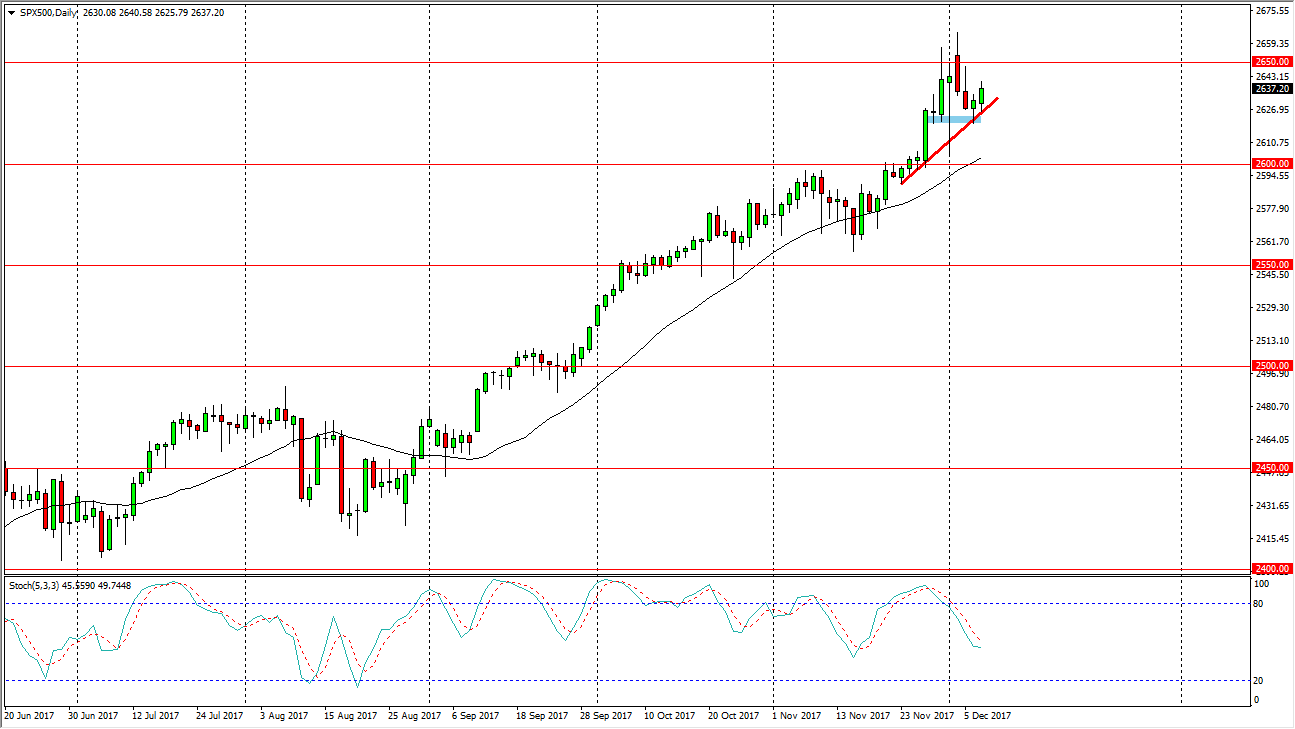

S&P 500

The S&P 500 initially fell during the trading session on Thursday, but found enough support at the short-term uptrend line to rally a bit. The Wednesday hammer was a bullish sign, and it looks as if we got a bit of continuation as the market looks to reach towards the 2650 level above. Pullbacks of this point should be buying opportunities and with the jobs number coming out today, we will almost certainly get one sooner or later. If we were to break down from here, I think that the 2600 level is massive support and essentially the “floor” in the market, and could be thought of as buying opportunities. Let it not be forgotten that the algorithmic traders continue to pick up dips as value, and we could see more of a going forward. A break above the 2650 level would be very bullish.

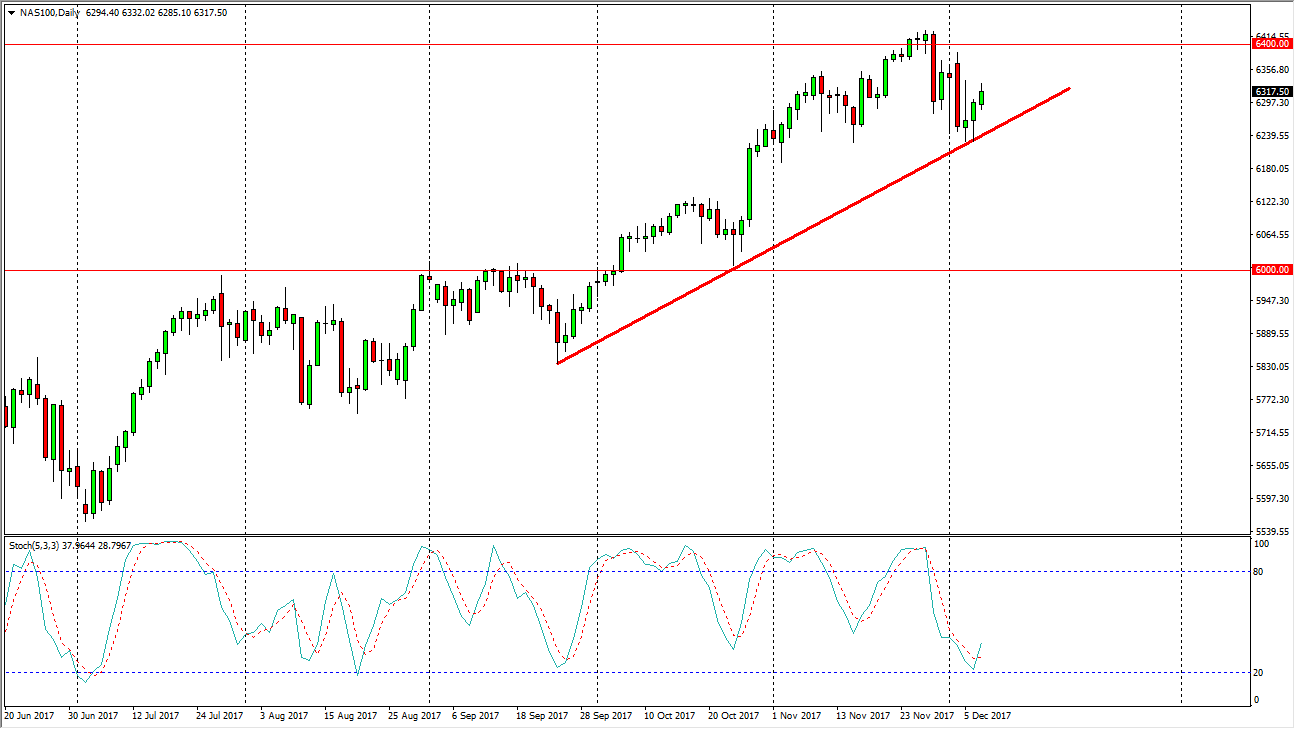

NASDAQ 100

The NASDAQ 100 has rallied a bit during the trading session, as we continue to grind higher. This market has crossed over just above the oversold area in the stochastic oscillator, so I think we are starting to see a continuation of the longer-term momentum as seen by the uptrend line on the daily chart. I look at pullbacks as buying opportunities, and algorithmic traders continue to pick up value every time we dip in US stock indices on the whole. The NASDAQ 100 will be any different, although it has been a bit shakier than several other indices in America. The 6400 level above is massive resistance, but if we can break above there I think we will be free to go towards the 6500 level longer term. A breakdown below the 6200 level would be very negative, and in fact could very well send this market down to the 6100-level next.