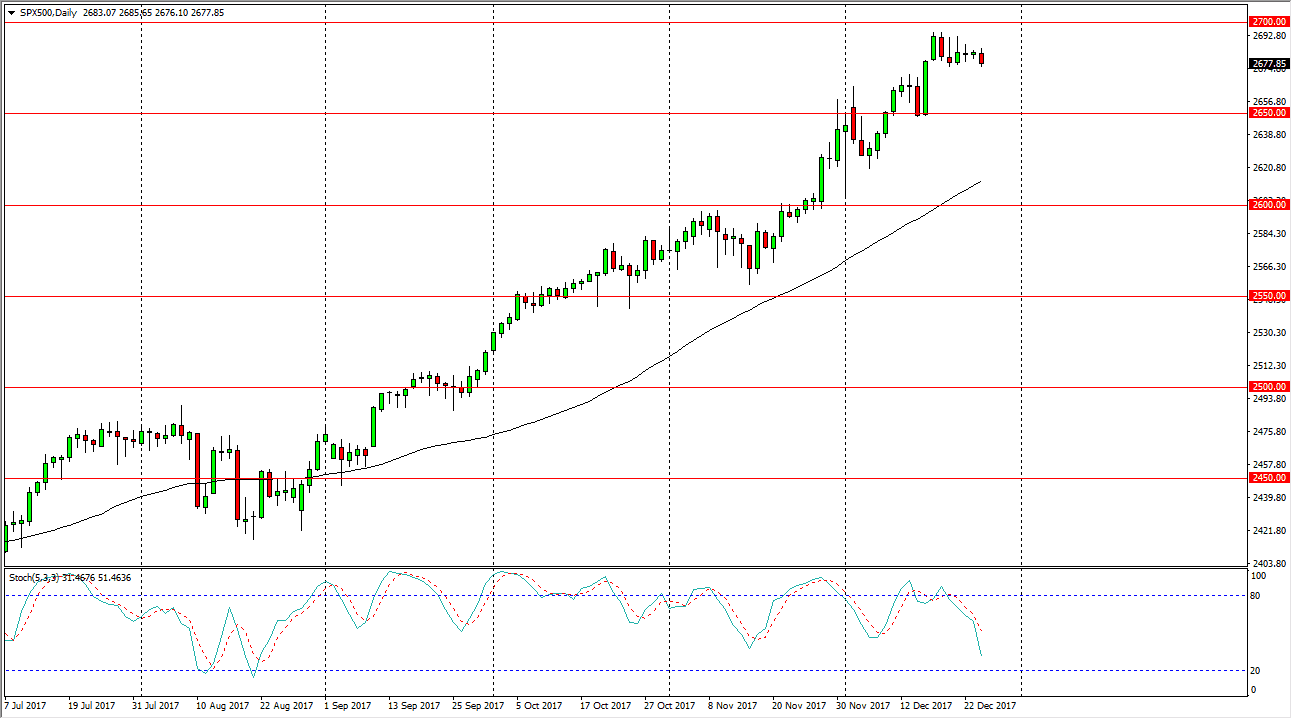

S&P 500

The S&P 500 was pretty quiet during the Wednesday session, which of course is what you would expect in a thin environment. I don’t have any interest in putting a lot of money into the markets right now, because quite frankly it’s nothing short of gambling and only those with issues would probably be willing to jump in with both feet. I think a pullback is very likely based upon the descending triangle, but I’m also not willing to short this market. I think the 2650 level underneath is going to be support, so therefore I’m looking to but at a lower level. Alternately, if we did break out to the upside, clearing the 2700 level would be very bullish as well. Either way, I’m not willing to short this market.

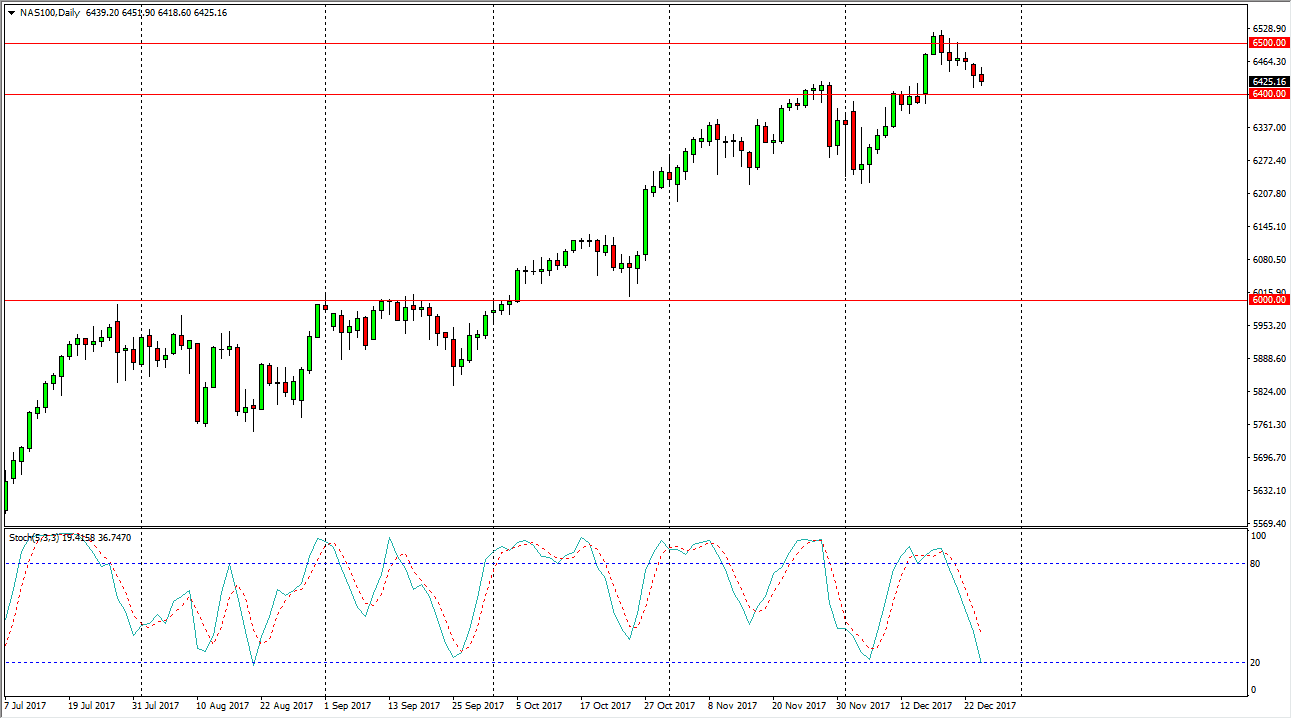

NASDAQ 100

The NASDAQ 100 was slightly negative during the day as well, but I think there’s plenty of support at the 6400-level underneath, and that should continue to offer a nice buying opportunity. I think a bounce from there probably sends this market back towards the 6450 handle, and then eventually the 6500 level. I think given enough time, we are going to break out to the upside and continue to go much higher, as the 6500 level would be the gateway to a “buy-and-hold” scenario. Even if we do break down below the 6400 level, I think that there is plenty of support down below at the 6200 level. I believe that the overall uptrend continues now that we have tax cuts approved, and of course low interest rates continuing to push marks to the upside. We are in a nice up trending channel, so I think we are suddenly going to see more of the same.