By: DailyForex

The EUR/USD moved again through the resistant at 1.1900 with continued pressure at the greenback, as the US Index tested the 92.96 DXY level, which pushed the pair to 1.1910, the highest this month and on the way to close this year higher. Despite the positive US economic data recently, the passage of the US Tax Cut bill in a way that would stimulate the US economic power, the US dollar is still under pressure and it seems that the markets digested the content of this bill and its effects on the current US economy. The Euro ignored the victory of the pro-independence parties in the latest elections at the district of Catalonia, which brought back the political fears inside the Eurozone, after a calm pace within the largest economic power in the region, Germany, with Merkel closer to forming a coalition government.

The EUR/USD will continue being affected by the directions of the US Federal Bank, with a hawkish policy including more steps to raise the US interest rates, and, the monetary policy of the European Central Bank, with worries of low inflation rates that have not reached 2%; the ECB’s inflation target. The US data yesterday showed a lower consumer confident, however, in 2017, it reached the highest level since 2000.

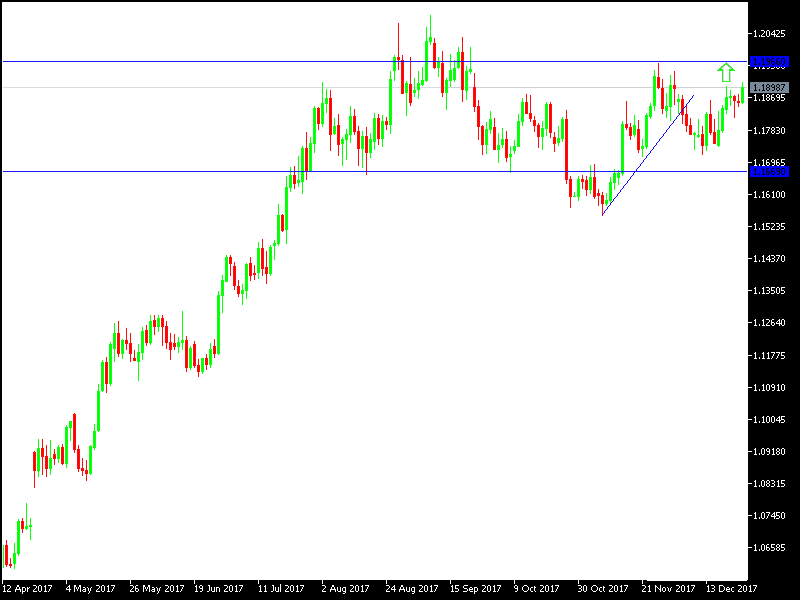

Technically: the EUR/USD is at a neutral zone with bullish bias which will gain strength if the pair settled above the 1.19 top, which supports the move towards stronger peaks at 1.2050 and 1.1966. On the bearish side, the nearest support levels are 1.1830, 1.1750 and 1.1640, the latest is a confirmation of the downward trend. In light of market closer due to holidays this week and early next week for Christmas and New Year, traders need to be alerted of price gaps due to markets coming back in interrupted form sometimes, and it is better to avoid trading until the markets are fully back to normal.

On the economic data front: Today’s agenda will focus on the ECD inflation report. From the US, there will be an announcement of unemployment claims, goods trade balance, the Chicago PMI and the US crude inventories.