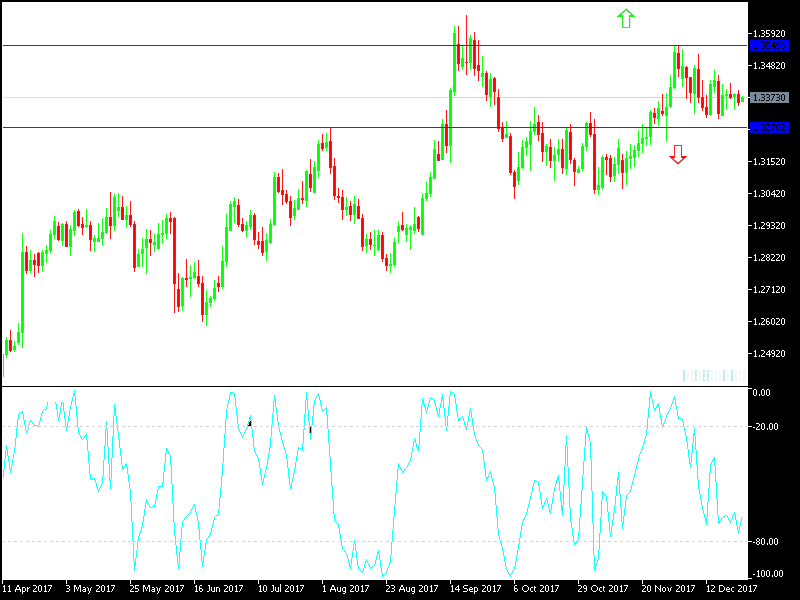

The steadiness of the GBP/USD on the daily chart warns, technically, that the pair might experience a price explosion determining the direction strongly. The most recent drop of the pair’s performance moved below 1.3300. For the fifth day in a row the GBP/USD moves in limited ranges between 1.3300 and resistance at 1.3420. It seems that the Pound is exhausted at the time when major currencies made gains against the Greenback, taking advantage of the pressure on the Dollar after the US tax cut bill. The GBP/USD’s bounce was not strong, as the gains didn’t go beyond the 1.3420 level, where the pair moved naturally for several sessions recently. The pair is stable at the time of writing around 1.3370, and it is clear that it is influenced strongly and effectively by the consequences and path of the Brexit negotiations.

The negotiations entered the second stage, the Trade Relations, after an almost done deal regarding the borders with Ireland. As wildly expected, the Bank of England, led by Carney, maintained the current monetary policy of the bank with interest rate at 0.50% and the asset purchase program worth 435 billion pound to support the UK economy which faced shocks since the country’s vote to leave the EU. The US growth rate was lower, against expectations, and the unemployment claims increased, while the only positivity was from the Philly Manufacturing index.

Technically: GBP/USD will be very bearish in case it is established somewhere below 1.3300, and then following levels will provide support: 1.3100 and 1.3220, and will be confirming the bearish trend. On the bullish side, the nearest resistance levels are currently at 1.3400 and 1.3475, and I still prefer selling at each upward bounce. In light of market closure due to holidays this week and early next week for Christmas and New Year's, traders need to be alert of price gaps due to markets coming back in interrupted form sometimes, and it is better to avoid trading until the markets are fully back to normal.

On the economic data front: This pair is not expecting any important data today, from the UK. From the US, there will be an announcement for the US consumer confident and the Pending houses sales. The market will monitor any updates regarding the Brexit negotiations, as well as Trumps internal and external policies.