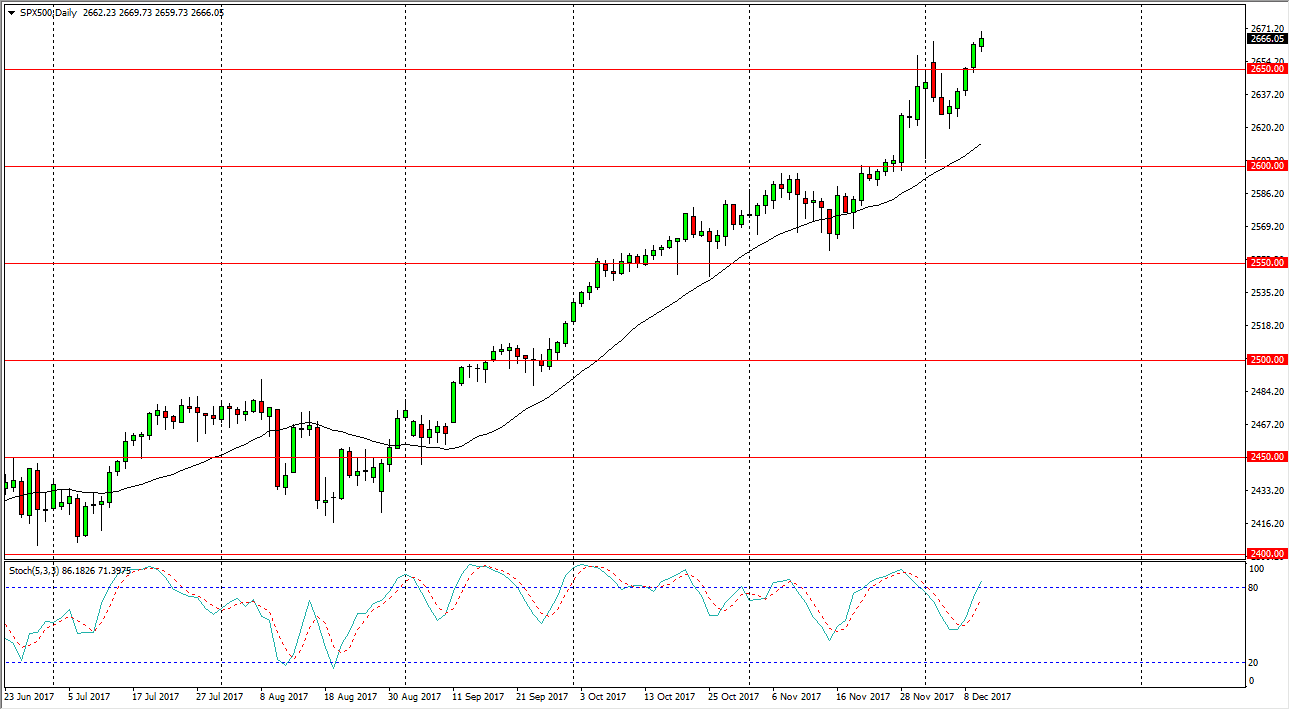

S&P 500

The S&P 500 rallied slightly during the trading session on Tuesday, as we continue to see bullish pressure. The 2650 level underneath is significant support, as it was previous resistance. As we pull back, I think there would be plenty of buyers willing to jump into the marketplace, but I think today is going to be especially interesting as the Federal Reserve has an interest rate announcement coming out, and more importantly: the statement afterwards. The statement gives us an idea as to whether the Federal Reserve is hawkish or dovish, and that of course can influence the market going forward. I think if the Federal Reserve seems more hawkish than originally anticipated, it could lift the value of the US dollar, which of course weighs upon the S&P 500, least in the short term. Longer-term though, I think that the buyers will continue to push to the upside.

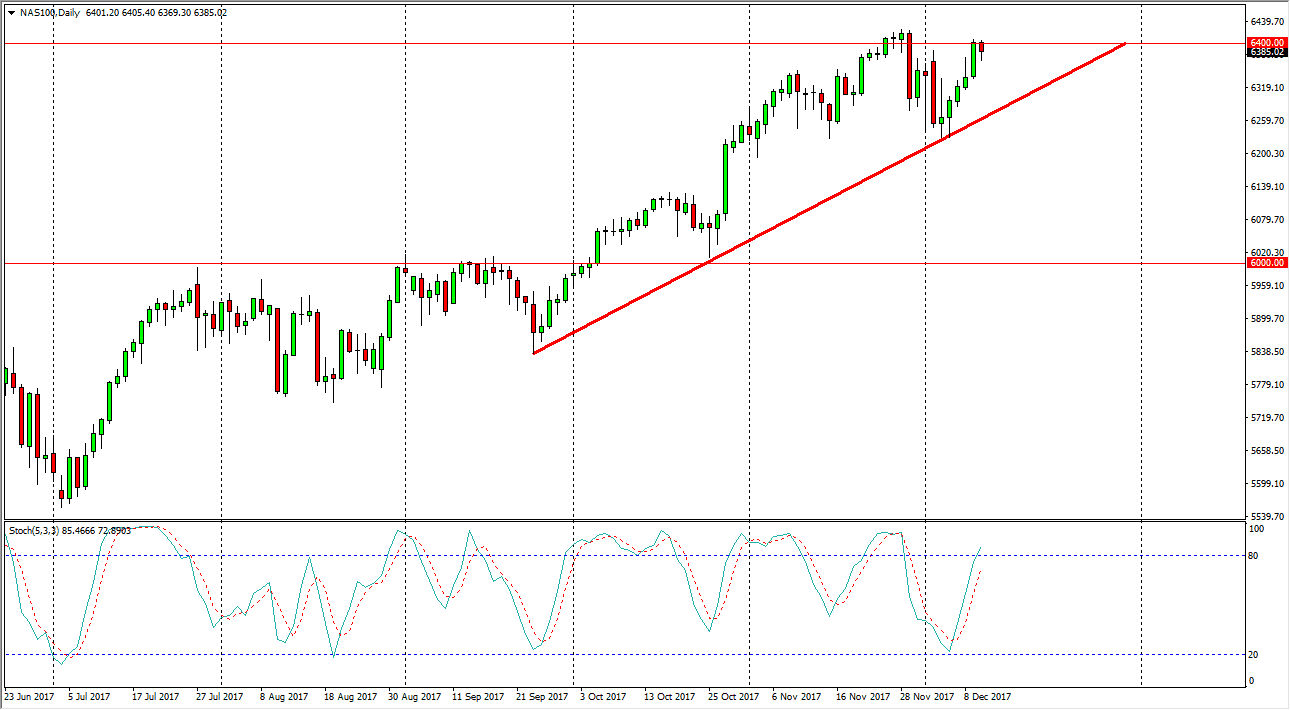

NASDAQ 100

The NASDAQ 100 dropped a bit during the trading session on Tuesday, as the 6400-level offered resistance. It looks likely that we could pull back from here, but I think that eventually the buyers will get involved. If we can make a fresh, new high, which is essentially above the 6425 handle. If we can break above there, then the market could continue to go much higher. I believe that the uptrend line underneath should continue to be support as well, so it’s not until we break down below the 6200 level that I would consider this market in some trouble, but even then, I would anticipate that the 6000-level underneath will be supportive also. Longer-term, I believe that the buyers are going to continue to jump into the NASDAQ 100, but we could get a bit of a short-term pullback after the statement.