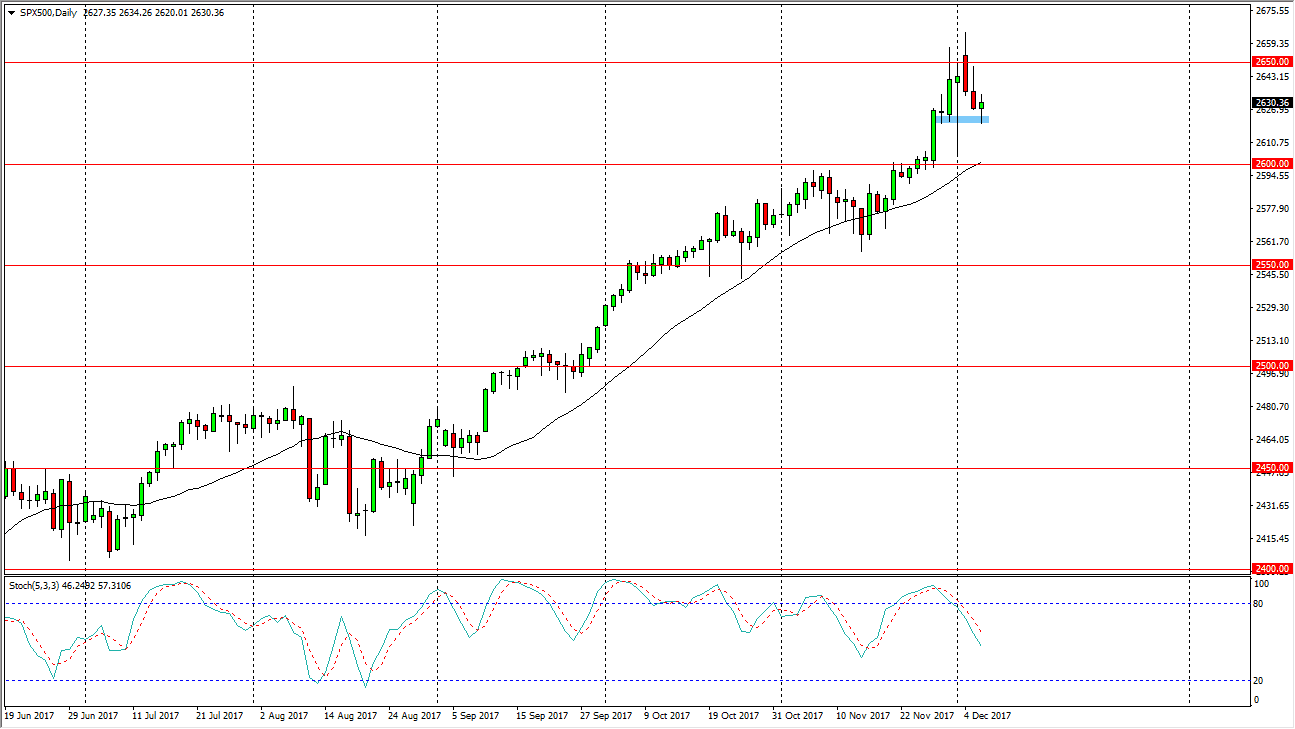

S&P 500

The S&P 500 initially fell on Wednesday, testing the 2625 handle for support, but we turned around to bounce and form a hammer during the day. That’s a very bullish sign, and we have retraced about 50% of the massive hammer that formed on Friday of last week. Because of this, I think that if we can break above the top of the range for the trading session on Wednesday, we will probably go looking towards the 2650 handle above which is massive resistance. I believe that the market continues to see bullish pressure longer-term, and I believe that the 2600 level is essentially the “floor” of the market. The market seems to have a significant amount of resistance at the 2650 handle, but algorithmic traders continue to jump into this market, and because of the momentum I feel it is only a matter of time before smashed through barrier.

