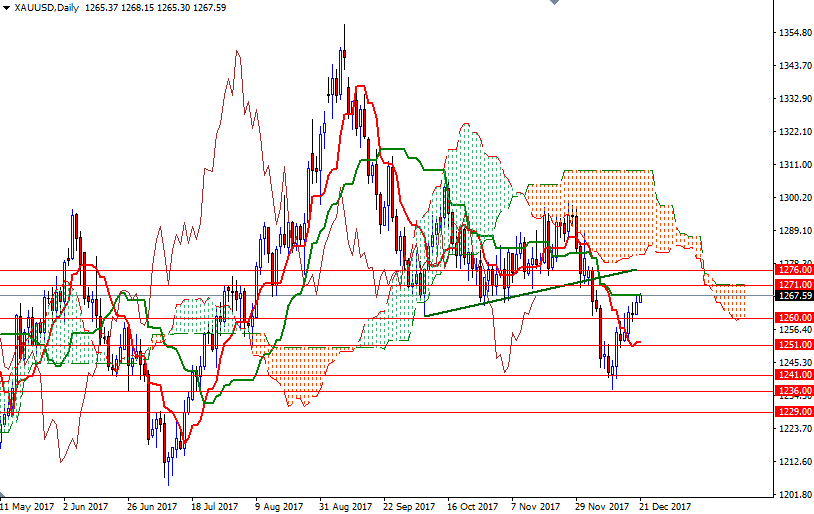

Gold prices ended Wednesday’s session up $3.98 an ounce as declines across global equity markets helped boost investor appetite for the precious metal. The weaker U.S. dollar index also worked in favor of the gold bulls. XAU/USD reached the daily Kijun-sen (twenty six-period moving average, green line) after the market climbed above the $1265 level. Today sees the release of important economic reports such as weekly unemployment claims, Philadelphia Fed manufacturing index and GDP, though trading volumes in most markets may be thin ahead of the upcoming Christmas holiday.

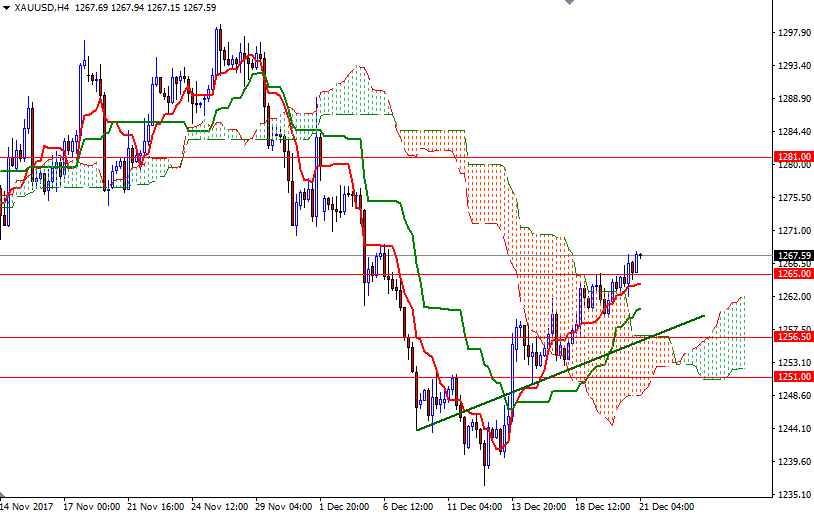

XAU/USD is trading above the Ichimoku clouds on the 4-hourly and the hourly charts. Plus, the Tenkan-sen (nine-period moving average, red line) and Kijun-sen are positively aligned. Although the short term charts are bullish, we have a strategic resistance right on top us, stretching from 1269 to 1271. If this barrier remains intact, expect a pull back to 1265/3. The bears have to pull the market below 1263 to test the support in the 1260/59 zone.

On the other hand, if the bulls push through 1271/69, then the market will be aiming for 1276/5. The bulls will need to produce a daily close above 1276 to make a run for 1281, the bottom of the daily Ichimoku cloud. The daily cloud occupies a large area so it could offer a strong resistance.