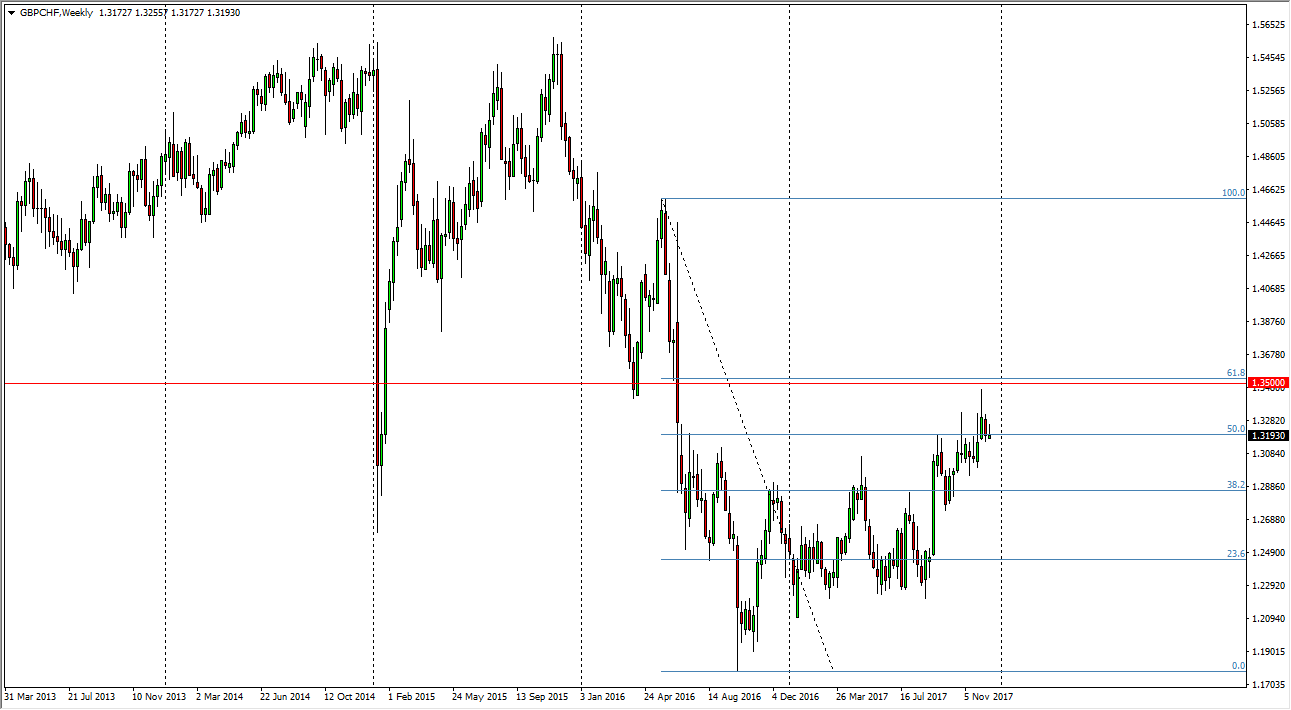

GBP/CHF

The British pound has rallied against the Swiss franc for the last several months, but it looks as if we are running into serious trouble at the 1.35 handle above. It coincides with the 61.8% Fibonacci retracement level of the most recent move lower, but we have now filled a significant gap so I think the next several weeks will be very important to the future direction of this pair. While the GBP/USD pair has been very interesting and at an inflection point, this pair will be the same but on steroids.

If we were to break above the 1.35 level on the weekly chart, I think that is a sign that we are going to go much higher, retracing the entire move and reaching towards the 1.46 region. Alternately, if we break below the 1.30 level, we could look for retrace to the 1.2850 level, and then perhaps 1.25 after that. This is a market that is highly sensitive to risk appetite around the world, so pay attention to that as well. That being said, the Swiss are doing everything they can to kill their own currency, with interest rates being negative all the way around. This is quite a bit of fuel for a move against the franc, and if the British pound get some type of a certainty out of the divorce from the European Union, that could be a bit of a turbo boost for this pair to the upside. Alternately, this is a likely very noisy market, so be careful and keep your trading position small. In general, I think this quarter is going to dictate where we go for the next couple of years. For my money, 1.35 above is vital to the future direction and any type of potential buying opportunity.