By: DailyForex

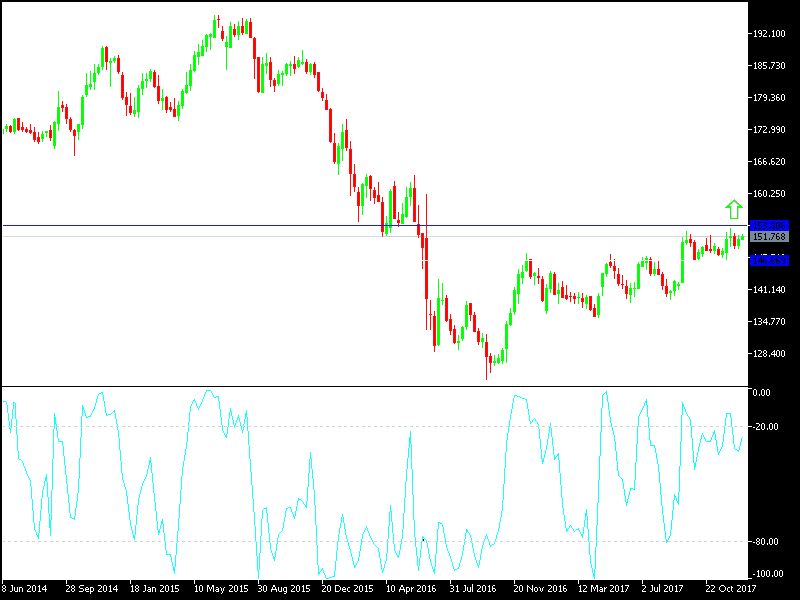

For the third day in a row, the GBP/JPY fails in settling on top of the resistance at 152, and it seems clear on the GBP/JPY chart that the pair is moving in tight ranges with slight bullish bias awaiting stronger catalysts for the GBP to overcome the resistance at 152.00 for a stronger bullish chance.

The pair’s moves during the last 4 trading sessions were between 152.00 and 151.25, showing a bullish stability still in need of more push. The GBP/JPY, is considered the least performing among the JPY’s pairs, as after the US tax cut bill passage announcement, there was an increase move towards risker assets and increased pressure on the JPY, and the JPY’s pairs found a better chance to achieve stronger gains, however, the pair’s gains didn’t go beyond 152.00, and settled again around 151.50 at the time of writing, which is considered a strong evidence that the GBP is still facing strong pressures from the BREXIT negotiations with daily updates from both parties.

The Bank of Japan maintained its monetary policy as is as expected, and the announcement from Bank of England about the monetary policy had no strong reactions on the pound’s directions against other majors. The GBP movement and performance is still based on the BREXIT negotiations updates, as well as the market reactions towards renewed international geopolitical fears at any time, as the JPY is one of the most important save heavens.

Technically:

The GBP/JPY will have a strong bearish move, as shown on the daily chart, if it moved towards 151.00, and below the psychologically important support level, 150.00 –previous psychological peak- as this level supports the continuation of the bullish move, and any move below that would threaten the bullish move. The support levels for this pair will be 149.20 and 148.00, which confirms the strength of the bearish move. On the bullish side, the nearest resistance levels are 152.20, 153.00 and 155.00. I still prefer selling this pair at each upward bounce, as the worry about BREXIT will stand and the negotiations will not be easy.

On the economic data front today:

This pair will focus today on the Japanese manufacturing production and retail sales data, and there are no important data today from the UK. The pair will be awaiting updates on the path of BREXIT negotiations, and will focus on the move towards save heaves led by the JPY in case of any renewed international geopolitical fears at any time.