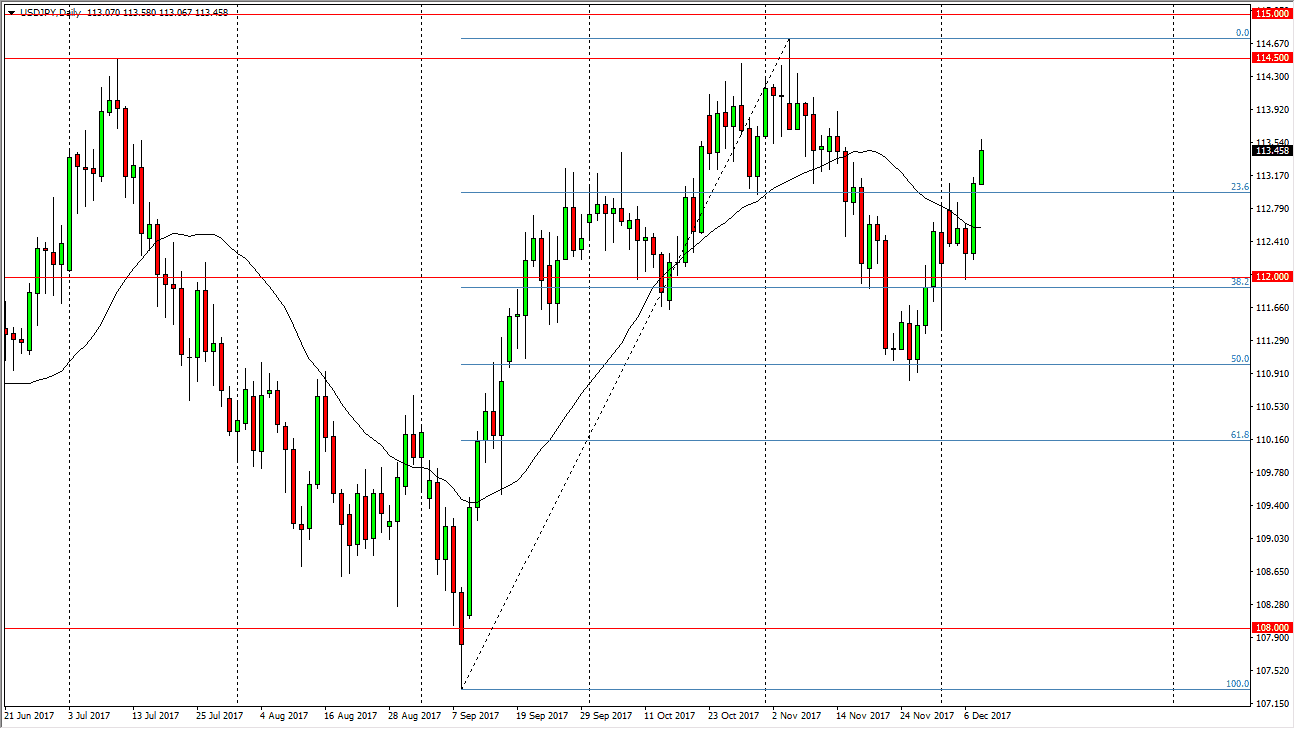

USD/JPY

The US dollar rallied significantly during the trading session on Thursday, breaking above the vital 112 level. By doing so, it looks as if we are ready to continue rallying, and if there is a tax deal coming out of the U.S. Congress, it’s likely that we will go looking towards the 114.50 level above, and perhaps even the 115 handle. If we can clear the 115 level, the market should go much higher, perhaps offering a buy-and-hold scenario. With this being the case, I like the idea of buying pullbacks, especially considering that interest rates look likely to go higher in the United States while the think Japan remains alter easy. If we were to break below the 111 level, the market should then drop to the 110 level, and then down to the 108 handle.

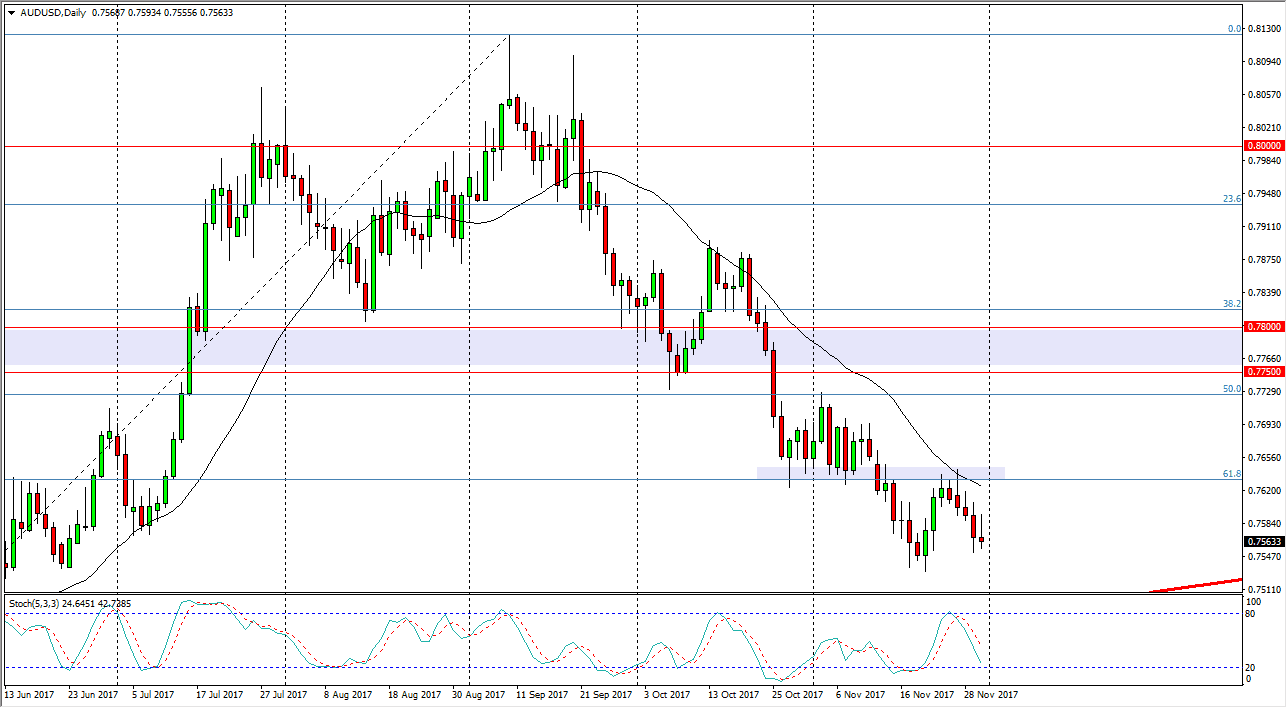

AUD/USD

The Australian dollar initially tried to rally during the day as well, but turned around to form a shooting star. The shooting star of course is a very negative looking candle, at the bottom of a move lower. If we can break down below the 0.75 level, the market could then go down to the 0.7350 level after that, specially considering that the gold market has been struggling. On the other hand, the gold market breaks above the $1300 level, it’s likely that the Australian dollar will rally as well. The 0.7750 level above is resistance, so I think even if we do rally from here, that’s as far as any rally would go. Passage of a tax bill would be a bullish turn of events for the US dollar, and should be reflected here in this pair as well. The market will remain volatile, but I think decidedly negative in general going forward.