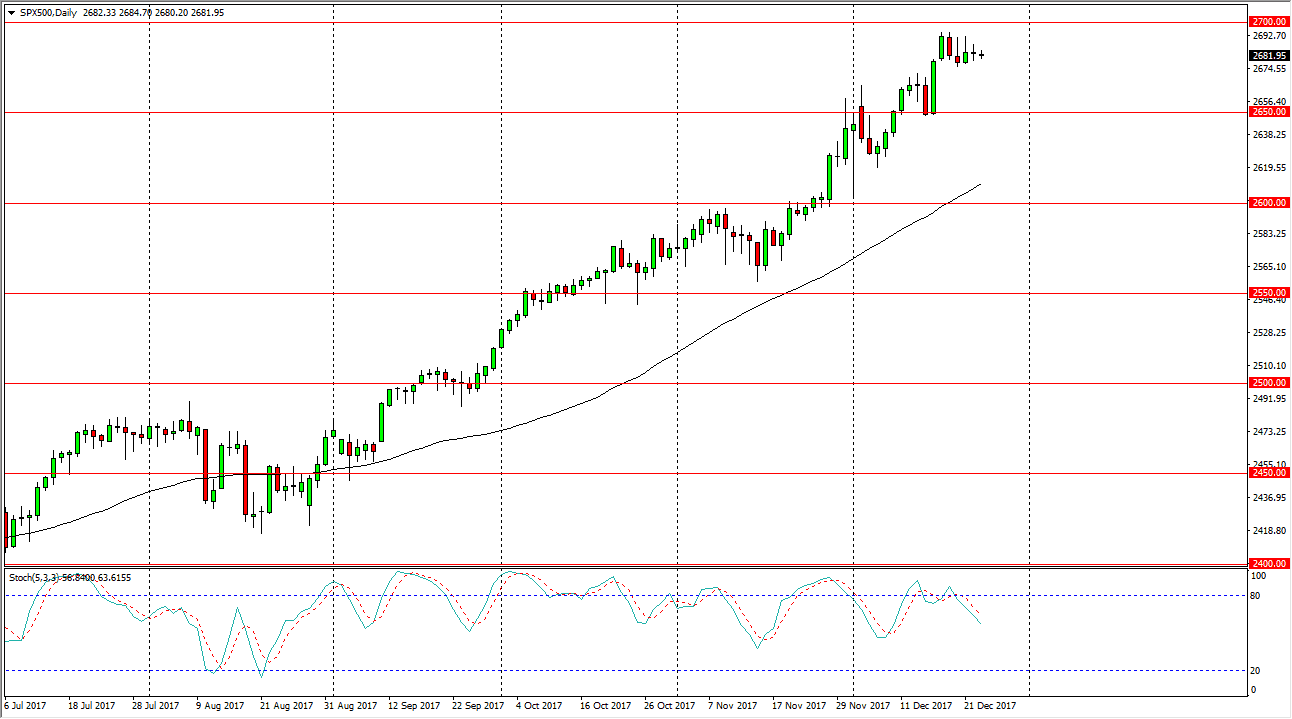

S&P 500

The S&P 500 barely moved during the trading session on Tuesday, which of course wasn’t overly surprising considering that the session was the first day after Christmas. Volume is going to be very thin, and at this point I think it’s very likely that we could pull back. The pullback should find plenty of support near the 2650 level though, so pay attention to these pullbacks as potential buying opportunities. The market will be very thin, and therefore the moves won’t be reliable. I think that the market rolling over makes sense, because quite frankly nobody’s going to be wanting to jump in and initiate a large position at this point. Even if we were to break down below the 2650 level, I think there is more than enough support underneath to keep this market bullish as well. The 2600 level underneath is a massive floor.

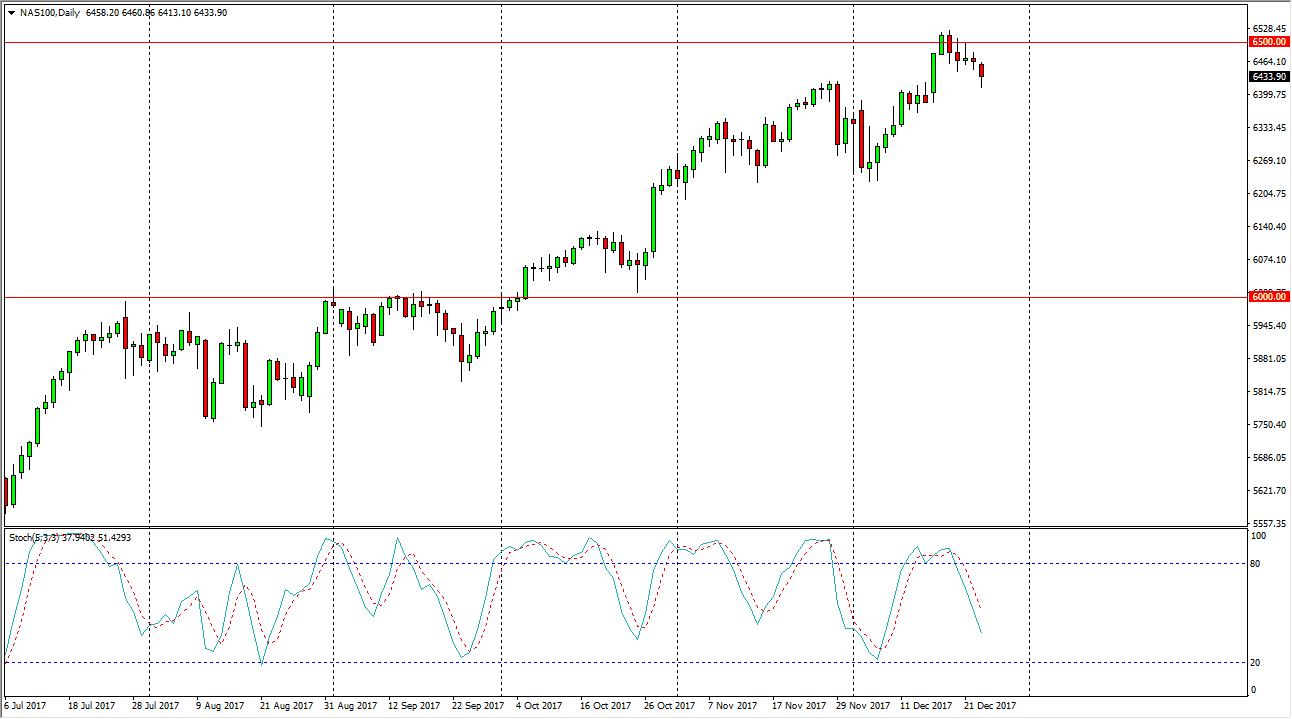

NASDAQ 100

The NASDAQ 100 fell during the trading session on Tuesday, but found support towards the end of the day near the 6400 level. If we can break above the 6500 level, that’s a very bullish sign and I think we could continue the longer-term uptrend. Remember that the NASDAQ 100 has trailed the other US indices, so it’s possible that we may have some catching up to do. However, I do believe that even if we fall from here, there should be plenty of support below near the 6250 level. As far as I’m concerned, as long as we are above the 6000 handle, this is a market that cannot be sold, but you should be aware that we will more than likely pull back occasionally. A break above the recent highs should free this market towards the 6550 level.