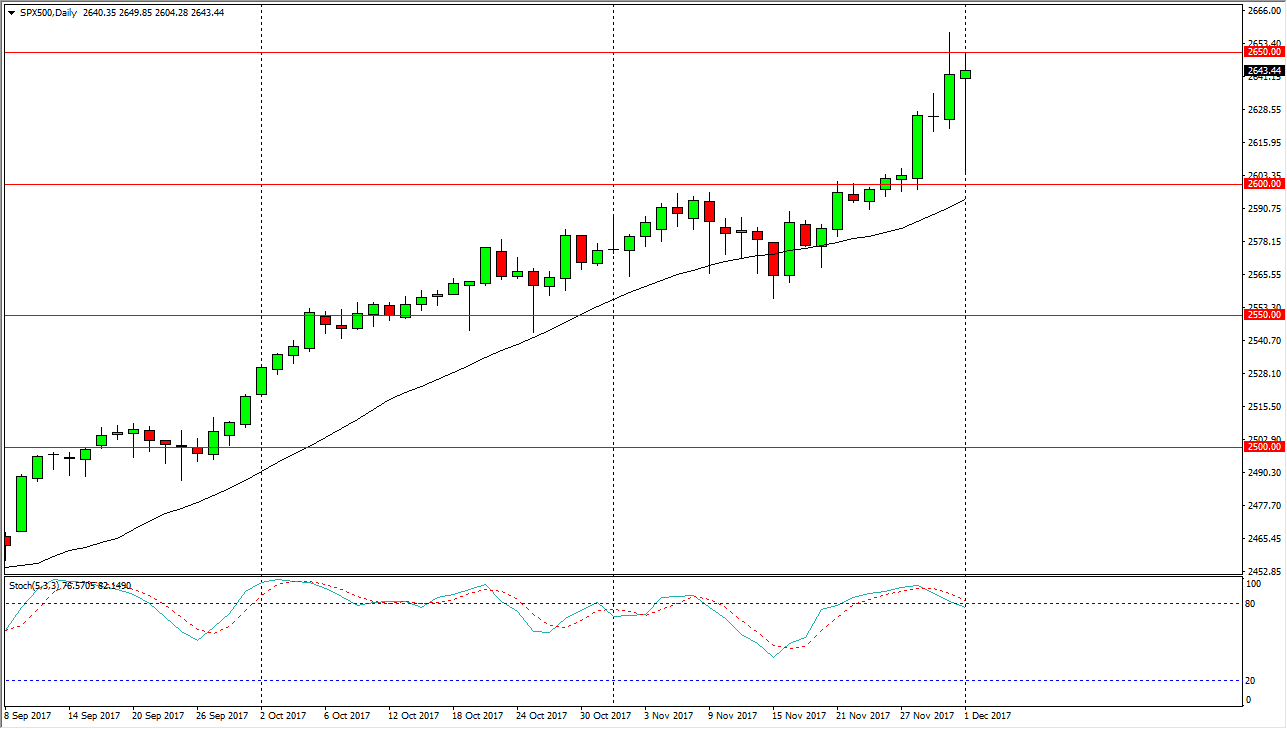

S&P 500

The S&P 500 has been very volatile during the Friday session, reaching as low as the 2600 level, only to bounce and form a massive hammer. This was mainly due to the announcement that General Flynn was testifying against the White House in the Russia investigation, and this of course have the markets freaking out. Longer-term though, I believe that most traders realize that this is a short-term event, and nothing has been settled yet. Because of this, it’s likely that this hammer signifies that we are ready to break out above the 2650 level, and continue the longer-term uptrend. A breakdown below the 2600 level is very negative and should have this market selling off. This is a market that has been bullish and algorithmic traders have been buying every dip as we simply do not have much in the way of pullbacks anymore.

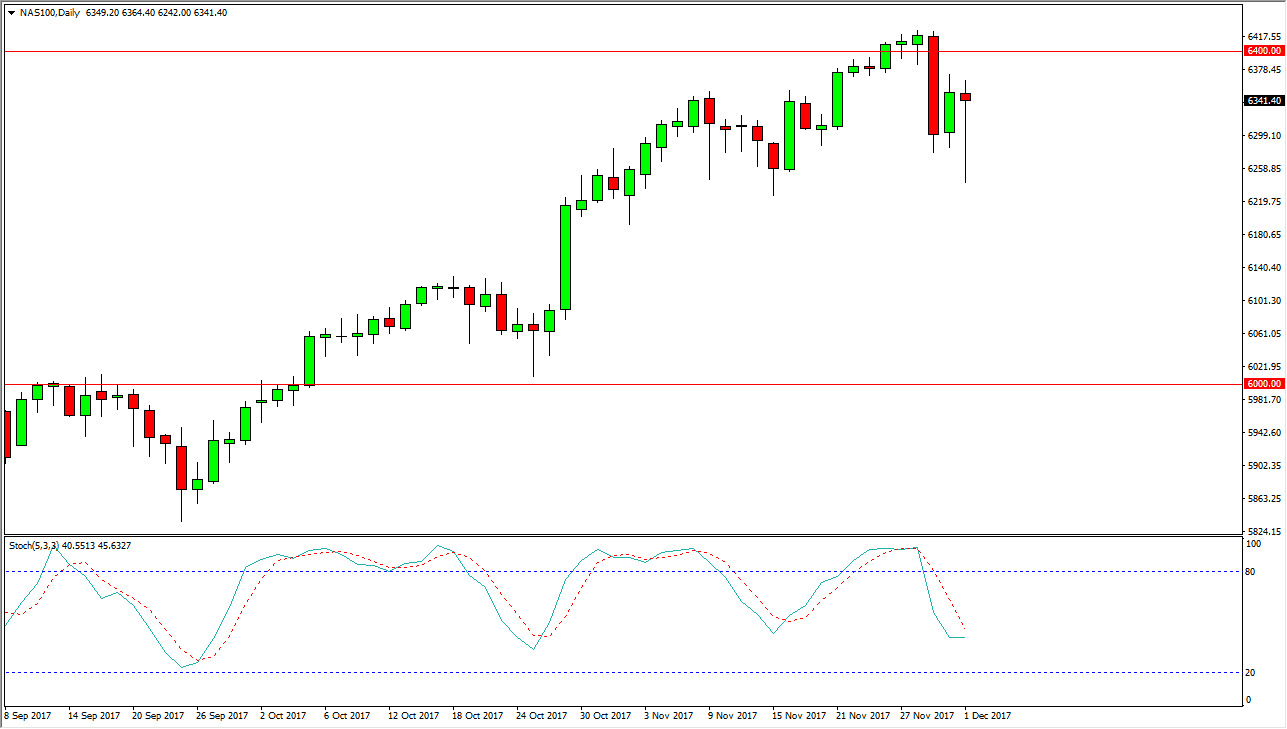

NASDAQ 100

The NASDAQ 100 fell as well, dropping down to the 2650 handle, but turned around to form a massive hammer. The hammer is a bullish sign, and I think it shows that we are ready to go towards the 6400 level next. A move above that level would be very bullish sign, perhaps sending the market to the 6500 level over the longer term. There will continue to be a lot of noise back and forth, but I think that the overall uptrend continues, as algorithmic traders continue to be a main driver of the NASDAQ, and even though this market has somewhat underperformed as of late, the longer-term direction is definitely from the lower left to the upper right on your charts. I believe that the floor in the overall trend is lower at the 6000 level, and it’s not until we break down below there that I would consider selling.