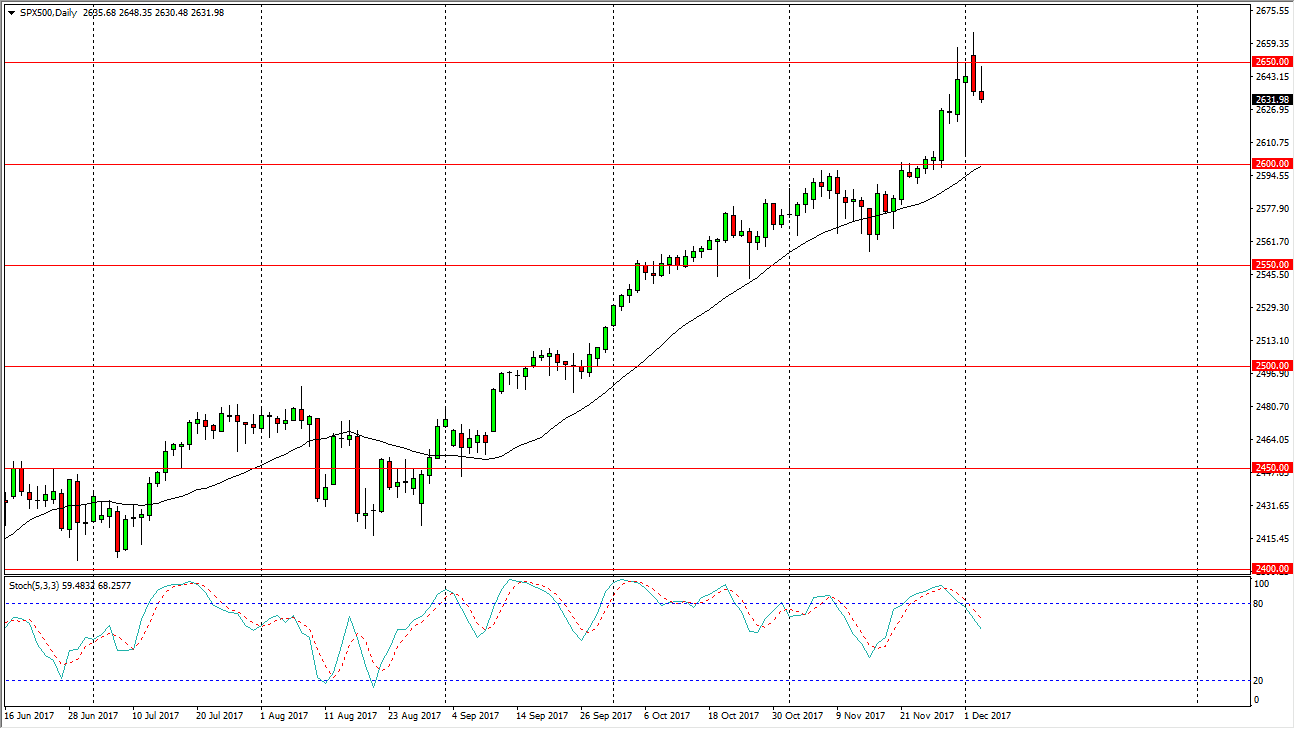

S&P 500

The S&P 500 initially tried to rally during the trading session on Tuesday, but found enough resistance at the 2650 level to turn around and form a shooting star, which of course is a very negative sign. I think that the S&P 500 will probably drop from here, looking to find support. At this point, I suspect that the 2600 level is probably that support, and it’s only a matter of time before the buyers will return. The level is an area that coincides with a reasonable uptrend line, so I think it’s only a matter of time before value hunters would return. If we did breakdown below the 2600 level, I believe that the next major support barrier starts somewhere near the 2560 level. Longer-term, I think that the uptrend is very much intact, and algorithmic traders will continue to jump into the market on dips. Currently, a lot of the noise is going to be based upon tax reform.

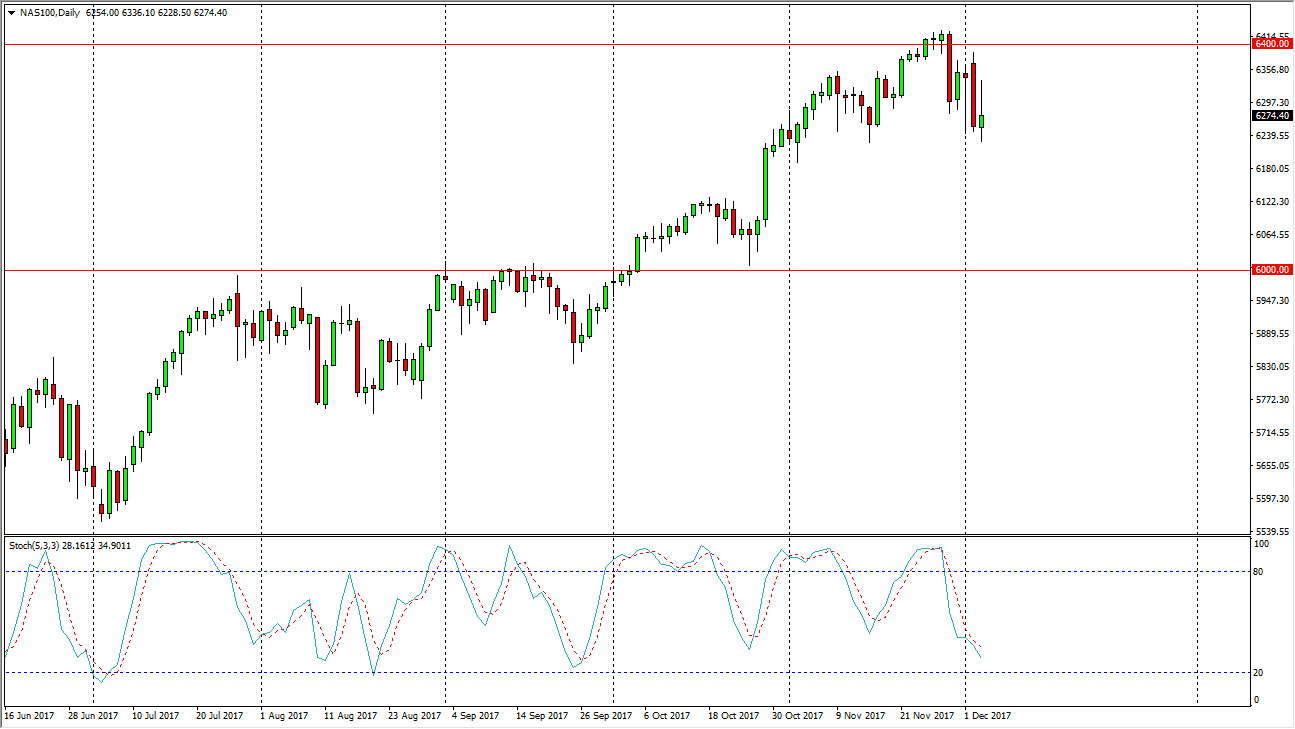

NASDAQ 100

The NASDAQ 100 market initially tried to rally during the day as well, but turned around to form a shooting star. We are sitting on top of support at the 6230 level, but I think it’s only a matter of time before we go below there as markets are looking a bit soft. In general, I believe the sellers may make some noise over the next several sessions, but I believe that the floor in the uptrend is somewhere closer to the 6000 level, meaning that patience will be needed to start buying again. The NASDAQ 100 has been less bullish than the other indices in America, and therefore I think it makes sense that it will lag any type of bounce in the other ones. I think if you are going to short either one of these indices, the NASDAQ 100 would make the most sense.