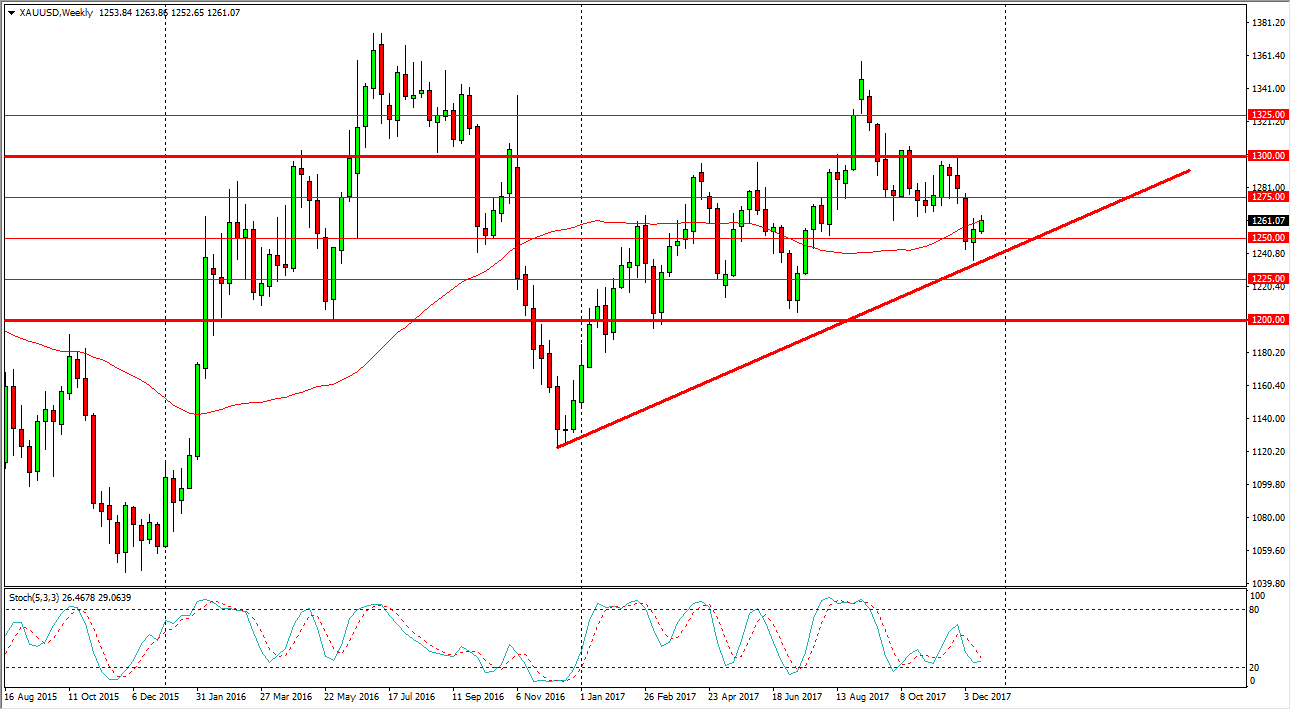

Gold markets have been a bit difficult over the last couple of months, but as you can see I have drawn a nice uptrend line that has offered support of the last couple of weeks. I think that we are going to continue to see upward pressure, and the $1300 level above will be the target. I think we will reach that sometime during Q1, and possibly even breakout above there. This has a lot to do with the US dollar, and if it continues to lose value, I think gold will rally. Pullbacks at this point should be supported, at least by the uptrend line if nothing else. Longer-term, we could reach towards the $1350 level above.

The choppiness of this market makes sense, because there are a lot of questions as to whether anti-dollar trading is shifting to the crypto currency space. I think it is to appoint, but eventually gold gets its due. If we were to break down below the uptrend line, that would be negative, perhaps in in the market back to the $1200 level, which would be a revisit of the support during the past year. Given enough time, I think we are going to find buyers and I think longer-term buy-and-hold traders should profit this year. The stochastic oscillator is starting to cross near the oversold level on the weekly chart, so that might be a technical reason enough to go long. Jump into the market slowly though, because there is a lot of volatility, or at least go with physical gold if nothing else, to give yourself an opportunity to ride out the waves of volatility that will almost undoubtedly come into this market over the next several months. I believe that the buyers are about to make their case again.