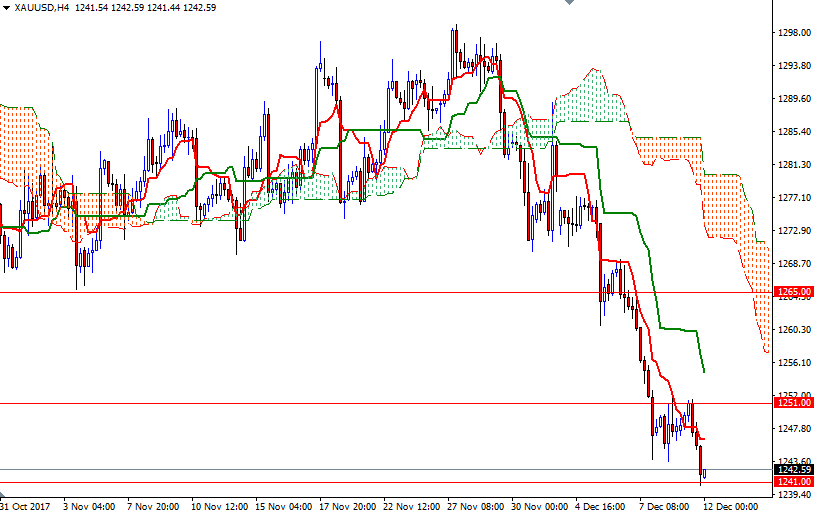

Gold started the week under pressure as investors maintained their risk for appetite. Global stocks continued going up and the U.S. dollar edged higher ahead of the Fed meeting. Financial markets pricing a roughly 92% probability of a rate hike this week. XAU/USD initially tried to move higher but surrendered earlier gains after the resistance in the 1251/49 area kicked in.

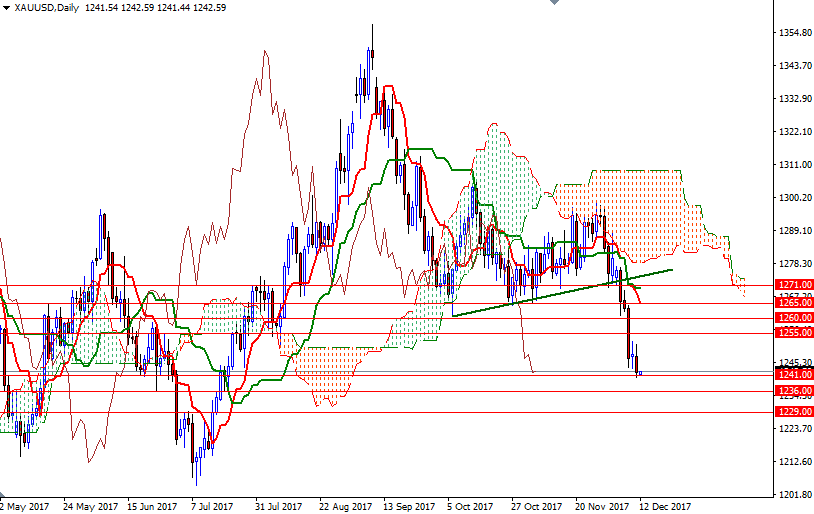

The market’s failure to overcome this obstacle suggests that the bears are maintaining their firm control of the technical charts. Prices are below the Ichimoku clouds on the daily and 4-hourly charts and we have negative Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) crosses. Despite the fact that gold prices seem vulnerable to the downside, some short-side profit-taking can be seen today.

If the support at 1241 remains intact, the bulls may have a chance to revisit 1246 and 1248.20 (the bottom of the hourly cloud). Beyond there, the 1251 level stands out as a strategic point. The bulls will have to pass through 1251 to tackle the next barrier in the 1256.50-1255 area. However, if the cloud on the H1 chart continues to block the bulls’ way and the market successfully gets below 1241, then the 1236/3 area will be the next target. A daily close below 1263 (the bottom of the weekly cloud) paves the way for 1229/6.