Gold prices ended a choppy, two-sided trading session slightly higher on Tuesday, with many investors in wait-and-see mode ahead of the Fed’s policy announcement. The Fed is expected to raise interest rates for the third time this year. Fed officials will update their forecasts for the growth, unemployment and inflation, but the most important question is whether they will modify their median forecast of three rate hikes next year.

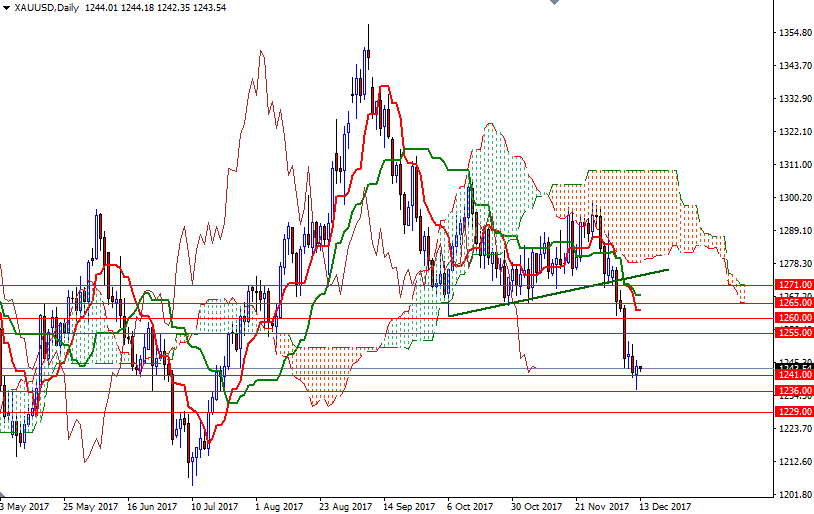

From a chart perspective, trading below the daily Ichimoku cloud, along with the negatively aligned Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line), implies that the near-term downside risks remain. The Chikou-span (closing price plotted 26 periods behind, brown line) also resides below the daily cloud.

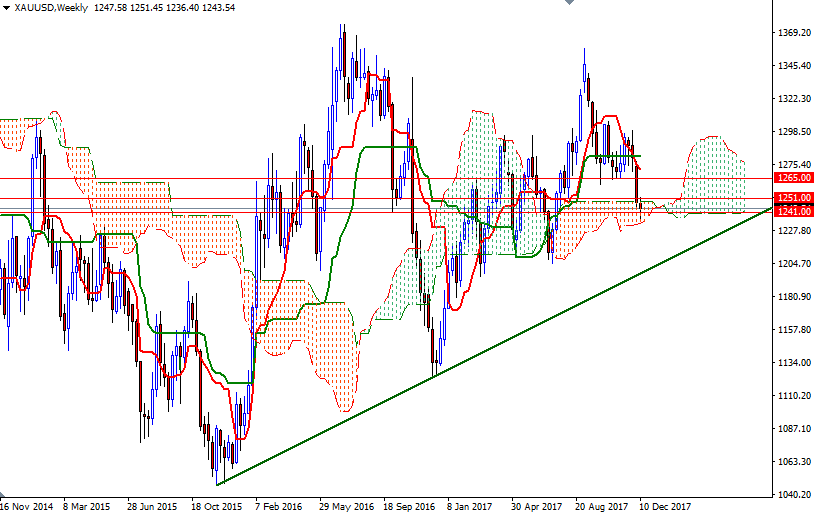

The first upside barrier comes in around 1246.40, the top of the hourly Ichimoku cloud. If XAU/USD successfully breaks up above 1246.40, prices may head to the 1251 level. Penetrating the 1251 level could provide the bulls some extra fuel they need to reach the next barrier standing in the 1256.50-1255 area. The bears, on the other hand, have to pull prices back below 1241 to increase pressure and make a fresh assault on the support in 1236/3. A break down below 1236 implies that the 1229/6 zone will be the next stop.