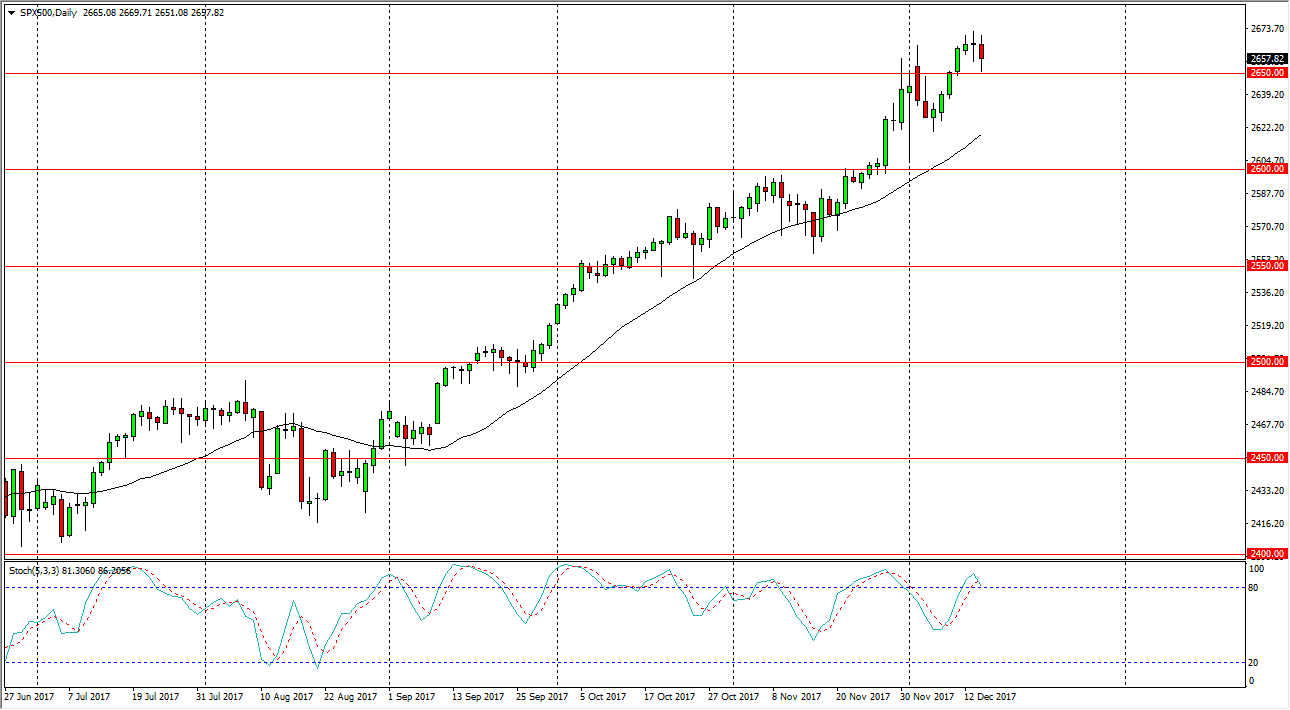

S&P 500

The S&P 500 had a negative session on Thursday, reaching down to the 2650 handle before finding buyers. It looks likely that we are going to continue to go higher, perhaps offering an opportunity to pick up a bit of value. I think that the uptrend is very much intact, and I believe that the bottom of the uptrend itself is near the 2600 level. I think that given enough time, the algorithmic traders will continue to jump into this market place, because quite frankly they don’t know what else to do. The end of the year rally is common, as money managers try to make up for lackluster returns. Because of this, the so-called “Santa Claus rally” could present itself rather soon, especially considering that the liquidity will be relatively thin in the next few weeks. If we were to somehow break down below the 2600 level, that could be catastrophic. “Buy on the dips” continues to be the mantra.

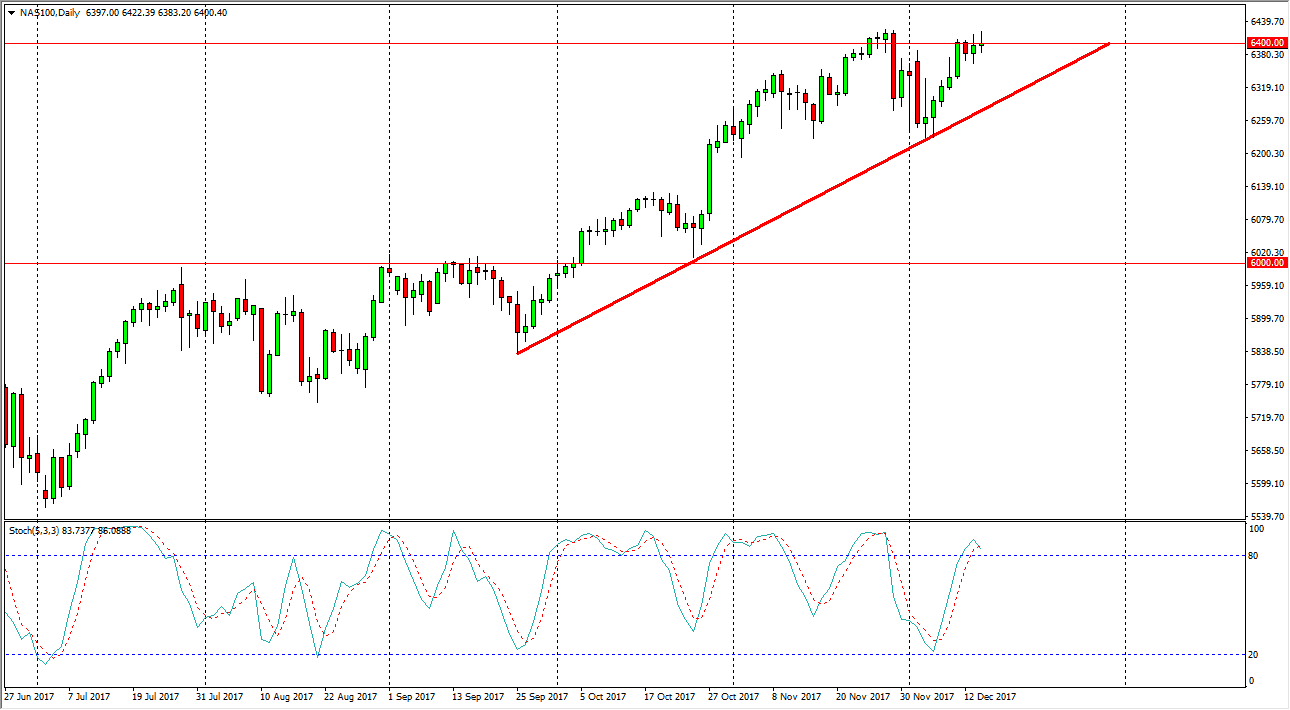

NASDAQ 100

The NASDAQ 100 went back and forth during the trading session on Thursday, but ended up forming a bit of shooting star at the psychologically important 6400 level. I think that the area will offer significant resistance, and of course perhaps cause a bit of a pullback. With today being Friday, and traders thinking more about the holiday season, it’s more likely that the profit-taking could ensue, but longer-term moves to the upside should continue. Remember, the NASDAQ 100 has trailed the other indices for the last several weeks, so I think that we could find buyers underneath trying to continue to take advantage of the potential “Santa Claus rally.” A break above the top of the candle is also a very bullish sign, given enough time, I expect we go to the 6500 level.