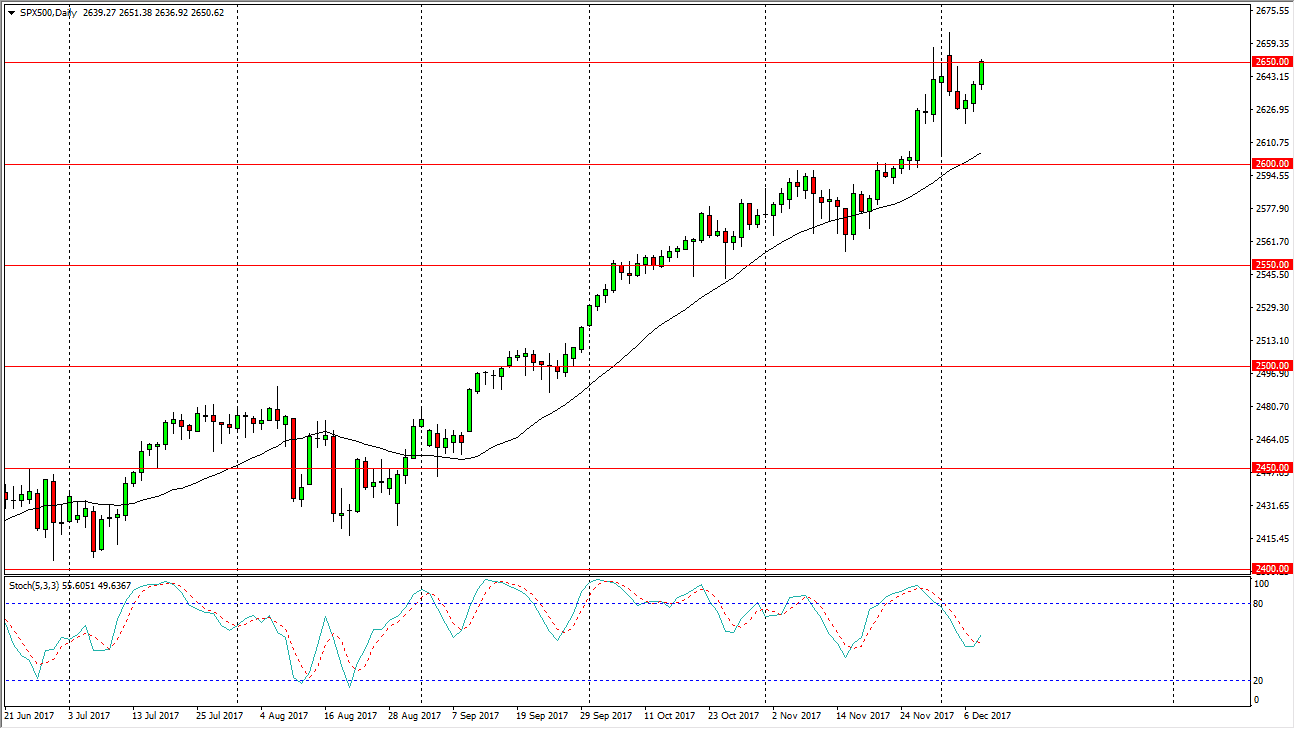

S&P 500

The S&P 500 rallied during the trading session on Friday, smashing into the 2650 handle. There is a significant amount of resistance here though, but I think we are going to continue to see the so-called “Santa Claus rally”, and therefore I think that buying the dips continues to be the case. I believe that longer-term, we should then go to the 2700 level and possibly even beyond that. I have no interest in shorting, I believe there is a hard “floor” in the market at the 2600 level. The market is picked up by algorithmic traders and money managers that are trying to pad their results for the year every time we pull back, and that should continue to be the case, especially if tax reform goes through in the United States, which is looking more likely every day.

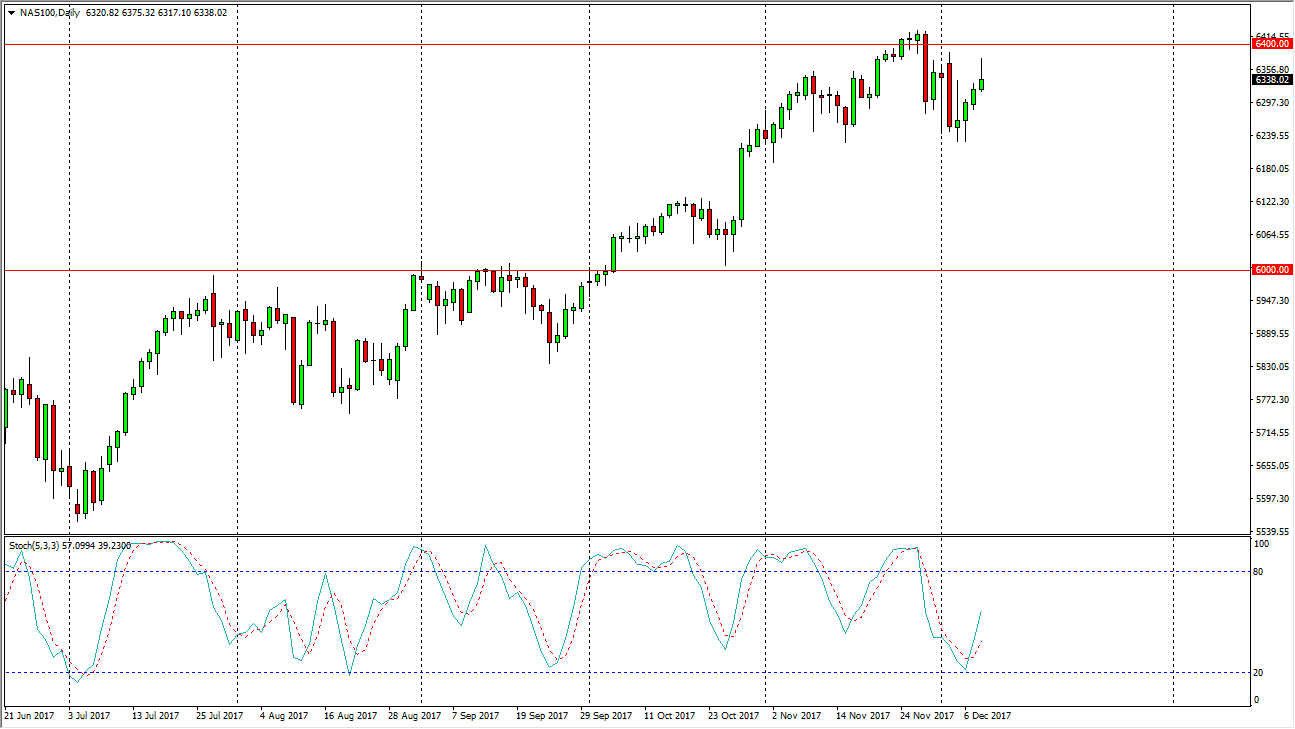

NASDAQ 100

The NASDAQ 100 continues to be very noisy in general, and we did rally on Friday with a certain amount of strength. However, we turned around to form a shooting star, and the shooting star of course is a negative sign. I think that the NASDAQ 100 may continue to lag behind the S&P 500 and the Dow Jones Industrial Average, so although I don’t necessarily want to short this market, I think that waiting for a certain amount of value on a pullback should be a nice buying opportunity, so I’m going to stand on the sidelines when it comes to the NASDAQ 100 is probably the best way to go. If we could break above the 6400 level, that would be a very strong sign, and send more money into the market. Regardless, it’s going to be very noisy. All things being equal though, I’m a buyer.