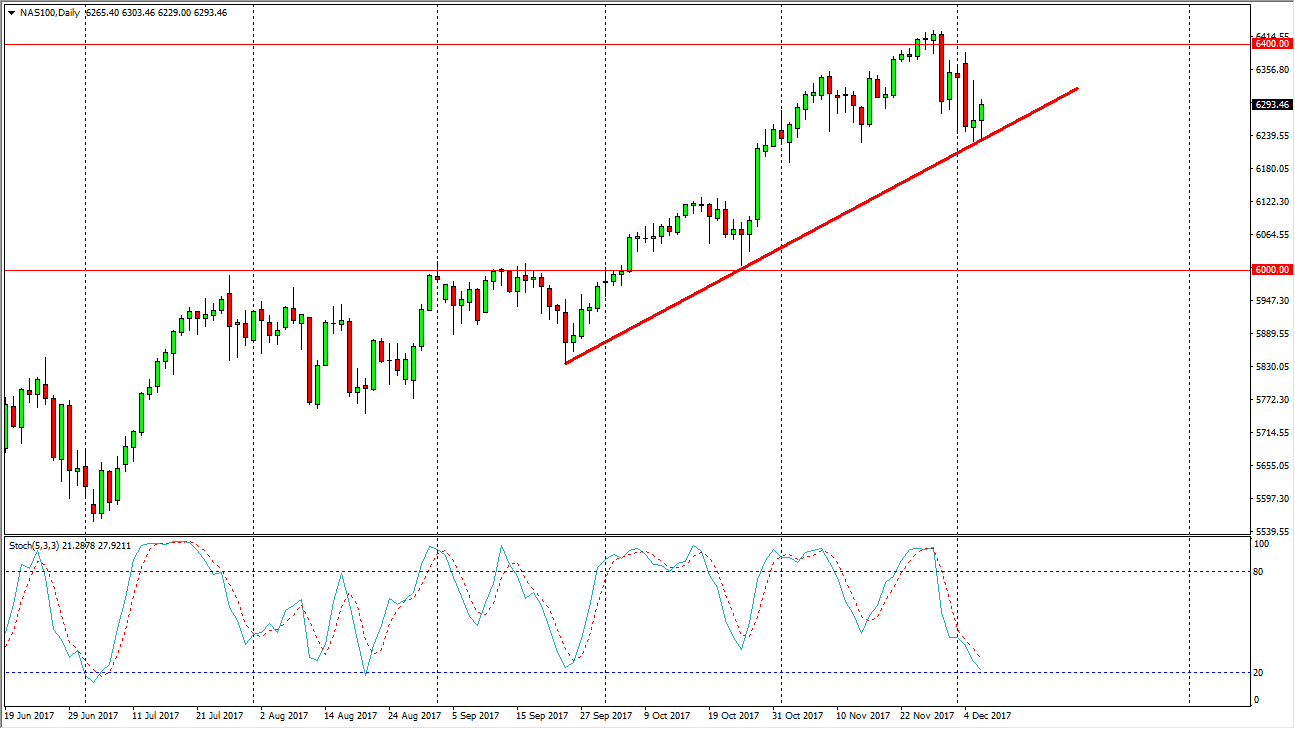

NASDAQ 100

The NASDAQ 100 initially fell during the trading session on Wednesday, testing an uptrend line that has been intact for several months. By doing so and then more importantly, bouncing, it looks likely that we will continue the uptrend. The Stochastic Oscillator is starting to reach into the oversold condition, so I think that some type of cross over in this area is probably a buying opportunity. By bouncing from this area, I suspect that we are going to go looking towards the 6400 level above, and it is possible that perhaps the massive selling of technological related stocks around the world is over. In general, we are in an uptrend, so buying is the only thing that I would consider doing anyway. I would be the first to admit though, if we break down below the bottom of the range for the Tuesday session, we will probably go down to the 6100 level.