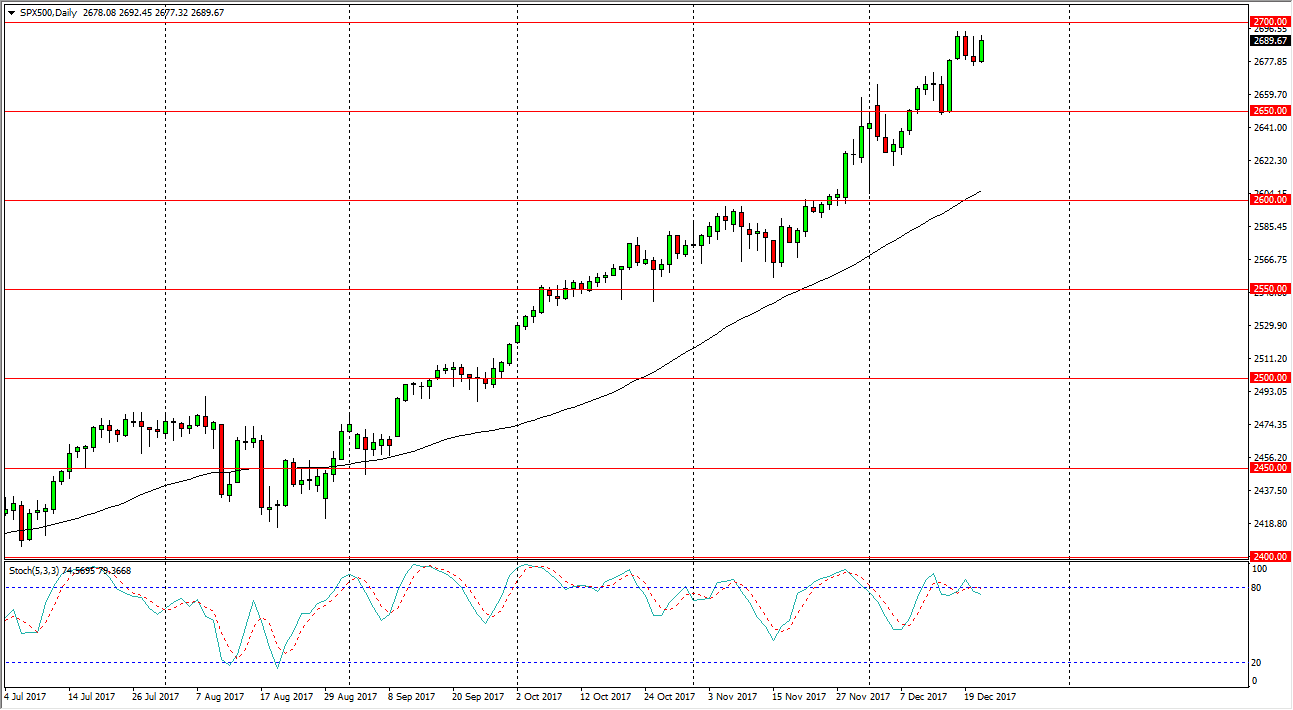

S&P 500

The S&P 500 rallied a bit during the trading session on Thursday, on light volume. We are continuing to see buyers jump into this market and push towards the 2700 level, but having said this, it’s going to be a short trading session during the day, and volume will be almost nothing. Because of this, I would stay out of the market, but I do recognize that a break above the 2700 level would be a very bullish sign, and perhaps send this market to the upside. A break above there does send the market much higher over the longer term, and I think it will happen given enough time. But I also recognize that we can pull back between now and then, looking towards the support at the 2650 handle. That’s an area that I think will attract a lot of value hunters, but right now we are simply focusing on the holidays, and not the markets.

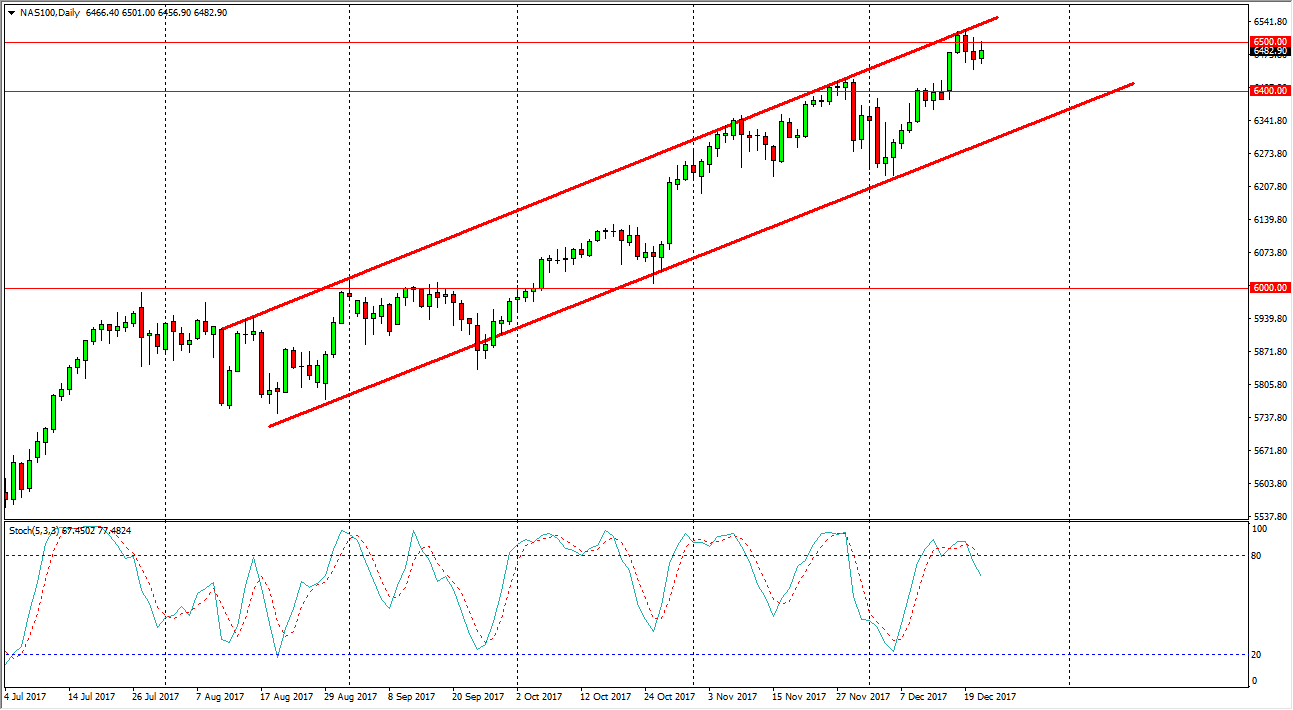

NASDAQ 100

The NASDAQ 100 has been noisy during the day as well, reaching towards the 6500 level. That’s an area that has been resistive in the past, and we are reaching towards the top of an overall uptrend in channel. As we head into the holidays, volume will dry up and at this point professional traders are already on vacation. That being the case, it’s probably best to stand on the sidelines and wait until after the holidays are out of the way to put fresh sessions into the market. However, the 6400-level underneath could offer enough support to offer a buying opportunity for the short term.