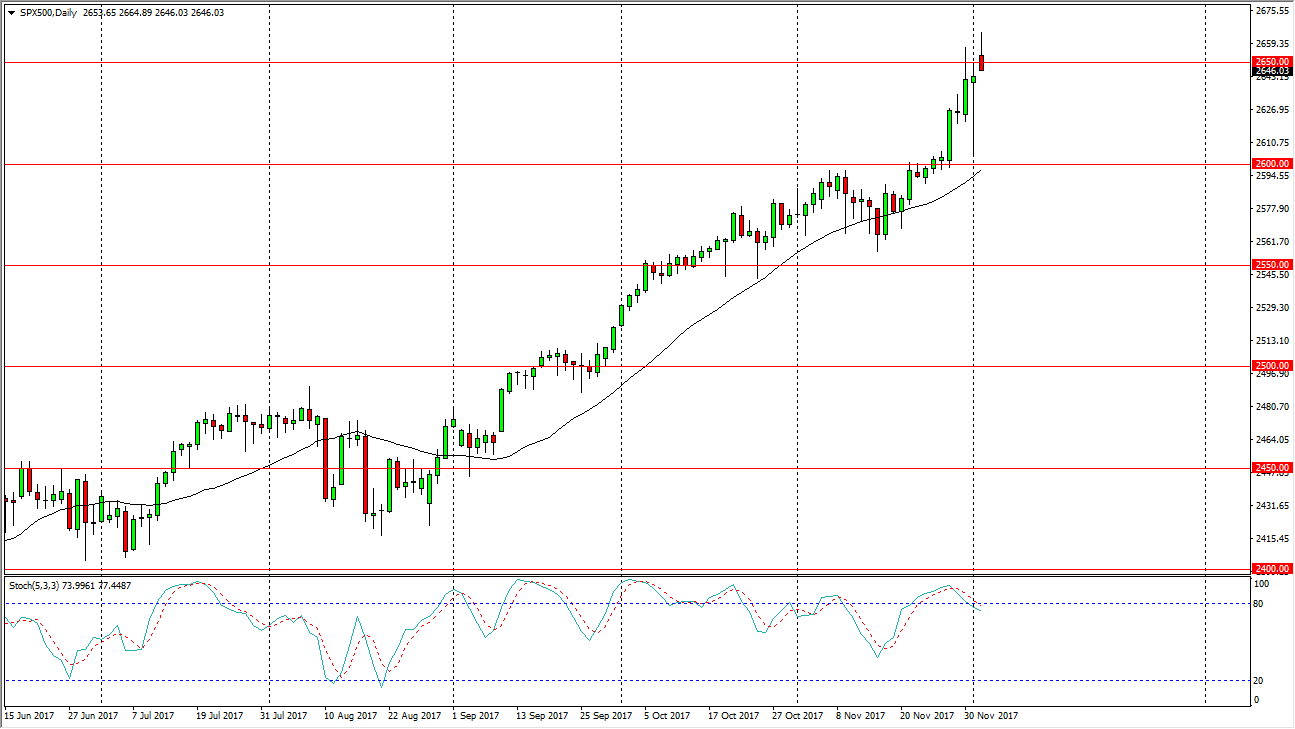

S&P 500

The S&P 500 gapped higher at the open on Monday, but then rallied significantly. However, we turned around to form a shooting star, which is preceded by a massive hammer. The fact that we formed a shooting star near the 2650 level tells me that perhaps we are starting to get a bit overextended, and the Stochastic Oscillator crossing over in the overbought section recently has also suggested that we are starting to get a bit overbought. Because of this, I think it’s only a matter of time before the buyers get involved, extending down to the 2600 level. Because of this, I’m looking for some type of bounce on the pullback to take advantage of value. The S&P 500 should continue to be a market that should go higher if we can get some type of tax reform as well, and as the week goes on, we should get more clarity.

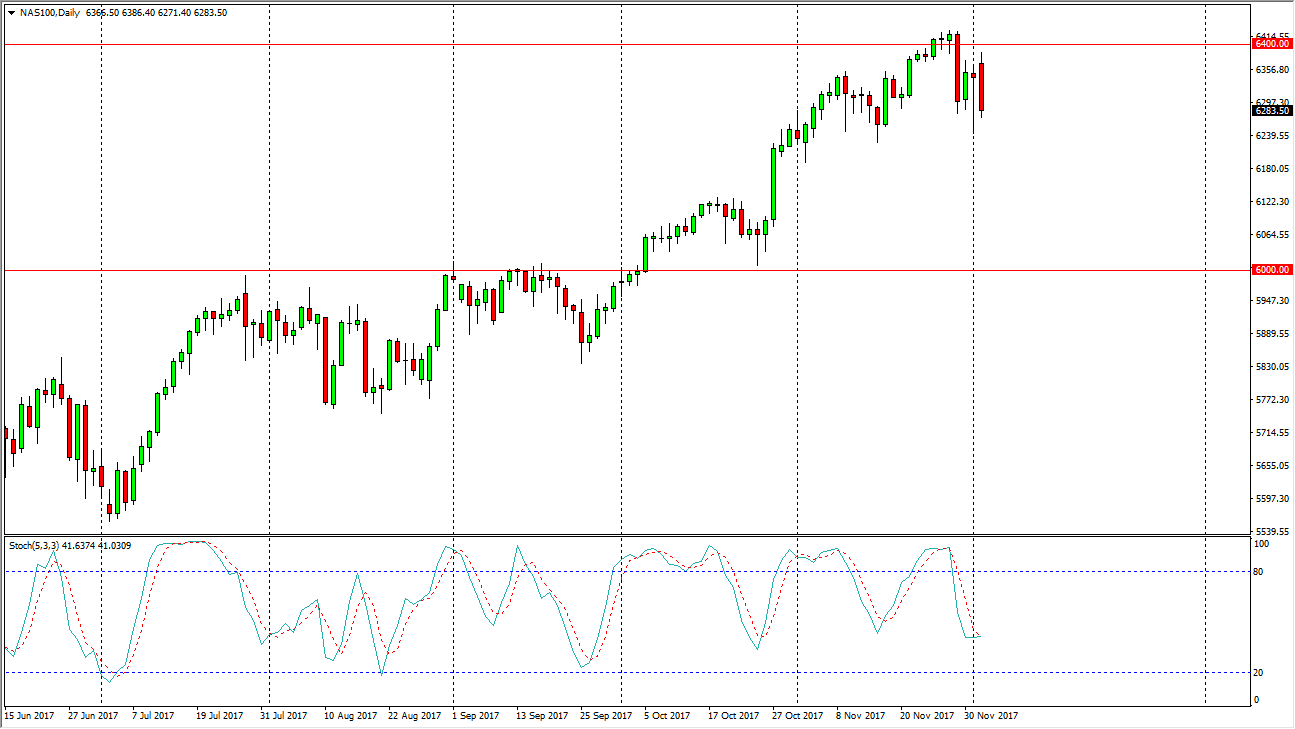

NASDAQ 100

The NASDAQ 100 initially tried to rally as well, but found enough resistance near the 6400 level to turn around and drop significantly. The 6250 level below seems to be supportive, especially considering that we formed a hammer for the Friday session. Ultimately, I think that the market should continue to go higher, but the 6400 level will continue to be massively resistive. If we can break down below the 6200 level, we should drop towards the 6000 level. Ultimately, this is a market that is a “buy the dips” going forward, and I don’t have any interest in shorting until we would break down below the 6000 level, which seems to be very unlikely. Stock markets continue to get buyers involved, and if we can get that tax reform, I believe this would turbocharge the next leg higher.